‘Reshoring’ Is Not a Myth

Processor Strategies: Vision Technical Molding

For this molder, 35% to 40% of current sales is new business generated in the past two to three years—and some of that is due to reshoring.

The global market gives and it takes away. Sometimes, it gives back what it once removed. In contemporary jargon, the previous decade’s wave of offshoring has spawned a smaller return flow of “reshoring”—overseas manufacturing business coming back to the U.S.

A case in point is Vision Technical Molding in Manchester, Conn. This custom injection molder of medical products has seen its business grow aggressively in the last few years, justifying addition of four more presses to its stable of Fanuc Roboshot all-electric machines in the past year (55, 110, and 165 tons), and a 500-ton Ferromatik Milacron hybrid is on order. That will bring the total to 33 machines in its 81,000 ft2 of space in two adjoining buildings, which also house a sister moldmaking company, Advance Mold & Manufacturing Inc.

Zach Brodeur, Vision’s business development manager, is pleased that 35% to 40% of current sales is new business generated in the past two to three years—and some of that is due to reshoring. Says Brodeur, “We brought in two transfer molds from a program moved back to the U.S. from Singapore. That product line is the largest, by sales volume, of our recent growth.”

That customer performed captive molding both in Singapore and in the U.S. It discovered that its domestic plant offered better value and overall cost, when shipping and secondary operations were taken into account.

Another new customer for Vision found it was incurring higher total costs—including downtime, quality issues, and tool repairs—by molding technical medical products at a Mexican plant.

“There’s a definite increase in quoting activity from customers who are coming back to the U.S. because they couldn’t get the quality they need at low cost abroad,” says Brodeur. “We’ve heard from numerous customers that they are realizing the hidden costs of offshoring.

When production issues overseas mean not having your product on the market and losing market share, that far outweighs any advantage in piece price. They are learning to spend a little more upfront and save in the long run.”

In Brodeur’s view, his firm competes in several ways. One is through molding sophistication. The company is gearing up for its first use of two-shot, spin-stack molding to produce a tiny, two-component part that uses only about 2 g on each shot to fill eight cavities. A 330-ton press will run the 8+8 mold with the help of two small auxiliary injection units from MGS Mfg. Group. They will fill the parts without using the machine’s main injector.

Another key competitive advantage is Vision’s use of automation. Every one of its machines has a Yushin linear robot or sprue picker. One new job in development will use a 16+16 cavity family mold to produce two different parts with independent hot runners. A robot will demold parts and snap them together outside the press within the molding cycle. Brodeur estimates this will save the customer around $1 million in capital expenditure alone by not needing a separate assembly line.

A third competitive advantage is having Advance Mold under the same roof. Says Brodeur, “When it comes to helping the customer with design for manufacturability, we have all the different knowledge bases together in one room. That’s a huge advantage you won’t find in China—or at many U.S. molders, for that matter.”

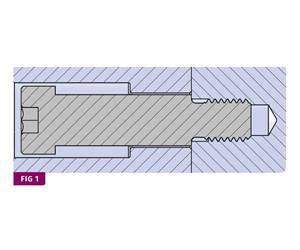

He says lower-cost Chinese-built molds may suffice for standard jobs and relatively simple molds—but not for high-cavitation, complex tooling. “We sell tooling on reliability, technology, and performance, using the likes of conformal cooling, advanced hot-runner systems, servo unscrewing, and multi-shot molding.”

Even so, Vision Technical Molding uses Chinese molds in a very small percentage of its jobs. “Sometimes the customer mandates a very low price and very short lead time. We have a relationship with some Chinese moldmakers that we have nurtured over the years. They now come close to U.S. standards of mold building.”

Related Content

Hot Runners: How to Maintain Heaters, Thermocouples, and Controls

I conclude this three-part examination of real-world problems and solutions involving hot runners by focusing on heaters, thermocouples, and controls. Part 3 of 3.

Read MoreHow to Select the Right Tool Steel for Mold Cavities

With cavity steel or alloy selection there are many variables that can dictate the best option.

Read MoreBack to Basics on Mold Venting (Part 1)

Here’s what you need to know to improve the quality of your parts and to protect your molds.

Read MoreWhy Shoulder Bolts Are Too Important to Ignore (Part 2)

Follow these tips and tricks for a better design.

Read MoreRead Next

Automation & Waste Reduction: A Medical Molder's Efficiency

Vision Technical Molding in Manchester, Conn., doesn’t believe in standing still.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More