Pricing Update - October 2006

Prices Up a Bit, But Outlook Is Mixed

Polyolefin prices rose a bit last month as suppliers implemented summer price increases to make up for higher energy and feedstock prices.

Polyolefin prices rose a bit last month as suppliers implemented summer price increases to make up for higher energy and feedstock prices. Resin capacity utilization remained high (over 90%) and suppliers expected a seasonal uptick in demand in the fourth quarter. They also said polyolefin exports to Europe, Asia, and the Middle East have revived after a pause of three to four years, thanks to a doubling of the price advantage of natural gas—the main feedstock of the U.S. industry—over oil, which feeds overseas production.

After oil prices dropped as much as $11/barrel by the second week of September, that scenario may be changing. Says Lowell Huovinen, managing partner at resin purchasing consultant Resin Technology Inc. (RTI), Fort Worth, Texas, “North American exports are slowing as oil prices have gone down. We don’t think domestic demand is as good as usual for this time of year, and producers’ inventories are increasing, as are those of processors. We expect to see downward pressure on resin prices for the rest of the year.”

A similarly mixed picture was evident for PS and PVC. Prices were up slightly last month, but prospects for further increases were in doubt.

PE prices up

Polyethylene prices rose about 5¢/lb in August as a result of partial implementation of the 7¢ increase announced for July. Suppliers moved to lift the remaining 2¢ TVA as of Sept. 15 or Oct. 1. A 5¢/lb increase for Aug. 1 was still pending. But the London Metal Exchange (LME) October short-term futures contract for butene LLDPE for blown film was down slightly to 59.9¢/lb from September’s 60.3¢/lb.

Contributing factors: Ethylene monomer contracts for August rose 2¢/lb, much less than the 7¢ to 8¢/lb originally sought. Suppliers say resin inventory levels are balanced to a bit tight. They say markets for PE exports are better than they have been in years. “We see strong demand for PE globally,” says one major supplier. Demand is weaker in some areas like stretch film and industrial liners but is strong in consumer packaging and pipe.

Polypropylene goes up, too

PP resin tabs moved up as suppliers got part of their August 4¢ increase. Average prices moved up 3¢/lb, letting suppliers recoup more than the 1.5¢ to 2¢/lb lost in July. A 4¢/lb hike was pending for Sept. 1. Still, LME’s October short-term futures contract for g-p injection homopolymer slid to 57.8¢/lb from September’s 60.5¢.

Contributing factors: Resin prices appear to be driven by escalating monomer prices. Rising August monomer contracts erased the 4¢ drop in July, and September contracts looked likely to go 2¢ higher. Nonetheless, RTI’s Huovinen expects PP suppliers to have a hard time implementing even part of the September hike.

PET prices still high

PET prices are 10¢/lb higher than in June. Suppliers implemented a 4¢ increase in May and got about 6¢ of their 8¢ July increase by the end of August.

Contributing factors: PET suppliers complain of poor profit margins and have yet to feel the impact of 1.1 billion lb of new capacity coming on by early 2007. Still-rising feedstock prices have pushed up resin tabs despite that looming oversupply.

PVC up 2¢ in August

PVC resin prices rose 2¢/lb in August, implementing a hike that had been pending since May. Another 2¢ increase announced for Sept. 1 isn’t expected to stick. PVC compounders announced increases of 3¢ to 4¢ for September and October.

Contributing factors: Pipe and compound demand softened in September. Housing starts dropped from 2.1 million units/yr to 1.8 million between the first and third quarters, but that’s still a strong market.

Polystyrene hike delayed

PS producers pushed through the 4¢ July increase last month. But they put a 5¢ hike for Sept. 1 on hold.

Contributing factors: Resin demand picked up in August on the threat of a possible hurricane. Despite record PS prices, producers have lost money this year because of soaring benzene prices. But benzene contract prices dropped in September to $3.55/gal from $3.72 in August.

More hikes for MDI, TDI

Dow and Huntsman increased MDI prices on Sept. 1—Dow by 10¢/lb and Huntsman by 5¢. (BASF hiked MDI 10¢ on Aug. 1.) Dow also said it would raise TDI tabs 15¢/lb on Oct. 1.

| Market Prices Effective Mid-Sept A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

Lanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

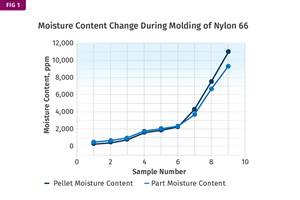

Read MoreWhat's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More