Index Climbs Higher Toward ‘Neutral’ Mark

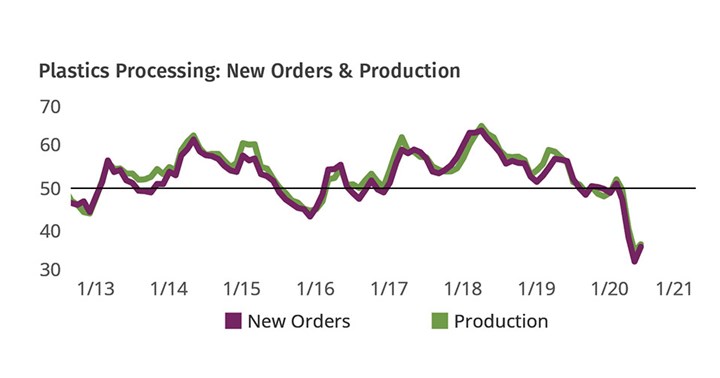

New orders and production hint at a bottom in the initial disruption caused by the Coronavirus pandemic.

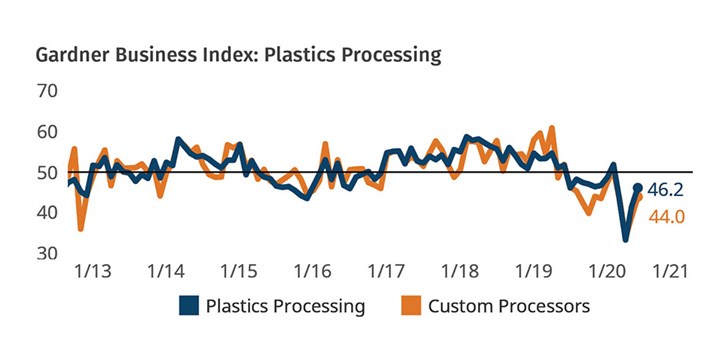

The Gardner Business Index for plastics processing jumped nearly five points in June to close at 46.2. A subset of those results from just custom processors showed a similar change in business activity. The Index, calculated from surveys of Plastics Technology subscribers, was supported by a slowing contraction in employment and new orders and an elevated but declining reading for supplier deliveries.

FIG 1 The GBI for plastics processing advanced 5 points as Plastics Technology subscribers reported a slowing contraction in business conditions.

When data points such as new orders, production and employment all move higher in absolute terms—but are below the point of no change from the prior month (50 on the Index scale)—the interpretation is that businesses are experiencing a slowing contraction. As the index and its components approach the 50 mark, the processing market should get a clear idea of how close it is to the bottom of the economic impact caused by Covid-19.

For context, it is important to remember the unique way in which supplier deliveries are monitored. Slowing supplier deliveries result in an elevated reading, increasing the overall Index. That’s because during an economic expansion upstream suppliers experience growing backlogs, causing shipment delays to their customers and our survey respondents. To correlate supplier deliveries activity to the economic cycle, the reading increases when delivery times slow. Unfortunately, the unprecedented disruption to the world economy caused by Covid-19 has slowed upstream production and thus also deliveries, causing the supplier delivery index to rise.

FIG 2 As critical measures of business activity show slowing contraction, the processing market may be nearing a floor from which business activity can begin to accelerate again. If readings continue to increase, the industry could begin to experience rebounding growth before the end of the year.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Reduce Downtime and Scrap in the Blown Film Industry

The blown film sector now benefits from a tailored solution developed by Chem-Trend to preserve integrity of the bubble.

-

Part 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

-

The Importance of Barrel Heat and Melt Temperature

Barrel temperature may impact melting in the case of very small extruders running very slowly. Otherwise, melting is mainly the result of shear heating of the polymer.

.jpg;width=70;height=70;mode=crop)