Your Business Pricing Update - December 2008

Resin Prices in Free Fall

Weak domestic demand, crumbling exports, and plunging feedstock prices brewed a “perfect storm” driving down commodity resin prices in the fourth quarter.

Weak domestic demand, crumbling exports, and plunging feedstock prices brewed a “perfect storm” driving down commodity resin prices in the fourth quarter.

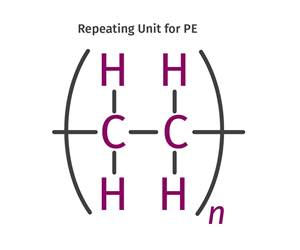

PE PRICES DROP

Polyethylene prices dropped 11¢/lb in October and 15¢ more in November—on top of the 7¢ decline in September. PE prices had risen a total of 42¢/lb this year through August. By mid-November, they had fallen back 33¢, but some industry sources predicted further declines before the year’s end. Meanwhile, the London Metal Exchange (LME) North American short-term futures contract for blown film LLDPE in December plunged to 58.7¢/lb from 76¢ in October.

Contributing factors: A big drop in feedstock prices coupled with poor market demand is expected to put further downward pressure on PE resin tabs. “I would not be surprised to see at least another 10¢/lb fall-off in December,” said Mike Burns, global business director for PE at resin purchasing consultant Resin Technology, Inc. (RTI), Fort Worth, Texas. While PE suppliers are generally doing well in terms of profit margins—particularly with the drop in feedstock and energy costs—processors are not, noted Burns. “Processors are buying as needed, and many have finished-product inventory sitting on the shelf since August. It is not a good time for them to buy until prices hit bottom.” For example, if a processor aiming to buy a railcar of PE on Oct. 31 waited one more day to Nov. 1, when prices dropped 15¢/lb, the buyer would have saved $27,000.

October ethylene contract prices dropped 12¢ to 50-52¢/lb, and industry sources predicted a double-digit drop in November. Said RTI’s Burns, “Contract price could fall below 40¢/lb.”

Flint Hills Resources, which last year acquired the polyolefins business of Huntsman Corp., plans to close its Odessa, Texas, facility by mid-2009. This removes the company from the PE business, where it has capacity for 800 million/lb/yr of LLDPE and LDPE.

PP PRICES back to 2007

After dropping 22¢/lb in August and September, PP prices fell another 5¢ in October and a whopping 30¢ in November. The total decline of 57¢/lb left prices 32¢ below their level at the start of 2008. LME’s North American short-term futures contract for December in g-p injection-grade homopolymer dropped to 37¢/lb from November’s 59¢.

Contributing factors: Fast-dropping feedstock costs, poor domestic demand, a vanishing spot market, the loss of exports, and what now seems like oversupply all contributed to this abrupt downtrend. According to Scott Newell, RTI’s director of client services for PP, prices have followed propylene monomer price drops nearly penny for penny. Contract monomer prices for September dived 20¢, followed by a 5¢ drop in October and what was widely expected at press time to be a 30¢ plunge in November. Newell said there was a possibility that prices would bottom out in December.

Meanwhile, shutdowns of PP resin capacity were announced by both Flint Hills Resources and Ineos Olefins and Polymers USA. The former, as noted above, will close its Odessa, Texas facility, where PP production capacity is reported to be 120 million lb/yr (the company would not confirm this). Upon its acquisition of the Huntsman polyolefins business last year, the company had a total of 1.085 billion lb of PP capacity in Odessa and Longview, Texas, and Marysville, Mich. There are currently no plans to shut the other two sites.

Ineos will close its Battleground Manufacturing Complex in LaPorte, Texas, which produces 520 million lb/yr of PP homopolymer and random copolymers. One of the lines will be closed by the end of this month, and the other by the end of January.

PVC PLUMMETS 6-7¢

PVC prices for October settled 5¢/lb lower and are predicted to drop at least another 6¢ in November, tracking declining feedstock prices. Domestic spot PVC prices in mid November were in the 40-43¢ range, while spot Asian resin (delivered) was around 10¢ lower.

Contributing factors: Resin producers say they have never seen demand so bleak. Pipe market demand is reportedly non-existent. Pipe prices are plummeting as producers try to unload inventory, and their operating rates reportedly are only 25% to 50% of capacity. Several pipe and siding plants have closed abruptly. Resin producers’ operating rates were estimated at 72% in October and in the 60s last month.

PS DOUBLE-DIGIT DROP

In mid-November, PS producers were slashing prices by 10¢ to 20¢/lb. Meanwhile, the spread between GP-PS and HIPS widened to about 10¢/lb from 6-7¢ in October.

Contributing factors: PS demand continues to be very weak across the board. And contract benzene prices took an unprecedented dive in November from $4.24/gal down to $1.60, well below where they should be relative to crude oil at $65/bbl.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More