Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Recent weekly reports from PetroChem Wire, a publication of the Oil Price Information Service (OPIS), suggest a late year stabilization in the prices of most major types of recycled plastics.

RPET Prices Stop Plummeting and Find Footing

Curbside bales of mixed-color PET scrap, having fallen from the 50s in late spring all the way below 10ȼ/lb in August, have since risen and remained in a a range of 12-15ȼ/lb since November. PET grade A scrap in Southern California followed a similar trend, bottoming at 12ȼ/lb in late August and now in the high teens.

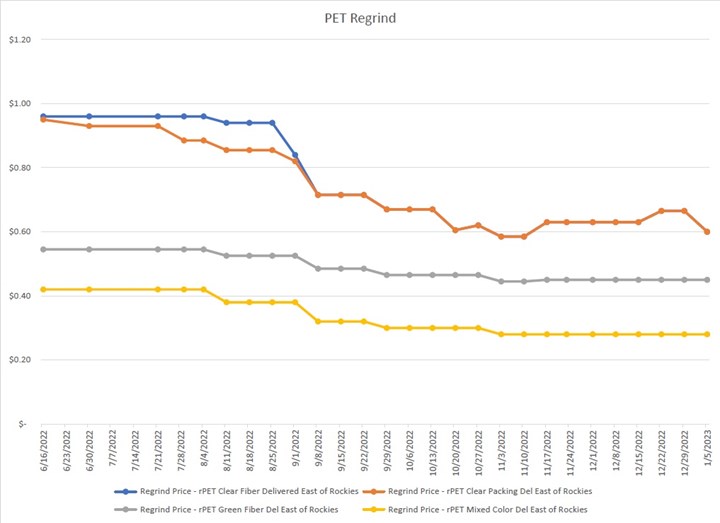

Price trend in rPET regrind from mid June to Jan. 5.

RPET regrind prices (chart) decreased in the fall, with clear fiber exhibiting the most pronounced decline, before stabilizing of late. Reprocessed PET prices followed approximately the same pattern.

Most resin types, across grades, exhibited similar price trending, qualitatively though not necessarily quantitatively: a steeply negative slope during the summer months or early fall, followed by a leveling off and in some cases a slight gain as winter approached.

PE Also Hits a Net, Natural HDPE Climbs

Most types of PE hit a low sometime in September or October before settling into a range for the rest of the year. High molecular-weight PE fell until mid-November before arresting at 21ȼ/lb.

An exception is natural color (dairy-type) HDPE, which has climbed significantly since late October. Reprocessed natural HDPE prices rose over 40% from 53 to 75ȼ/lb in California, and over 20% to $1.12/lb in the Southeast. Meanwhile the Dec. 22 report gave a price of 68ȼ/lb for curbside bales, a 66% climb from September lows. Analysis in the Dec. 1 report cited tight supply and strong demand for natural HDPE PCR in explaining the rising reported rates.

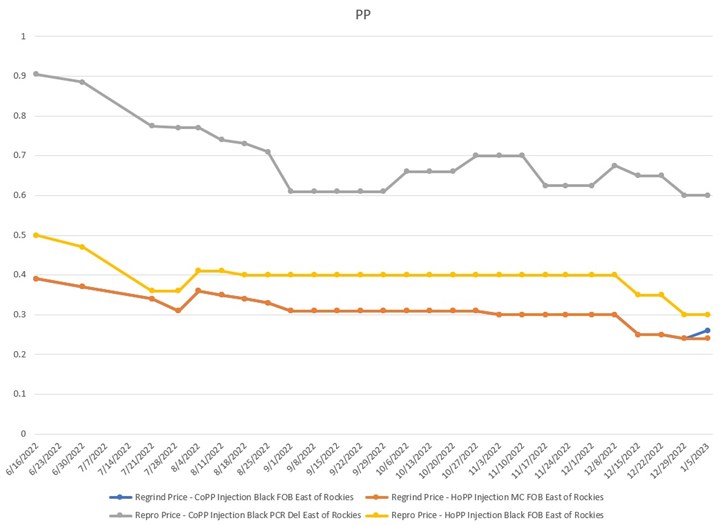

PP Steps Downward

OPIS reported prices on four types of PP delivered east of the Rockies; regrind and reprocessed homopolymer and copolymer PP. After falling in July, prices were generally steady throughout the fall before falling again in December. According to the December 29 report, an increase in supply due thanks to optical sorting technology coincided with weak demand to depress prices.

Prices for reprocessed copolymer polypropylene showed much more variability than other grades.

PS, ABS, Nylon, PVC Hold After Fall Declines

Prices for regrind and reprocessed polystyrenes were mostly unchanged throughout December, after a fall decline that was particularly pronounced in both clear and mixed-color regrind delivered in the Midwest, each dropping over 40% in three weeks. ABS mixed and black colors mirrored each other, rising in late June before declining gradually to December, before holding steady for the past month.

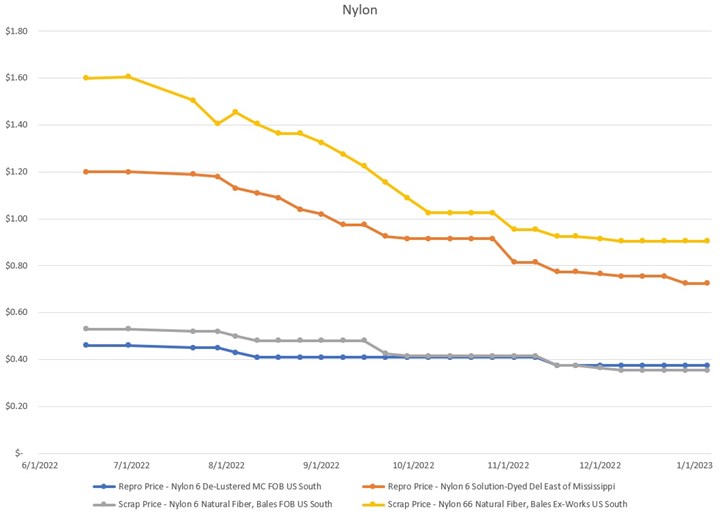

Declines in reclaimed nylon were much more pronounced for nylon 66 scrap and reprocessed, dyed nylon 6.

Bale prices for scrap nylon 66 fiber fell 56% from June to December, but have held steady at 91ȼ/lb for five consecutive weeks. Regrind mixed-color PVC fell dramatically in September, losing over 10ȼ/lb in a single week, but has remained in the mid-30sȼ/lb ever since.

Related Content

-

BASF Highlighting How They 'Make, Use and Recycle Future Solutions'

NPE2024: BASF is using its proprietary computer-aided engineering tool Ultrasim when designing for sustainability in a broad range of industries.

-

Automotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

-

NPE2024 Materials: Spotlight on Sustainability with Performance

Across the show, sustainability ruled in new materials technology, from polyolefins and engineering resins to biobased materials.