PE Film Market Snap-Shot: Stretch Film

The six largest processors of stretch film accounted for more than 85% of capacity in 2017—product differentiation is essential for any newer, smaller players to enter the field.

With this blog we launch a series of articles based on 2017 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for extruders of polyethylene film. Each weekly blog will consist of growth projections, technology drivers, and key players in each of 10 different film segments. We’ll kick off the series with stretch film.

According to Mastio’ s research, the stretch film market continues to be one of the largest and most rapidly evolving PE film markets. Interview with processors conducted by Mastio reveal that stretch film processors remain optimistic about increases in demand for stretch film products, as stretch film continues to displace other conventional means of pallet unitization and product bundling.

Three distinct types of stretch films are commonly produced: hand-wrap, machine rotary or power-stretch wrap, and silage-wrap stretch films. However, within each category there are several highly customized sub-grades of stretch films designed for specific end-use applications, the Mastio report states. Stretch film application equipment is more cost-effective, faster, more user-friendly, more energy efficient and safer to use than shrink-wrapping equipment. Shrink film requires the use of heat lamps or hot-air guns, which use greater amounts of energy and labor than power stretch wrapping equipment. New applications for specialty grades of stretch film continue to be developed and commercialized in North America, and more sophisticated stretch films are being designed for existing applications.

Stretch film is offered in a wide variety of widths ranging from 1 in. to 100+ in. Hand-held grades of stretch wrap are typically marketed in narrower web widths of 1, 2, 5, 10, 12, 15, and 18 in., with 12 and 18 in. being the most common. The most common range of web widths for machine rotary stretch film is 18 to 30 in. Stretch films are most often wound on extended core rolls, allowing both hand and machine rotary application techniques. The extended core rolls aid in applying resistance to the film and stretching the film while it is being applied. Pre-stretching of the film is required to ensure good load retention during transportation and storage.

Stretch films are offered in many grades and gauges allowing applicators to use the most economical film for their specific applications. Unitized loads, which will be transported short distances or within a warehouse, require a lesser performing stretch film than loads being shipped greater distances. Stretch films can be further classified as being either yield films or load-retention films. Yield films are designed to provide the greatest amount of coverage during unitization. Yield stretch films are used for bundling products which are light weight or are intended to be shipped and moved short distances.

High yield or high percent stretch films provide the maximum coverage at the lowest cost. High load retention stretch films are designed to provide the greatest load retention, preventing large or heavy unitized products from shifting during transportation and storage. Load retention films provide greater resistance to stretch and have more “film memory” over time. Load retention stretch films are applied to heavier unitized loads that will be shipped greater distances. It should be noted that film thickness is a poor indicator of yield versus load retention abilities.

MATERIAL TRENDS

One of the most significant changes that continues to manifest in the stretch film market is increased use of metallocene single-site catalyst based linear low-density PE (mLLDPE) resin. When used in blends or in coextrusion with conventionally produced PE resins, mLLDPE resin greatly enhances the physical properties of the films in lower gauges.

In 2017, approximately 2.083.4 million lb of PE was consumed in the production of stretch film, making this sector one of the largest and fastest growing markets within the PE film industry. With an average annual growth rate (AAGR) of 3.7%, PE resin consumption to produce stretch film should reach 2.327.2 million lb by 2020, Mastio predicts.

TECHNOLOGY TRENDS

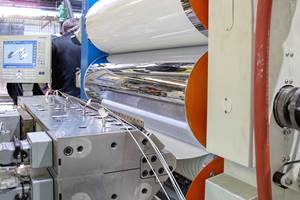

Current methods for producing stretch film include the following: monolayer blown film extrusion, multi-layer blown film coextrusion, monolayer cast film extrusion and multi-layer cast film coextrusion. During the past several years the stretch film industry has continued to experience a shift from the utilization of the blown film extrusion process to the cast film extrusion process and from monolayer construction to more multi-layer coextruded film constructions. According to Mastio, nearly 76% of all stretch film produced in North America was via cast film, while 82% of all films produced were coextrusions. Monolayer blown film extrusion is the most common method used to produce hand-held stretch wrap films.

MY TWO CENTS

According to Mastio, the six largest processors of stretch film (Berry Global Group Inc., Sigma Stretch Film Corp., Inteplast Group Ltd., Paragon Films Inc., Malpack Ltd., and Intertape Polymer Group Inc.) accounted for more than 85% of capacity in 2017. This is up slightly from Mastio’ s 2014 study, when the top six players accounted for 82% of the market. Patent disputes have restrained the development of more-sophisticated nano-layer structures that are more common in Europe. What’s more, unlike Europe, stretch film in North America is sold through distributors, separating the entity that produces the film from the entity that uses it. Product differentiation is essential for any newer, smaller players to enter the field. Ultimately the nano-structures that are prevalent in Europe will be produced in North America.

Read the Stretch Film Market Report.

Related Content

Novel Air Ring Solves Gauge Variations for Film Processor

Crayex installs Addex gauge-controlling air ring built for rotating/oscillating dies on a problematic line and notices dramatic improvement in thickness variations.

Read MoreHow to Effectively Reduce Costs with Smart Auxiliaries Technology

As drying, blending and conveying technologies grow more sophisticated, they offer processors great opportunities to reduce cost through better energy efficiency, smaller equipment footprints, reduced scrap and quicker changeovers. Increased throughput and better utilization of primary processing equipment and manpower are the results.

Read MoreBreaking the Barrier: An Emerging Force in 9-Layer Film Packaging

Hamilton Plastics taps into its 30-plus years of know-how in high-barrier films by bringing novel, custom-engineered, nine-layer structures resulting from the investment in two new lines.

Read MoreRoll Cooling: Understand the Three Heat-Transfer Processes

Designing cooling rolls is complex, tedious and requires a lot of inputs. Getting it wrong may have a dramatic impact on productivity.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More