Prices Flat or Slightly Lower

Prices of PE, PP, PS, and PVC remained steady through last month, although price initiatives were on the table for all but PP.

Prices of PE, PP, PS, and PVC remained steady through last month, although price initiatives were on the table for all but PP. Flat to lower feedstock costs, improvements in supplier inventories, and slowed demand are among the contributing factors, according to resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

Meanwhile, ABS, PC, and nylon 66 prices dropped a bit in the third quarter while nylon 6 prices were flat. RTi sees potential for price increases to surface before year’s end, owing primarily to higher costs of feedstocks—especially benzene and propylene—and suppliers’ aim to strengthen profit margins.

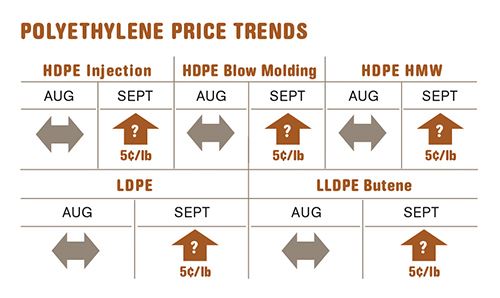

PE PRICES FLAT

Polyethylene prices appeared to remain flat through August into September. Any price hikes that were not implemented through the summer are now off the table. However, all suppliers issued a new 5¢/lb price increase for Sept. 1, and two suppliers issued another 5¢ hike for Oct. 1, which did not appear to get further support.

“The fundamentals are simply not there to support a price increase,” says Mike Burns, RTi’s v.p. for PE. Burns has noted consistently that supplier inventory levels, tight throughout the year, have become the key driver behind any price initiative, rather than ethylene monomer price fluctuations. While supply is not loose by any means, it has been slowly improving. Suppliers’ inventories are now at 34-35 days vs. under 30 days for most of the earlier part of the year. Spot ethylene prices, with the exception of some temporary fluctuations, have held steady in the mid-50¢/lb range.

Greenberg from The Plastics Exchange noted that spot PE prices were strong through August, due to several supply interruptions. In early September, he noted indications of widespread material availability so long as buyers were willing to pay the proposed 5¢/lb increase.

North American PE demand, meanwhile, has been pretty good across the board this year, according to Burns. PE exports to Mexico and Latin America have been the highest ever, although Asia has been out of the picture. Those exports have contributed to some of the supply tightness this year. Processors are not likely to see any price relief until November or December as inventories further improve.

PP PRICES STABLE

Polypropylene contract prices were flat in September, as propylene monomer contract prices rolled over at 70¢/lb. PP suppliers implemented the full 5¢/lb increase in August, but the extra 2¢/lb suppliers sought for “margin correction” was not broadly successful. In some isolated cases, buyers with no contract protection or monomer price deals may have had to pay a portion or all of the margin increase, ventures Scott Newell, RTi’s director of client services for PP.

Newell noted that there is still some potential for another increase because of tight supplies of both PP and monomer and the prospect of a couple of planned production shutdowns for monomer and resins before November. However, what he describes as “very average, unremarkable” demand for PP could allow processors to ride through the shutdowns unscathed.

Meanwhile, by the end of August, spot PP prices had ticked up another 1¢/lb, according to Greenberg, who noted that the spot PP market has rallied steadily since bottoming out in May

While PP contracts are still 9¢ below first-quarter peak levels, spot PP prices are now flirting with those peak levels, and traders’ inventory stocks are light.

PS PRICES STEADY FOR NOW

Polystyrene prices remained unchanged through August, but suppliers issued price hikes of 3¢/lb for GPPS and 1-3¢ for HIPS. The move is attributed directly to a jump of 23¢/gal in September benzene contract prices, following a spike in crude oil prices.

There were also some planned PS plant shutdowns that tightened resin supply, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC. According to Kallman, benzene contract prices were expected to increase this month as well, but not by as much.

Offsetting the higher benzene prices are flat ethylene contract prices as supply has improved considerably. Meanwhile, demand for PS is slowing as we move into its traditional off-peak season. And while supply is expected to be even tighter with planned resin-plant shutdowns this month and in November, slowed demand could balance things off.

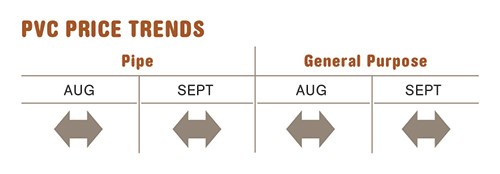

PVC PRICES UNCHANGED

PVC prices remained flat for a second month in a row despite suppliers’ attempts to hike prices by 2¢/lb in July and again in August. One supplier was pushing for a similar increase last month, but there did not appear to be any support for it, according to RTi’s Kallman.

Suppliers attributed their moves to tight supplies. Scheduled plant shutdowns in July took longer to come back up, which tightened PVC supply. While exports have fallen off, domestic demand has been fairly stable, with the year expected to show a gain of 3-4%. “It has been a better construction season than the last couple of years, but not of the sort we saw back in 2007,” says Kallman. He expected PVC prices to remain relatively flat through both September and October, despite some planned maintenance shutdowns this month and in November.

ABS PRICES LOWER

ABS prices dropped by another 1-3¢/lb in the third quarter after falling 2-6¢ in the second quarter, owing to very competitively priced imports from Asia.

But suppliers are likely to try to raise prices in response to feedstock price increases (mainly benzene) and margin losses, according to RTi’s Kallman. A lot will depend on the costs of benzene, ethylene, and propylene, as well as the level of competition. Domestic ABS demand has been quite stable in automotive, with appliances and electronics trailing a bit behind.

PC PRICES DROP A BIT MORE

Polycarbonate prices dropped by another 1-2% through third quarter, having held flat to a bit lower through the second quarter. RTi’s Kallman attributes this to an oversupplied market and to competitively priced imports. The scenario for the fourth quarter is likely to be somewhat different. Kallman expects upward pressure from higher prices of feedstocks, primarily benzene and propylene, and suppliers’ aim to improve margins.

NYLON PRICES FLAT OR DOWN

Nylon 6 prices remained flat through the third quarter, as they did in the second, with some isolated instances of price erosion, despite suppliers’ repeated attempts to push through their second-quarter 5¢/lb increase, according to RTi’s Kallman. He attributes these failed attempts to a depressed global nylon textile market and low prices of caprolactam monomer. Nylon suppliers may look to increase prices before the end of the fourth quarter, driven primarily by higher benzene prices and tighter supply as they lower operating rates.

Nylon 66 prices dropped by 1-2% in third quarter. Price erosion is due mainly to the collapse of butadiene prices—down from over $1/lb for the last two years to 42.5¢ in September. This is linked directly to low demand from tire markets as well as global capacity additions, according to Kallman. Suppliers have been under a lot of pressure from nylon 66 processors to pass on price relief from lower butadiene costs.

Processors that use nylon 66 made from propylene and benzene instead of butadiene and benzene (a minority share of total production) will have more of a challenge, as prices of both are trending upwards. A price increase is likely to surface before year’s end.

Related Content

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More