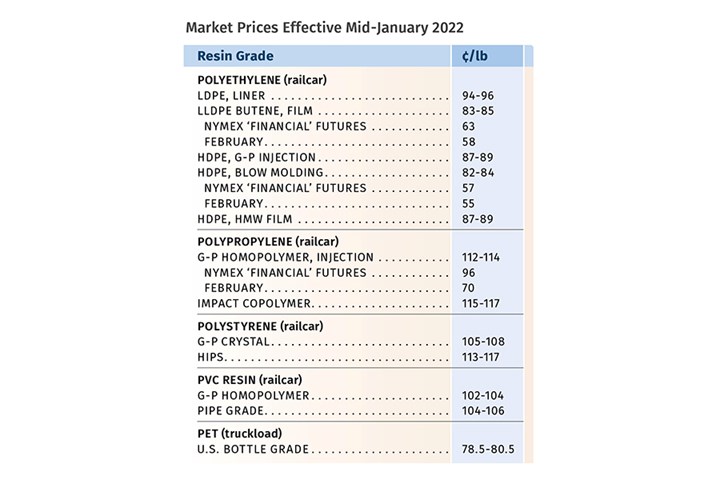

Prices Drop for Polyolefins and PET

Projected trajectory is downward for polyolefins, flat to upward for PVC, PS, and PET

Going into January, prices of polyolefins had dropped, most significantly for PP. Despite an announced PE price increase, the trajectory generally projected for both PP and PE was further decline, at least for the first quarter. Contributing factors include rising supplier resin inventories, lower feedstock prices, slowed domestic and exports demand, and new PE capacity scheduled to come on stream. Meanwhile, prices for PVC were expected to stabilize through at least part of the first quarter, while prices of PS and PET were likely to head higher, driven by higher feedstock costs and a tight market in the case of PET.

These were the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW), and Michael Greenberg, CEO of The Plastics Exchange.

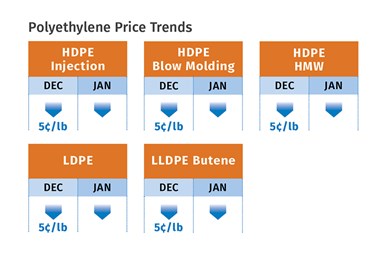

PE Prices Down to Flat

Polyethylene prices were expected to drop by another 5¢/lb by the end of December. Meanwhile, suppliers issued price hikes of 4¢/lb for January, a move intended largely to stem further price decline, according to Mike Burns, RTi’s v.p. of PE markets, as well as PCW senior editor David Barry, and The Plastic Exchange’s Michael Greenberg. In 2021, PE prices increased by 41-43¢/lb through August, followed by decreases of about 15-17¢/lb in the fourth quarter.

RTi’s Burns ventured that PE prices would be flat to lower for January and February, with more downward pressure within the first half of the year. “While demand is still strong, buying habits have returned to buy-as-needed.” He ventured that PE prices could settle as much as 30¢/lb below the 2021 July peak by the end of the second quarter. “Expectations include steady-to-lower demand, high production rates, potential strong exports, and aggressive 2022 contract negotiations to retain market share.” He noted that the Chinese New Year and The Winter Olympic Games starting this month could impact PE suppliers’ ability to export. Moreover, major new PE capacity is slated to come on stream from Shell and the SABIC/Exxon/Mobil joint venture in the first half.

PCW’s Barry noted that suppliers might be able to get a portion of their increases due to some outages for deferred maintenance in this first quarter, which could tighten the market. “Domestically, processors expected strong demand to continue in 2022, although perhaps at a more modest growth rate than in 2021. The market appeared well-supplied, except for some tightness reported for LLDPE hexene and octene film grades,” he reported.

Greenberg said it was too early to gauge a timely implementation of suppliers’ new price initiative. “If not in January, producers could probably have a better opportunity in February.”

