Legal Resource Discusses Proposed Plastics Bill

U.S. Senator Tom Udall (D-N.M.) and U.S. Representative Alan Lowenthal (D-Calif.) announced that they plan to introduce legislation this fall that will tackle the plastic waste crisis. Maureen Gorsen, partner in Alston & Bird's Environment, Land Use & Natural Resources Group, talks about the potential impact of the plan.

This fall, U.S. Senator Tom Udall (D-N.M.) and U.S. Representative Alan Lowenthal (D-Calif.) plan to introduce legislation that aims to address plastic waste. The proposal includes a mix of phase-outs of certain single-use consumer products, an extended producer responsibility for those and other products, and deposit or charge requirements at the consumer retail level. Companies that produce products would be required to design, manage and finance end-of-life programs for both products and their packaging.

Maureen Gorsen is a partner in Alston & Bird's Environment, Land Use & Natural Resources Group and a national chemicals authority who has testified previously before Congress on proposed reforms. She’s also the former director of the California Department of Toxic Substances Control and former general counsel of the California Environmental Protection Agency. Here’s her perspective on the potential impact of this plan:

What are some of the key components of this proposed legislation for producers?

The proposal is almost a kitchen sink of all the Extended Producer Responsibility (EPR) bills and concepts that have been floating around, tested or enacted in smaller components in many localities and states. So, it has many components. The principle component is the very idea of EPR, which is that design of and material choices for products and packaging should take into account the end-of-life disposal costs at the front end, and that the manufacturer bear those costs—not local governments or the public.

To that end, the main part of the proposal would require manufacturers of plastic products and packaging design to manage and finance for the end-of-life management prior to the time of sale.

The proposal would also put a national deposit on beverage containers at the retail level, require beverage sellers to install reverse vending machines, place fees on all non-reusable carryout bags—paper and plastic—set recycling targets to get to 100% recyclability, add labels on plastic consumer products to indicate presence of plastic and proper disposal and ban lightweight plastic carryout bags, cups, lids, cotton buds, cutlery, plates, straws, snack packaging and drink stirrers as well as expanded polystyrene in foodware, disposable coolers and shipping packaging.

In addition, the proposed federal bill would set collection targets for states for single-use plastic drink bottles and penalize states that hinder local governments from taking even more aggressive measures with a loss of federal funding.

What is the potential impact of this legislation for those in the plastics manufacturing industry who produce plastic packaging?

There is already a push in states such as California to eliminate all single-use plastic packaging, so we will see a reduction in demand with this proposal even if it does not pass, as other states will pick up on and enact some of its key components. R&D costs will go up to redesign the materials to meet new recyclability standards, and the requirement to incorporate the costs of disposal will increase their price and make them less desirable in the marketplace.

What type of impact will this have on the cost of consumer products?

This will result in shifts in choices in material choices across industries, so it is too broad a question to have a single answer. Some products will be more expensive, but some material changes may be cost- neutral or have significant savings as consumers get used to having less packaging overall.

Do you see the potential for brands to shift from plastic packaging to other packaging material to avoid having to cover the costs such as waste management and clean-up?

Absolutely, I haven’t seen a plastic straw in a while. They’ve all been replaced with paper straws. This will happen in many plastic products and packaging sectors.

Related Content

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreHow to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

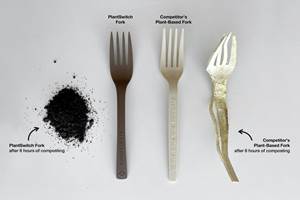

Read MoreAdvanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

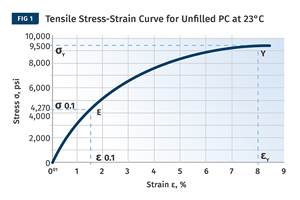

Read MoreThe Effects of Stress on Polymers

Previously we have discussed the effects of temperature and time on the long-term behavior of polymers. Now let's take a look at stress.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More