Avantium and U.S.’s Origin Materials Aim to Accelerate Production of FDCA and PEF

The partnership aims to bring together both companies’ technology platforms to produce FDCA from sustainable wood residues on an industrial scale.

Avantium, the Amsterdam-based technology company in renewable chemistry, has entered into a technology agreement with U.S. company Origins Materials (West Sacramento, Calif.) bringing together Avantium’s proprietary YXY Technology that converts plant-based sugars into FDCA (furandicarboxylic acid), the main building block for PEF (polyethylene furanoate), with Origin’s patented technology platform which turns carbon found in sustainable wood residues into useful building-block chemicals such as CMF (chloromethylfurfural). Bridging these two complementary technologies creates a route that can convert sustainable wood residues via CMF into FDCA.

For over a decade, Origin has developed a platform for turning the carbon found in inexpensive, plentiful, non-food biomass such as sustainable wood residues into useful materials while capturing carbon in the process. Origin says its drop-in technology platform can help revolutionize the production of a wide range of end products, from plastics and packaging to toys and clothing. The company also recently reported that it has mechanically completed its first commercial manufacturing plant Origin 1 in Canada. This plant is anticipated to produce materials including CMF from sustainable wood residues, which can subsequently be converted into high-performance products used in packaging, textiles, apparel, automotive, and other applications. For Origin 1 and future plants, Origin has signed numerous capacity reservations and offtake agreements with well-known brand owners.

The technology partnership between Avantium and Origin includes a non-exclusive industrial technology license agreement, providing Origin Materials access to relevant parts of Avantium’s process technology to enable the conversion of Origin-produced CMF derivatives into FDCA at a 220,000-lb/yr scale facility. Under the technology license agreement, Avantium grants Origin a non-exclusive license to use certain parts of Avantium’s proprietary YXY process (including certain patent rights) for the purpose of designing, constructing and operating the licensed facility, and producing, using, selling and converting FDCA manufactured at that facility. Avantium will also execute a development program under the license agreement to establish a bridge between Origin’s and Avantium’s technologies. Origin Materials expects to incorporate Avantium’s process technology into the supply chain for product from its future plants.

In support of the industrial technology license agreement, Avantium and Origin Materials have made ancillary arrangements to develop the market for FDCA and PEF applications. They have also entered into a conditional offtake agreement, whereby Avantium will sell FDCA and PEF to Origin Materials from its FDCA pilot plant in Geleen (the Netherlands) in 2023, and from its FDCA Flagship Plant in Delfzijl (the Netherlands) as from the commercial operations date in 2024. During the term of the COA, Origin will purchase a gradually increasing minimum annual volume of FDCA on a take-or-pay basis, which has the potential to enable Origin to accelerate market adoption of FDCA and PEF. Avantium continues to pursue its dialogue on additional offtake and industrial license agreements with other industrial partners to further expand and diversify the market for FDCA and PEF applications.

We started reporting on Avantium back in 2012, when the company had signed its second major partnership for using its new catalytic process to convert plant sugars into furanic precursors for a new ‘green’ polyester bottle resin--PEF. That was a joint agreement with Danone Research (the then number two in the global bottled-water business) for development of bottles from polyethylene PEF. In December of 2011, Avantium had entered its first joint development agreement with Coca-Cola. The goal to produce a 100% biobased alternative to PET has been in the works by Avantium since late 2010. That was when the company started up its FDCA monomer pilot unit as well as a small PEF pilot plant, capable of producing 80,000 lb/yr.

Since then, Avantium has been pushing for commercial-scale production of PEF through approaches such as licensing and partnering arrangements in the belief that once commercial scale is achieved, PEF would compare quite favorably with reigning bottle king PET. PEF reportedly has oxygen barrier that is 10 times that of PET, along with double the water vapor and four times the CO2 barrier. Its glass-transition temperature of 190.4 F is 53.6 F higher than PET, with a tensile modulus that is 1.6 times greater. The thinking is that even though PEF has about a 5% higher density than PET, it could make lighter bottles by thin-walling and/or eliminating barrier layers.

In 2016, we reported that Avantium and BASF formed the Synvina joint venture with Avantium for the production and marketing of the “green” FDCA building block, as well as marketing of PEF. This venture has been using Avantium’s YXY process for the production of FDCA, and the partners have aimed to further develop the process and to construct a reference plant for the production of FDCA with annual capacity of about 110-million lb/yr at BASF’s Verbund site in Antwerp, Belgium. However in early 2019, BASF announced it was exiting the Synvina joint venture. It appears there was a dispute between the two companies on the timing for the fulfillment of the criteria to invest in the commercial-scale plant for FDCA.

However, last year we reported on the Avantium’s plans to start-up the world’s first commercial-scale FDCA Flagship Plant in Delfzijl, the Netherlands, slated for startup in 2024, as noted above. We also reported that the company has signed offtake agreements with both the global brewery group Carlsburg and the Brazilian brewing company AmBev for the securing of fixed volumes of PEF produced by the new plant. AmBev, the largest beer company in the world, will purchase PEF from Avantium’s Flagship Plant and will use it to make bottles for its soft drinks portfolio. Also in 2022, Avantium signed a conditional offtake agreement with world luxury goods leader LVMH Group (Moët Hennessy Louis Vuitton). With this offtake agreement, LVMH Perfumes & Cosmetics Houses has secured a fixed volume of PEF from Avantium’s Flagship Plant for its cosmetics packaging.

Related Content

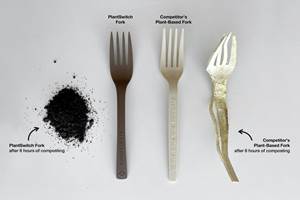

Advanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

Read MoreHow to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MoreMaking a Play With PHA

Processors with sustainability goals or mandates have a number of ways to reach their goals. Biopolymers are among them.

Read MoreBest Practices for Purging PHA and PHA/PLA Blends

Because bioplastics are processed at lower temperatures, purging between jobs requires a different process and purging agents than those applied for traditional resins.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More