Biodegradable Plastics Volume to Increase More than 50 percent

Western Europe now leads as the largest market with regulation as the most significant driver.

As I have in the past five years, I’m looking forward to attending and reporting on the upcoming 6th Annual Global Plastics Summit (GPS) 2018, October 30 – November 1, in Chicago. Among key topics of discussion will be the issue of plastics and sustainability.

Experts from IHS Markit and the Plastics Industry Association will discuss the latest market outlooks from key industry sectors, with senior business leaders sharing their companies’ strategies for success and innovators presenting the latest in plastics technologies.

Bob Maughon, R&D vice president, Packaging and Specialty Plastics and Hydrocarbons, at The Dow Chemical Company, will discuss sustainability as a catalyst for innovation in packaging. Don Thomson, president of The Center for Regenerative Design and Collaboration, will address turning plastic waste into building blocks.

The new IHS Markit Chemical Economics Handbook: Biodegradable Polymers Report provides an in-depth analysis of the growing demand for biodegradable plastics. Key drivers are increasing regulations and bans against plastic bags and other single-use plastic items such as drinking straws.

Said Marifaith Hackett, director, specialty chemicals research at IHS Markit and the report’s lead author, “The last time we at IHS Markit assessed the global demand for biodegradable polymers, we noted the U.S. was the largest driver of demand growth for this segment, but due to legislation, Europe is by far the leading demand center. Europe is the place to watch, as Europeans are particularly motivated to reduce marine litter….More legislation is likely coming in Europe or at the E.U. level, and if that occurs, we could see major changes in this industry and pushback from producers of traditional plastic products.”

The current market value of biodegradable plastics exceeds $1.1 billion in 2018, but could reach $1.7 billion by 2023. In 2018, global demand for these polymers is about 794 million lb (360,000 m.t.), but total consumption of biodegradable polymers is expected to increase to almost 1.2 billion lb (550,000 m.t.) by 2023, representing an average annual growth rate of 9 percent for the five-year period, which is equivalent to a volume increase of more than 50 percent from 2018 to 2023.

The major manufacturers of biodegradable polymers include NatureWorks (a joint venture of Cargill and PTT Global Chemical), Novamont, BASF, and PTT MCC Biochem Co., Ltd., a joint venture of PTT Public Company Ltd. (the parent of PTT Global Chemical) and Mitsubishi Chemical Corporation.

In addition, TOTAL Corbion PLA, a joint venture of energy producer TOTAL and lactic-acid producer Corbion, plans to start up a world-scale polylactic-acid facility in Thailand by the end of 2018. The U.S. accounts for the bulk of production for these polymers, but Thailand, with its proximity to growing markets in Southeast Asia, its expanding bio-economy, favorable investment climate, stable government, and access to cost-effective sugarcane feedstocks for fermentation, is becoming an increasingly important contributor to the biodegradable polymers market, according to the report..

Biodegradable or compostable polymers are bio-based or fossil-fuel-based polymers (plastics) that undergo microbial decomposition to carbon dioxide and water in industrial or municipal compost facilities. A few of these polymers decompose in backyard compost bins or in soil, freshwater or saltwater. Key markets are as follows:

- The food packaging, disposable tableware (cups, plates, and cutlery) and bags sector is the largest end-use segment, as well as the major growth driver for biodegradable polymer consumption. This segment will benefit from local restrictions on plastic shopping bags and will achieve double-digit growth.

- Compost bags are the second most important end-use for biodegradable polymers. This market segment will experience strong growth thanks to the gradual expansion of composting infrastructure and growing interest in diverting organic waste such as leaves, grass clippings and food waste from landfill.

- Foam packaging, which includes starch-based loose-fill packaging (packing peanuts), is a significant end-use for biodegradable polymers in Western Europe and North America;. mulch films and other agricultural applications are important end uses in Western Europe and Asia.

- Smaller-volume markets include paper coatings for cups and cartons, as well as textiles, nonwoven fabrics, resorbable medical devices such as sutures and implants, downhole tools for oil and gas field operations, and 3-D printing filament.

Said Hackett, “Biodegradable plastics, which are largely starch-based compounds or polylactic acid (PLA)-based materials, have become more cost-competitive with petroleum-based plastics and the demand is growing significantly, particularly in Western Europe, where environmental regulations are the strictest. However, the demand for these biodegradable polymers is still a drop in the bucket when you compare it to demand for traditional plastics such as polyethylene (PE).”

According to IHS Markit, global demand for PE, the world’s most-used plastic, has nearly doubled during the last 20 years. IHS Markit expects 2018 global PE demand to exceed 220 billion lb (100 million m.t.). However, significant new market pressures, including a rise in consumer expectations around sustainability, along with tightening environmental regulations in mature markets such as Europe and key growth markets such as China, could threaten future demand growth.

