Plastics Equipment Shipments Hold Steady in Third Quarter

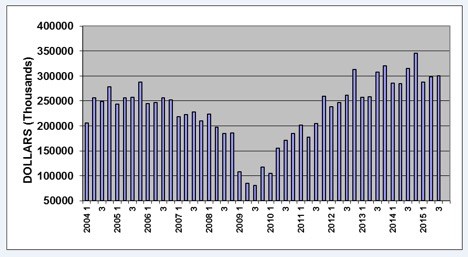

Shipments of primary plastics equipment in the third quarter were flat compared to the previous quarter and down 4.6% year over year.

Despite the lull, SPI: the Plastics Industry Trade Association’s Committee on Equipment Statistics (CES) said the plastics sector continues to outpace the broader U.S. manufacturing sector, with year-to-date 2015 figures matching the first nine months of 2014.

Reporting companies’ shipments of primary plastics equipment, including injection molding, single-screw and twin-screw extrusion, and blow molding machinery, totaled $300.6 million in the third quarter, up 0.8% from the second quarter total of $298.4 million, but off 4.6% percent compared with the same quarter last year.

Breakdown By Equipment

Injection molding machinery declined 2.4% in the third quarter compared with last year.

Single-screw extruder shipments rose 3.3% in the third quarter compared with last year.

Twin-screw extruder shipments (co- and counter-rotating) dropped 37.6% in the quarter.

Blow molding machines estimated shipment value fell 9%.

Auxiliary equipment’s new bookings jumped 9.8% year over year to $118.8 million.

Looking Forward

The CES also conducts a quarterly survey of plastics machinery suppliers, which was overwhelmingly optimistic about how 2015 would close out and 2016 would fare. Highlights:

89% of respondents expect conditions to either improve or hold steady in the fourth quarter.

94% expect conditions to be steady or better in 2016.

84% said third quarter quoting activity was steady or higher.

In terms of global markets, Mexico is the only global region where a majority of respondents expected market conditions for machinery suppliers to improve in the coming year. Expectations for North America and Latin America are for steady-to-better market conditions, while the outlook for Europe and Asia is steady-to-weaker.

By end market, a majority forecast improvement in the medical sector, with steady-to-better business anticipated in automotive. According to the CES, a solid majority expects all other major end-markets to experience steady market conditions in 2016.

Manufacturing Taps the Brakes

A potential harbinger of a broader change for the manufacturing sector came in November. According to the Institute for Supply Management and its broadly read monthly PMI report, economic activity in the manufacturing sector contracted in November for the first time in three years, while the overall economy grew for the 78th consecutive month.

Plastics and Rubber products, as well as machinery, were among the 10 industries that reported contraction in November, according to ISM, with only five reporting growth. Relevant comments from survey respondents include a representative of the chemical product industry noting that deflation in raw materials is ongoing, with a member of the petroleum and coal products sector saying, “the oil and gas industry is realizing that the ‘low’ oil prices are now the new reality.” A member of the machinery sector noted that the downturn in China and Europe was negatively affecting sales, while others described automotive and medical devices as “strong.”

The plastics and rubber products segment also saw decreases in new orders, production, inventories, order backlog, and new export orders. The sector’s employment levels were flat in November while supplier deliveries were faster and imports grew.