Plastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

In March, plastics processing activity contracted faster for the first time since August of 2022. In April, it contracted even faster.

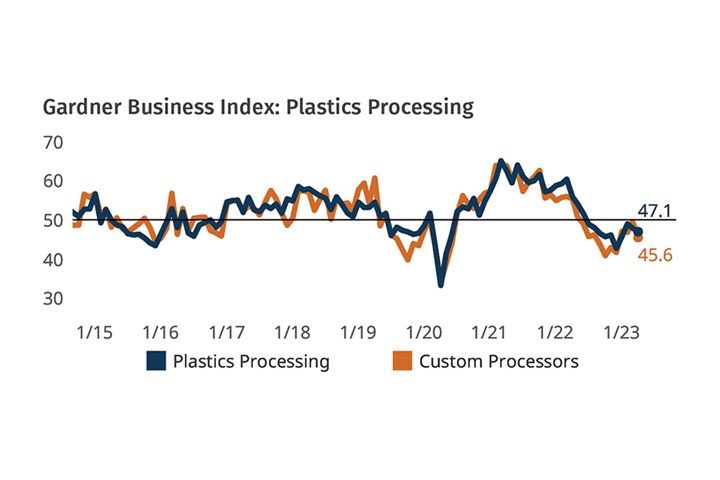

The Gardner Business Index (GBI): Plastics Processing closed April at 47.1, down almost a full point from March’s 48 index. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

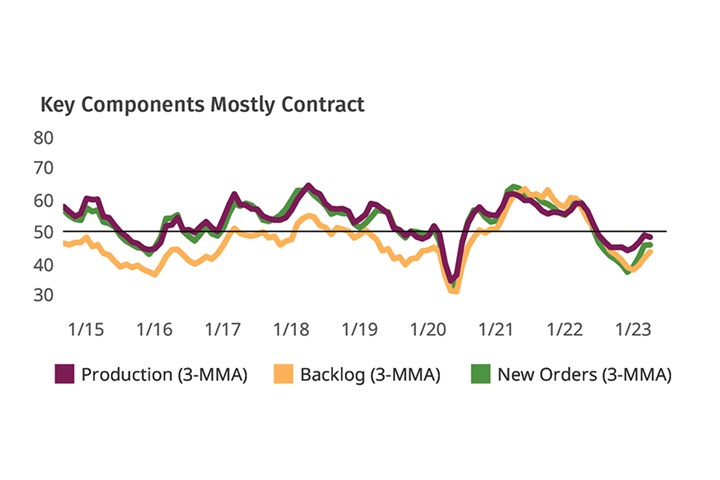

Four of the six GBI components put the brakes on what had been slowing contraction in recent months, ending April with values the same as March.

New orders, backlogs, exports and production activity all contracted in April. Only backlog kept up its three-month run of slowing contraction. The other three contracting components maintained their March rates of contraction into April.

FIG 1 Plastics processing activity contracted in April for both total plastics processing and custom processing, the former landing in a bit better position.

Employment expanded in March, sustaining about the same value into April. This suggests that even in an otherwise (mostly) steady state of plastics processing activity, employment activity can still grow. This dynamic is likely a function of plastics processors, like many manufacturers, being deep in the skilled workforce/labor hole.

Supplier deliveries flirted with flat in March, then lengthened a bit again in April. Lengthening of supplier deliveries is typically a good sign, indicating that volume/demand is more than suppliers can accommodate in a timely manner. However, since none of the other components appears to be driving expansion this month, it may be that remnants of supply-chain issues continue to impact supplier deliveries in plastics.

Overall business activity for custom plastics processing took a hit in April, down almost 4 points from March.

FIG 2 Only backlogs contracted at a slower rate in April; other contracting variables, including new orders and production, leveled off.

EDITOR’S NOTE: Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Plastics Processing Index serves as a great tool for making data-driven decisions. Thank you to everyone who has previously completed GBI surveys. Your participation helped increased response in 2021-2022, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

ABOUT THE AUTHOR: Jan Schafer is director of market research for Gardner Business Media, parent company of both Plastics Technology magazine and Gardner Intelligence. She has led research and analysis in several industries for over 30 years. She has a BA in psychology from Purdue University and MBA from Indiana University. She credits Procter & Gamble for 15 years of the best business education. Contact: (513) 527-8952; jschafer@gardnerweb.com.

Related Content

Processing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

Read MorePlastics Processing Contraction Slows Slightly

While the market is still sluggish, future business outlook rose significantly from last month.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More