R&E Tax Credit: A "Smart" Incentive for Industry 4.0 Companies

International CPA and business advisory Clayton & McKervey shareholders make case for improving your financial performance with R&E tax credit.

We were recently approached by CPAs Tim Finerty and Sarah Russell—shareholders at Clayton & McKervey, a Detroit-based international certified public accounting and business advisory firm—regarding the Research & Experimentation (R&E) tax credit, also known as the R&D tax credit.

The two authors noted that while the R&E tax credit has given businesses a powerful tool to strategically improve their bottom line, it is often overlooked or unclaimed. In reality, they note, there has never been a better opportunity for “smart” manufacturers in the Industry 4.0 era to explore and capitalize on these cash savings. Tax savings can be extensive. For companies who have adopted an Industry 4.0 approach, it’s worth it to take a second look at their qualified research activities to make sure they are receiving all the tax savings available to them. Here is further clarification.

The R&E benefit is available for the development or improvement of products, processes, techniques, formulas, inventions or software and is a dollar-for-dollar credit against the taxpayer’s federal income tax liability, which means companies may get a twofold benefit—the deduction in the year the expenditure is paid, as well as by claiming the tax credit.

Excellent candidates for the R&E tax credit are businesses related to technology, industrial production and design, but also some machine shops, tool and die shops, and custom machine manufacturers. That’s why S-corporations, start-ups and partnerships in the business of improving industrial production processes should consider the R&E tax credit. Unfortunately, many of these businesses are prematurely thinking about converting to a C-Corp structure under the new tax law instead.

Before a change in structure, additional factors should be considered, such as whether the business qualifies for the pass-through deduction; if the business generates research credits; whether the business will pay dividends to its owners; and the long-term exit strategy of the business. Because R&E credits generated by a business can be used to offset any income generated from that same business activity, converting to a C-Corp may not be the best solution.

Examples of Qualified Research Activities (QRAs) under the R&E credit include:

- Providing custom control and automation solutions for various applications

- Developing new functionality or performance to meet customer specifications

- Development of schematic drawings for integration of system components

- Designing and developing cost-effective and innovative operational processes

- Developing new tool-specific fixturing or other tooling

- Improving processes through robotics or other types of automation techniques

- Experimenting with new alloys or other materials

- Testing new mold/die designs through sampling or trial

- Providing product and system solutions, including design engineering and mechanical fabrication

- Performing evaluations and system test

- Implementation of automated systems

There may also be Qualified Research Expenditures (QREs) if companies can substantiate how the expenditures are connected to the qualified activities, including:

- Qualified Wages of Employees performing, supervising and supporting qualified activities

- Supplies used to fabricate prototypes/items consumed during the conduct of research

- Contract Research–65 percent of fees paid to outside consultants/subcontractors/ engineers/software developers

- Estimates are allowed, however documentation of how the estimates were determined must be provided and reasonable methods must be used

Related Content

NPE2024 Wrap-Up: Sustainability Dominates Show Floor News

Across all process types, sustainability was a big theme at NPE2024. But there was plenty to see in automation and artificial intelligence as well.

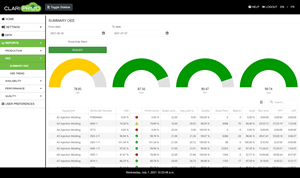

Read MoreReal-Time Production Monitoring as Automation

As an injection molder, Windmill Plastics sought an economical production monitoring system that could help it keep tabs on its shop floor. It’s now selling the “very focused” digital supervisor it created, automating many formerly manual tasks.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MoreNew Technology Enables ‘Smart Drying’ Based on Resin Moisture

The ‘DryerGenie’ marries drying technology and input moisture measurement with a goal to putting an end to drying based on time.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More