“The properties and processability of biodegradable polymers have improved, allowing the use of these materials in a broader range of applications, but legislation is the single most important demand driver for these plastics,” Hackett said. “Restrictions on the use of non-biodegradable plastic shopping bags in Italy and France have led to a significant increase in the consumption of biodegradable polymers in those countries, and we expect European countries will continue to lead in legislative restrictions.”

In contrast, Hackett said, biodegradable polymer use has grown more slowly or stagnated in places that lack mandates. “Growing consumer awareness and activism regarding environmental issues could certainly increase the market for biodegradable plastics…To truly capture the benefits of these biodegradable polymers, however, you need to have the collection and composting infrastructure to support their use. Very few major cities or municipalities currently have the necessary infrastructure in place.”

Hackett said it is important to understand that many biodegradable polymers are compostable only in special industrial composting facilities, which operate at higher temperatures than home compost piles. “Only a subset of biodegradable polymers is compostable in backyard compost bins; an even smaller subset is compostable in the soil or in marine environments,” Hackett said.

Despite the positive potential of biodegradable polymers, they are still mostly taking a backseat to other sustainability approaches, such as reducing plastics consumption and recycling, Hackett said. “For various reasons, which may include consumer confusion regarding bio-based plastics versus biodegradable polymers, there is not as much demand for these more sustainable plastics as you might expect, despite heightened public awareness of the plastics waste issue…In addition, suitable disposal options for products made from biodegradable polymers are often lacking. The cost of establishing the infrastructure necessary to support their collection and composting remains a barrier to demand growth.”

Mandatory composting programs can contribute to demand growth for biodegradable polymers, the IHS Markit report said. These programs divert organic waste from landfill, thus reducing greenhouse gas emissions from landfill sites. The expansion of composting programs can spur demand for compostable trash bags and food service ware, both important end uses for biodegradable polymers. The shortage of composting facilities that are capable of processing biodegradable polymers limits the positive impact of mandatory composting programs on biodegradable polymer demand.

The report notes that the biodegradable polymers industry is affected by several major drivers in the environmental area: solid-waste disposal patterns, existing and potential legislation, and consumer attitudes and behavior. The evolution of these factors and their impact on the biodegradable polymers industry differ in each region of the world.

For example, in the U.S., landfilling is the most common method of municipal solid waste (MSW) disposal. According to the U.S. EPA, landfill accounted for 53 percent of total MSW in 2014 (the most recent year for which data are available). Materials recycling accounted for 26 percent, and combustion with energy recovery at 13 percent were next in order of importance. Composting accounted for 9 percent of MSW disposal.

Composting has the potential to become a more important means of MSW disposal, especially for food waste and yard trimmings. According to the IHS Markit report, together, these two categories of waste accounted for 28 percent of U.S. MSW generation in 2014. In the case of yard trimmings, 31 percent of the waste generated was landfilled, while 61 percent was composted, and the remaining 8 percent was combusted with energy recovery.

Composting of plastics waste was negligible in 2014. Landfill was the primary method of disposal, responsible for 75 percent of plastics waste in the U.S. Combustion with energy recovery was 15 percent, and recycling accounted for 9 percent of the remainder.

Said Hackett, “Biodegradable or compostable polymers can play a role in diverting waste from landfills. For example, biodegradable pods for single-serve coffee makers simplify disposal of used capsules; compostable trash bags can control odors, minimize mess, discourage pests, and otherwise reduce the ‘yuck’ factor associated with residential composting programs….Diverting organic waste from landfill reduces emissions of methane—which is a potent greenhouse gas. We at IHS Markit expect biodegradable or compostable plastics will increasingly be an important part of the sustainability solution, but much of their advancement and adoption will depend on legislation as well as consumer attitudes and behavior.”

Related Content

PHA Compound Molded into “World’s First” Biodegradable Bottle Closures

Beyond Plastic and partners have created a certified biodegradable PHA compound that can be injection molded into 38-mm closures in a sub 6-second cycle from a multicavity hot runner tool.

Read MoreICIS Launches: Ask ICIS Generative AI Commodities Assistant

Said to be the first of its kind, this AI assistant will enhance access to ICIS’ intelligence and insights for the energy and chemical markets.

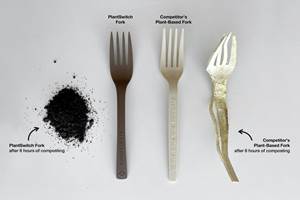

Read MoreAdvanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

Read MoreBest Practices for Purging PHA and PHA/PLA Blends

Because bioplastics are processed at lower temperatures, purging between jobs requires a different process and purging agents than those applied for traditional resins.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More