Contraction Slows for Processors

For the first time since the coronavirus pandemic, Gardner Business Index signals decelerating contraction as all components report improved readings.

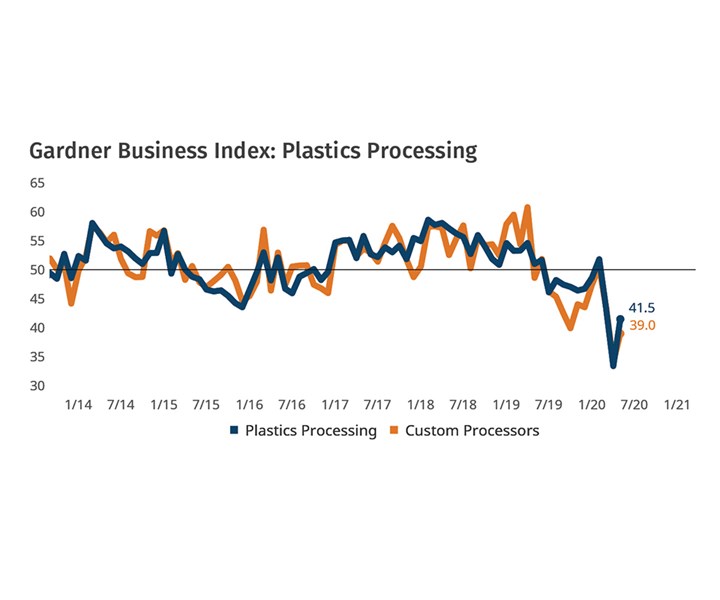

The Gardner Business Index for plastics processing moved up by eight points in May, registering 41.5 after setting an all-time low in April. For the first time since the government curtailed normal business operations to prevent the spread of COVID-19, all components of the Index moved towards more “normal” levels. Excluding supplier deliveries, all components moved higher from their prior-month readings, although each remained below 50. This situation signals that the industry is experiencing a slowing contraction, meaning that while conditions deteriorated further in the latest month, they did so at a slower rate than in the prior month.

FIG 1 Both the overall plastics processing and custom processors indices moved higher in May. Higher readings for new orders, production, exports, backlogs, and exports, along with a decline in the supplier deliveries reading, were welcome news as they indicate the first signs of a turn towards more typical business conditions.

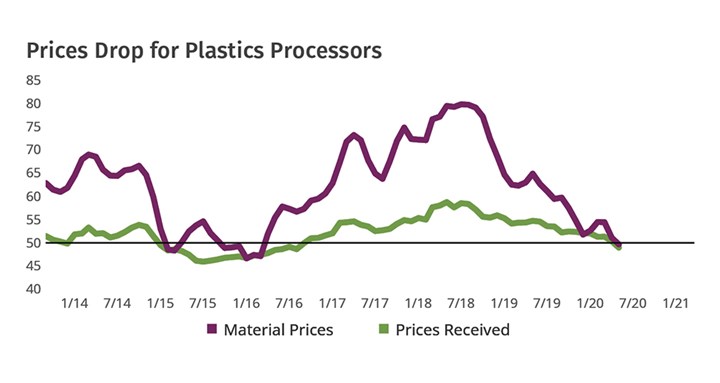

The supplier delivery reading fell slightly in May, which may indicate a turning point in the unprecedented disruption that affected upstream production and slowed deliveries earlier in the year. (Quickening supplier deliveries lower this Index component’s reading.) The plastics processing market was exceptional in May in that survey participants reported both falling material prices and weaker pricing power for their own products.

FIG 2 Most manufacturing industries saw higher prices for raw materials in May. But not for plastics processors. While most polymers are derived from natural gas, resin prices have traditionally tracked oil prices. Prices received by processors for their goods also declined.

FIG 2 Most manufacturing industries saw higher prices for raw materials in May. But not for plastics processors. While most polymers are derived from natural gas, resin prices have traditionally tracked oil prices. Prices received by processors for their goods also declined.Across manufacturing in general, material prices increased during May. But not for plastics processors. Even though most resin is derived from natural gas feedstock, the price of resin has historically tracked that of oil. West Texas Oil prices have plunged 50% since the beginning of 2020, which likely explains why plastics processors’ materials costs have bucked this trend.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology Magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

How to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

-

Plastics Technology Year in Review: Your Favorite Reads of 2024

A year-end review of the top stories showcasing industry trends, advancements and expert insights. Revisit the articles that captured the attention of the plastics community.

-

First Water Bottles With Ultrathin Glass Coating

Long used for sensitive juices and carbonated soft drinks, KHS Freshsafe PET Plasmax vapor-deposited glass coating is now providing freshness and flavor protection for PET mineral water bottles.

.jpg;width=70;height=70;mode=crop)