PE Film Market Analysis: Frozen Foods

Near-term growth looks good but millennials' desire for fresh meal solutions could impact longer-term growth..

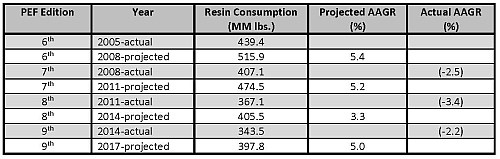

Last year, polyethylene resin consumption for frozen-food packaging reached 343.5 million lb. This market's consumption of PE is expected to increase at an average annual growth rate (AAGR) of 5% over the next three years, boosting it to 397.8 million lb.

These are among the conclusions of the most recent study of the PE Film market conducted by Mastio & Co., St. Joseph, Mo.

Industry analysts estimated that U.S. retail sales of frozen foods were flat and amounted to approximately $44 billion in 2012 (most recent figures), with nearly all dollar sales gains resulting from inflation or new products. Previous forecasts that this market would expand aggressively did not come to pass due to the nation’s slow economic recovery, changing consumer eating patterns, demographics, and shopping patterns, according to the Mastio report. Retailers are expected to continue focusing on the “freshness” factor and promote fresh foods, due to competition from prepared fresh foods, shelf-stable foods, and restaurants; thus hurting frozen foods and frozen foods packaging sales.

PE film used in frozen foods is limited to packaging some, not all, of the frozen foods sold such as vegetables, fruits, pizza, pastries, potato products, appetizers, and some breakfast and side-dish items. According to several industry analysts, U.S. product shipments of frozen fruits and vegetables reached $11.1 billion dollars in 2011 (most recent figures). A little more than 72% of the product shipment value amount was captured by the frozen vegetables segment, and the remaining by the frozen fruit segment.

PE frozen food film is typically sold as rollstock, but some companies manufacture finished bags. Rollstock frozen food film varies in width and length depending upon customer specifications. Typically, widths range from 6 in. to 40.0 inc., but can be as wide as 90 in, Mastio’s research reveals. The gauge of this film ranges from 0.5 mil to 6.0 mils, with 1.5 mils and 2 mils being the most typical. Institutional (food service) rollstock is typically 1.5 mils to 2 mils, and retail (consumer) rollstock typically has a gauge ranging from 2 mils to 2.5 mils.

According to the study, finished bags are commonly 12-in. wide by 12- in. long . Smaller bags are commonly 8-in. wide by 15-in. long. The largest (institutional) finished bags are 48- in.-wide by 60-in. long. Finished bags are generally 2.25 mils and typically come in 9-, 16-, 20-, 32- and 40-oz capacities, says Mastio

Some performance specifications for frozen food film include the following: sealability, strength, puncture resistance, moisture barrier, odor barrier, oxygen barrier, toughness, cold temperature resistance, opacity and appearance. Because of the damaging ultraviolet rays from fluorescent lighting in grocery store freezers and unsightly ice crystals which surround frozen foods, many manufacturers blend titanium dioxide (TiO2) in the film structure to produce opaque film.

Zippered closures have been accepted in the frozen food packaging market. Zippered bags have been used to package fish, battered chicken strips, and various other appetizers. Zippered closures enable the consumer to use a portion of the product, reclose the package, and return it to the freezer with the food product protected from possible freezer storage damage. Although the zippered closure offers convenience, added value, and product freshness; it has yet to completely penetrate the market, primarily because it is more expensive than traditional frozen food bags.

MATERIAL ALTERNATIVES

Other materials, such as biaxially oriented polypropylene (BOPP) film, PP film, polymer-paper structures, polyester film, wax paper, and extrusion coated paperboard cartons, all compete with PE film for frozen-food packaging, says Mastio. Although alternative packaging is commonly used in the frozen foods market, PE film is the preferred material because of its superior moisture retention properties. Over time, frozen produce packaged in extrusion coated paperboard cartons loses moisture and become brittle, while PE bags retain the natural moisture in frozen foods. When frozen foods film producers were asked what the advantages of PE film were, responses included: cost effectiveness, good sealant properties, ease of disposal, source reduction of packaging, and ease of recycling, Mastio says.

TECHNOLOGY TRENDS

Frozen food packaging is produced via blown and cast film extrusion processes. That said, according to this report, approximately 99.1% of the PE film for this market was processed via blownfilm.

Frozen food packaging can be either monolayer or multi-layer coextruded in construction. Approximately 46.1% of PE film utilized in the frozen food packaging market was monolayer in construction. More frozen-food film is multi-layer. Participants in the Mastio study reported producing 2-, 3-, or 5-layer coextruded films; several companies have capabilities of coextruding up to 11-layers.

Mastio & Co. profiled 32 North American film extrusion companies in the frozen food film market during 2014. The five largest producers of frozen food PE film are: Bemis North America; Sigma Plastics Group; Apollo Management, L.P. (Berry Plastics Corp. Div.); EPC Industries Ltd. (Polycello Ltd. Div.) ; and Sigma Plastics Group (ISO Poly Films, Inc. Div.). Collectively, they consumed approximately 51% of PE resin this market gobbled up last year.

MY TWO CENTS

“Millennials” (the generation born between 1982 and 2001) will play a strong role in determining the future of this market. By and large, they are less brand-loyal and are more willing to purchase organic and locally produced products and meal solutions. As millennials move into their peak earning years, this growing consumer segment will spend nearly 50% of their food budget on ready-to-eat solutions, such as take-out food and restaurant meals. Millennials buy fresh food more frequently and eat immediately versus the older generations that buy, store and eat later.

That said, some PE film processors are predicting and hoping for growth through innovative products and packaging, population growth, and the fact that companies such as Nestle S.A. and ConAgra Foods, Inc. are improving efforts to reinvigorate this sluggish food segment.

One other point: unlike higher-volume PE markets, the major players in frozen-food film hold a strong yet not overwhelmingly dominant position in the market, suggesting there is room for processors with innovative solutions to either enter the market or grab market share.

Related Content

How to Select the Right Cooling Stack for Sheet

First, remember there is no universal cooling-roll stack. And be sure to take into account the specific heat of the polymer you are processing.

Read MoreWhy Are There No 'Universal' Screws for All Polymers?

There’s a simple answer: Because all plastics are not the same.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

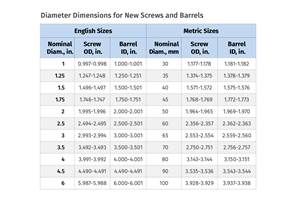

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreMedical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Extrusion simulations can be useful in anticipating issues and running “what-if” scenarios to size extruders and design dies for extrusion projects. It should be used at early stages of any project to avoid trial and error and remaking tooling.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More