Double-digit gains for North American plastics equipment

Shipment of plastics equipment in the third quarter of 2013 jumped 20%, according to SPI data, reflecting gains seen the world over.

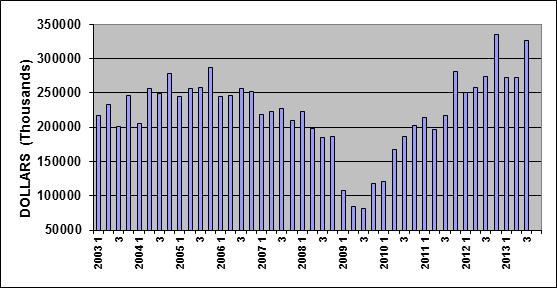

North American plastics equipment shipments spiked in the third quarter of last year, jumping 20% in value over the year-ago and previous quarter totals, and showing the largest quarterly gain of 2013. The Society of the Plastics Industry’s Committee on Equipment Statistics reported that shipments of primary plastics equipment for reporting companies totaled an estimated $3276 million in the third quarter of 2013. For the full year, SPI reports that shipments were up 12% through the first nine months.

By process, shipments of injection molding machines were up 20% in the third quarter when compared with the year-ago quarter. Single-screw extruder shipments rose 9%, and shipments of twin-screw extruders jumped 12%. Shipments of new thermoforming equipment spiked 50% in the third quarter when compared with 2012. In auxiliary equipment, including robotics, temperature control, and materials handling, orders totaled $99.9 million, up 12% from the second quarter of 2013.

The gains in plastics were mirrored by increases in the overall industrial machinery sector, SPI noted. According to the Bureau of Economic Analysis, business investment in industrial equipment rose 5% in the third quarter when compared with last year. The Census Bureau reported that the total value of U.S. shipments of industrial machinery rose by 13% in the third quarter.

Brighter outlook

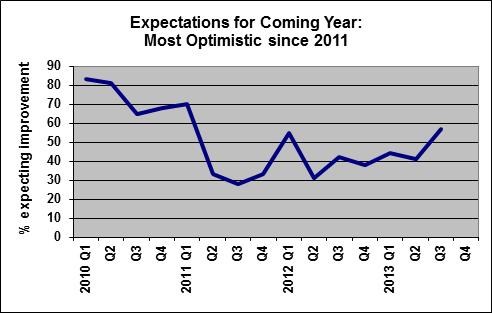

The Committee on Equipment Statistics also surveys the business outlook of participating plastics machinery suppliers, and responses from the Q3 survey reveal “an upbeat attitude that is broad-based across the industry,” SPI reported.

Fully 87% of the respondents expect conditions to stay the same or even improve in the coming quarter, and 92% expect them to hold steady or get better during the next year. The strongest gains were expected to come in North America and Mexico, and a strong majority predicted that Europe, Asia, and Latin America will be steady-to-better.

As for the major end-markets, the respondents expected that automotive, medical, and packaging will continue to be the strongest in terms of demand for plastics products and equipment. The industrial, construction, electronics, and appliance sectors are all expected to hold firm or even improve next year.

Plastics processor index on the rise

Gardner’s Plastics Processors’ Business Index, compiled by Plastics Technology publisher, Gardner Business Media, showed that in January, “Processors generally are doing significantly better now than they were a year ago,” according to author Steve Kline Jr., who noted that new orders grew for the third time in four months.

A capital equipment survey also conducted by Gardner predicted that processors would invest approximately $3.3 billion in primary machinery, auxiliary equipment, and molds and related supplies in 2014, about 10% more than its projection for 2013.

The view from Germany

German machinery and tool orders were up 7% in November 2013, compared to year-prior levels, in the most recently released data from the German Engineering Association (VDMA). That report showed that the growth came from exports, with international business up 12% while domestic sales slipped 1%.

For the three-month period of September to November, orders were down by 3% compared to year-ago data. During that time, domestic orders rose by 5% while foreign orders fell by 7%. VDMA Chief Economist Ralph Wiechers noted in a release that domestic demand is on the rise but foreign orders “are still waiting for clear signals of recovery.”

Last August, the VDMA reported that orders for German plastics and rubber machinery rose by 14% in the second quarter of 2013. The industry’s sales in the first half of 2013 matched the previous year’s level. Exports were up by 9.7% from March to May, with increased demand from Russia and the U.S., with “substantial rates of growth” from China, India and Turkey.

Global plastics machinery market rising

Global plastics processing machinery demand was forecast to rise 7% annually through 2017 to $37.6 billion, according to a recent Freedonia report. Freedonia forecast that injection molding equipment would account for two-fifths of new machinery sales in 2017, the largest share, but the fastest gains were expected to come from 3D plastics printers.

Central and South American sales were expected climb the most rapidly, followed by Africa and the Mideast region, led by Turkey.

China has the largest national equipment market, according to Freedonia, accounting for 29% of all 2012 sales, with expectations that it will maintain that status through 2017. The report predicts that India will be the fastest-growing national market, expanding more than 12% per year.

Related Content

Automotive Awards Highlight Emerging Technologies

Annual SPE Automotive event gives nods to several ‘firsts’ as well as sustainability.

Read MoreDesign Optimization Software Finds Weight-Saving Solutions Outside the Traditional Realm

Resin supplier Celanese turned to startup Rafinex and its Möbius software to optimize the design for an engine bracket, ultimately reducing weight by 25% while maintaining mechanical performance and function.

Read MoreIndustrial Resin Recycling Diversifies by Looking Beyond Automotive

Recycler equips for new business in medical, housewares and carpeting.

Read MoreAtop the Plastics Pyramid

Allegheny Performance Plastics specializes in molding parts from high-temperature resins for demanding applications as part of its mission to take on jobs ‘no one else does.’

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More