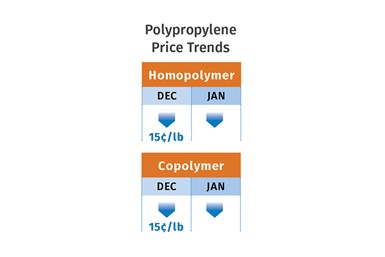

PP Prices Plunge Further

Polypropylene prices declined further in December by at least 10¢/lb in step with propylene monomer, along with another 4-5¢/lb in another “supplier margin give-back,” according to Scott Newell, RTi’s v.p. of PP markets, along with Barry and Greenberg. All described the market as “very bearish.” Newell noted that from their peak in August 2021, PP prices dropped about 40¢/lb through December.

Barry said PP spot prices were still significantly lower than contract prices, by 20¢/lb vs. a more typical 5¢-10¢/lb. “Contract prices remained unusually elevated versus spot prices because of the rapid drop in the spot market, especially for wide-spec resin. Demand was slower in December, but suppliers expected a rebound in 1Q,” he reported.

Newell saw potential for another 5¢-6¢/lb drop in propylene monomer in January and, depending on demand trends, even further decline in the first quarter. He noted that if PP demand rebounded significantly, propylene monomer availability would likely be an issue pushing prices upwards. Meanwhile, all three sources noted that PP supplier inventory buildup was at near record levels. “With a lack of imports and five straight months of reduced production, it is possible that an ongoing liquidation of resin could help rebalance supply and demand,” stated Greenberg.

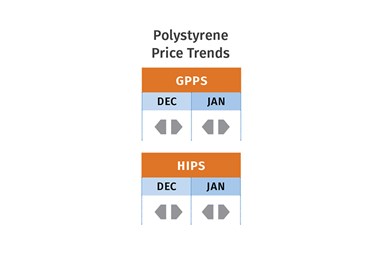

PS Prices Flat to Higher?

Polystyrene prices in December were mostly flat, but going into January, there was concern about an upward price move by suppliers driven by a rebound in both benzene and ethylene spot prices, according to Barry and Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets.

“With recent feedstock supply disruptions for the European styrenics industry, North American PS producers were now eyeing a potential feedstock-driven price increase for January,” reported Barry. Chesshier noted that January and February could go either way, driven primarily by the benzene price trajectory and demand. “Domestic demand is down and PS prices are not sustainable. There is a lot of pushback.” Barry reported at the close of December that the implied styrene monomer production cost based on a 30/70 ratio of spot ethylene/benzene was at 43.6¢/lb, up 5.9¢/lb over a four-week period. However, styrene monomer spot prices had dropped 2.2¢/lb in that time frame.

PVC Prices Flat

PVC prices in December were flat, following the November 5¢/lb price hike. Prices for January and February had a chance of holding even, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. “Suppliers are at highly elevated prices after this last increase and while I think demand will continue to be robust, prices will stabilize for at least part of the first quarter,” noted Kallman. He added that two planned PVC plant-maintenance shutdowns are scheduled during that time, but new capacity from Shintech’s new 640-million-lb/yr plant in Plaquemine, La., would also impact the supply/demand balance.

PCW’s Todd reported that over the course of 2021, PVC prices were raised nine times for a total of 31.5¢/lb. “Prior to December, only July and October prices were flat. Producers did not announce any price increase for January either, and are no doubt hoping to roll prices over yet again. Buyers may have some ammunition this time, however, due to the decline in international PVC prices in recent weeks. Suppliers used rising export prices as a reason to push up domestic prices this year, among others, but now the worm has turned.”

PET Prices Down, Then Up

PET prices were expected to drop in the range of 4-5¢/lb in December, in step with a price drop in key feedstocks MEG and PTA and due to recovery from previous production issues, according RTi’s Kallman. However, he ventured that PET tabs would rebound somewhat in January-February.

“The market is very robust. Demand for PET packaging continues to be high as retail stores are restocking.” Kallman characterized the market as extremely tight, and ventured that 2022 PET contract prices were most likely higher.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MorePrices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More