PE Film Market 2020 Snapshot: Stretch Film

Stretch film accounted for 2.4 billion lb of PE of resin consumption in 2019, making this sector one of the largest and fastest growing markets within the PE film industry, according to Mastio’s research. The top five players hold about 80% of the market.

With this blog we launch a series of articles based on 2019-2020 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for extruders of polyethylene film. There will be 10 articles in all, two a week. The first five—beginning with this one—will offer Mastio’s analysis—based on interviews with processors conducted direct by the Missouri firm—with film processors representing the five largest PE film markets. The second batch of five will be focused on the five fast-growing PE film markets.

Check out the video that accompanies each of these articles in which Kevin Huntsman, Mastio’s senior vice president, and I discuss the takeaways of each market highlighted.

The Numbers

In 2019, approximately 2.4 billion lb of PE was consumed in the production of stretch film, making this sector one of the largest and fastest growing markets within the PE film industry, according to Mastio’s research. With an average annual growth rate (AAGR) of 4%, Mastio PE resin consumption to 2.7 billion by 2022.

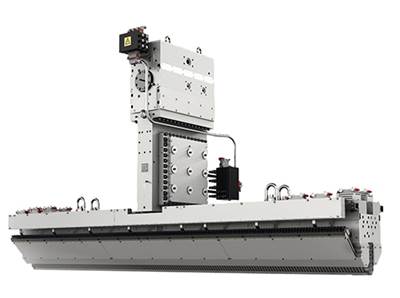

Photo: Davis-Standard

Of the 2019 total, machine wrap stretch film represented nearly 1.4 billion lb—58% of the market. Hand-held stretch film represented about 40% of the market, and stretch hooder film represented about 2%. The stretch hooder segment is expected to have the fastest growth of any stretch film product segment. Growth is determined by increased investment in hooding machinery that allows companies to package or wrap tiles and bricks, appliances, roofing material, and bulk warehouse packaging.

In his reports, Mastio notes that in both the blown and cast film extrusion processes, coextruded stretch film constructions allow processors to design a film that has high levels of cling and one-side slip, ensuring a low coefficient of friction (COF). Coextruded stretch films allow for maximum utilization of space where pallets, boxes and rolls of stretch wrapped products are tightly packed in rail cars, transportation vehicles, and warehouses. One-side slip prevents stretch-wrapped products from sticking to each other or disrupting the packaging. Stretch films are available in a wide range of tackifier levels designed to reduce noise during application and to avoid damage to products or packaging during removal, without any leftover adhesive residue.

Stretch film is offered in a wide variety of widths ranging from 1 to more than 100 in. Hand-held grades of stretch wrap are typically marketed in narrower web widths of 1, 2, 5, 10, 12, 15, and 18 in., with 12 and 18 in. being the most common. The most common range of web widths for machine rotary stretch film is 18 to 30 in., states Mastio.

The Players

During 2019, the five largest stretch film producers were Berry Global Group, Inc. (Engineered Materials Div.); Sigma Plastics Group (Sigma Stretch Corp.); Inteplast Group Ltd. (AmTopp); Well Springs Capital Management, L.L.C. (Paragon Films); and Malpack Corp. Collectively, those five companies accounted for an 80.1% share of this market and a combined PE resin consumption totaling 1.928 billion lb.

Coextruded stretch film constructions allow processors to design a film that has high levels of cling and one-side slip, ensuring a low COF.

Scientex Packaging Film, headquartered in Port Klang, Selangor, Malaysia, is a new entrant in the stretch film market in North America. Scientex has been in film processing for more than 40 yr, and the Port Klang plant ranks as the world’s largest stretch film facility in a single location. Scientex set up its first stretch film operation in January of 2018 in Phoenix. According to Mastio, Scientex Packaging is currently spending $43 million to open its second stretch film manufacturing plant in Lancaster, S.C. in 2021.

Zummit Plastics also located in Phoenix. is another new participant in the North American stretch film market. Mastio’s research revealed that they are currently looking to expand by adding two cast film extrusion lines and possibly building facilities in the eastern U.S. over the next two years. Specifically, there has been discussion of expanding in Columbus, Georgia.

The Resins

Stretch films continue to become much more sophisticated in composition and construction. Stretch films are also custom designed for specific end-use applications. Many specialty blends of LLDPE and LDPE resins are being utilized in the manufacturing of monolayer stretch films.

Additionally, greater use of coextruded films, using all grades of PE resins, can provide a multitude of combinations of desirable film properties. Varying degrees of one-or two-sided cling and one-sided or two-sided slip are the main reasons for utilizing coextrusion technologies.

Metallocene-based LLDPE resin has experienced a great increase in utilization for stretch film over the last several years. Due to its inherent elastomeric/rubber-like properties and when used in blends or in coextrusion, mLLDPE yields higher levels of film clarity, greater stretch levels, and greater impact resistance at lower gauges than conventionally produced LLDPE resins.

