North American Robotics Market Experienced Best Quarter Ever

The first three months of 2022 were up 28% over the same time period in 2021, while globally robot sales for 2021 rose 27% year over year.

Setting a new record, the North American robotics market saw companies from the U.S., Canada and Mexico order 11,595 industrial robots in the first quarter—a 28% gain compared to the first quarter of 2021, according to data released by the International Federation of Robotics (IFR). Revenue rose by 43%, reaching a value of $664 million. These results reflect a positive trend globally with preliminary data for 2021 showing that 486,700 industrial robots were installed around the world, marking a 27% gain over 2020.

IFR President Milton Guerry noted in a release that worldwide installations of industrial robots in 2021 exceeded the previous record year of 2018. In 2021 in North America, Guerry said first quarter order volumes for both units and revenue were at all-time highs.

In North America, car makers and their suppliers accounted for 47% of robot orders in the first quarter of 2022, as their orders grew by 15% year-on-year. A portion of this growth reflects the fact that several car manufacturers have announced investments to further equip their factories for new electric drive car models or to increase capacity for battery production. “These major projects will continue to create demand for industrial robots in the next few years,” the IFR stated in its release. The U.S. has the second largest production volume of cars and light vehicles in the world, following China. Worldwide installations of industrial robots in the automotive sector reached 109,400 units in 2021, growing 37% year-on-year.

Continuing a trend, non-automotive customers have ordered more robots than automotive customers. Worldwide, the electrical & electronics industry is the strongest adopter with a record of 132,200 units installed in 2021. In North America, automotive customers ordered 5476 units in the first quarter, while non-automotive customers ordered 6122 units the same period. In seven out of the last nine quarters, orders from non-automotive customers surpassed orders from automotive customers.

In 2021 on the basis of annual installations, plastic and chemical products ranked fourth globally in terms of robotics markets, trailing, in order: electrical electronics, automotive, and metal and machinery.

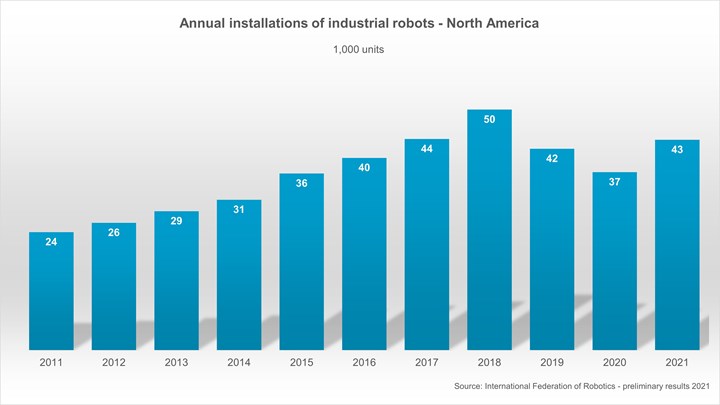

IFR data show North American robot sales rebounding strongly in 2021 after two straight years of declines. The first quarter of 2022 marked a record start.

Photo Credit: IFR

Related Content

-

Scaling New Heights With Vertical Integration

Eden Manufacturing was founded on a vision of vertical integration, adding advanced injection molding capabilities to a base of precision moldmaking and more recently bringing Swiss-type machining capabilities in-house.

-

Processing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

-

Cobot Creates 'Cell Manufacturing Dream' for Thermoformer

Kal Plastics deploys Universal Robot trimming cobot for a fraction of the cost and lead time of a CNC machine, cuts trimming time nearly in half and reduces late shipments to under 1% — all while improving employee safety and growth opportunities.