In 2019 more than 78% of the stretch film produced was made via cast film.

Stretch film is currently being produced with one or more resin combinations. LLDPE-butene, LLDPE hexene, LLDPE-super hexene, LLDPE-octene, mLLDPE, LDPE-homopolymer, LDPE-EVA copolymer, and PP resins are extruded individually, in blends, or coextruded.

LDPE-EVA copolymer resins are often used to increase the stretch film’s clarity, low- temperature flexibility, impact resistance, and heat seal properties. LDPE-EVA copolymer resins are well suited for use in stretch film that requires printing. As the EVA copolymer percentage content increases, so does the impact strength (especially at lower temperatures), optical clarity, gas permeability, environmental stress crack resistance (ESCR), and COF. Conversely, as the EVA copolymer percentage increases, the stiffness modulus, surface hardness, tensile yield strength, and chemical resistance will generally decrease. Moreover, manufacturers are utilizing mLLDPE combined with EVA copolymer resin to produce stretch film with enhanced performance properties.

Some participants in this market coextruded PE materials with PP resin. A common blend of stretch film contains 5% to 25% LDPE resin with 75.0% to 95.0% representing LLDPE-butene, LLDPE-hexene, LLDPE-super hexene, LLDPE-octene, or mLLDPE resins. LDPE/LLDPE resin blends exhibit good clarity and a higher tendency to elongate under load, due to their lower degree of crystallinity and resultant modulus.

Polyisobutylene liquid is commonly custom blended into stretch film resin as a tackifying agent to yield cling properties.

The Processing Trends

Current methods for producing stretch film include the following: monolayer blown film extrusion, multi-layer blown film coextrusion, monolayer cast film extrusion and multi-layer cast film coextrusion. During the past several years the stretch film industry has continued to experience a shift from the utilization of the blown film extrusion process to the cast film extrusion process and from monolayer construction to more multi-layer coextruded film constructions.

Mastio reports that in 2019 more than 78% of the stretch film produced was made via cast film, and more than 83% of all the stretch film sold (cast and blown) was coextruded.

The Future

During 2019, some participants in this market were optimistic about increased growth in demand due to the current improved economic conditions and expectations over the next three years, while a few others felt that growth would result from gaining market share from other competitors. Generally, the reported overall production of stretch film has increased and will continue to grow through the year 2022 due to the tremendous PE capacity currently coming in, companies developing new products, companies adding capacity, building new plants, adding new equipment, and/or adding building square footage.

Stretch hooder film and pre-stretched film segments will be leading the growth in the stretch film market. Overall, the stretch film market will remain strong because it lowers handling costs, saves money in transportation and labor, reduces damage and pilferage, and makes it easier to identify inventories.

As the economy fluctuates, many stretch film producers feel they are the first ones to feel the effects. If the economy goes into a recession there will be less consumer purchases, therefore resulting in less shipping and less stretch film usage. Remember also that downgauging is a key trend in this market which impacts the growth of stretch film on a pounds-consumed basis.

It’s unclear to what extent nanolayer technology is being used among North American suppliers due to patent issues. It’s more common in Europe, leading some to speculate that stretch-film processors based there will be setting up shop in North America at some point to offer this new technology while taking advantage of generally lower resin prices.

Related Content

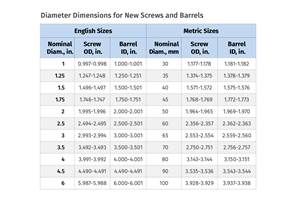

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

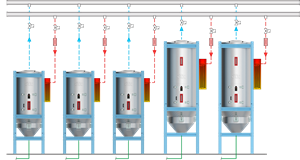

Read MoreHow to Effectively Reduce Costs with Smart Auxiliaries Technology

As drying, blending and conveying technologies grow more sophisticated, they offer processors great opportunities to reduce cost through better energy efficiency, smaller equipment footprints, reduced scrap and quicker changeovers. Increased throughput and better utilization of primary processing equipment and manpower are the results.

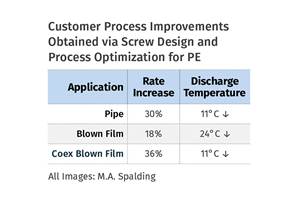

Read MoreHow Screw Design Can Boost Output of Single-Screw Extruders

Optimizing screw design for a lower discharge temperature has been shown to significantly increase output rate.

Read MoreWhy Are There No 'Universal' Screws for All Polymers?

There’s a simple answer: Because all plastics are not the same.

Read MoreRead Next

What You Need to Know to Make World-Class Stretch Film

Advances in materials, feedblock/die technologies, and winding can help processors develop more sophisticated cast-stretch products.

Read MoreAre You Ready to Export Your Film?

The shale gas boom could provide unprecedented opportunities for film processors.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More