From A (Accurate Plastics) to Z (Zircon); heading west to California and east to New York; tracking north to Michigan and down south to Texas: Plastics Technology’ 2020 Top Shops survey represents a wide swath of the United States’ injection molding community. But despite the broad diversity of the group, the best performers share some key similarities.

This benchmarking survey of injection molders asked participants to share demographic data, performance indicators and business and process strategies from 2019. A portion of those performance metrics was then scored, with the resulting 23 companies named Top Shops for 2020.

Plastikos, which maintains white- and clean-room molding, was among the 2020 Plastics Technology Tops Shops.

The top performers and the remaining pool of participants have more in common than not, but where there are discrepancies they are often pronounced and impactful in terms of business success.

Maximum Efficiency

Looking at machine fleets for survey participants, all entries showed roughly the same age, orientation (proportion of horizontal vs. vertical) and styles (relative proportions of hydraulic, all electric and hybrid), for their machines; but Top Shops actually had 43% fewer machines on average than the rest (16 vs. 28), and those machines were mostly smaller, with a majority under 500 tons of clamping force or less. In terms of secondary operations, Top Shops provided far more assembly and decoration than other survey entrants.

Compared with other survey respondents, Top Shops molded almost double the amount of individual parts from nearly the same amount of resin (2.4 million lb for Top Shops vs. 2.9 million lb for the rest), indicating smaller parts; and they ran an average of 32 different resins—34% more than other shops. The total part discrepancy can also be explained by the percentage of high cavitation tools—16-plus cavities—run by Top Shops (30%), compared with only 3% for others.

In terms of total employees—manufacturing and front office—Top Shops averaged 87 staff, 42% more than other entrants; but Top Shops averaged 40 manufacturing employees, just above the 31 employed by the rest of the survey group (on average), indicating more of their staff were on the administrative side or in part and mold design and quality assurance.

Despite the challenges of the coronavirus pandemic, Precision Tool Technologies is on track for record sales in 2020.

All survey participants showed the average age of their shop-floor workers skewing older—40 and 46 for Tops Shops and others, respectively. The overall headcount grew much more at Top Shops, with 43% reporting expanded staff in 2019 vs. 11% for the rest of the survey. Top Shops also paid their employees more, with an average hourly wage for non-management shop-floor workers of $16.73, vs. $14.80 for other shops.

Regarding markets served, Top Shops and other survey participants hewed closely to each other, except in three instances: automotive, military/defense, and packaging. Only 35% of Top Shops served automotive, compared with 57% of others; while 43% of other entrants generated defense and military business, compared with 22% of Top Shops. While 22% of Top Shops generated revenue in packaging, only 7% of other survey participants did.

Perhaps the best example of a gap in performance beween the two groups is in the revenue generated relative to a molder’s size. Sales per employee and per machine for Top Shops were nearly double those for the others; and Top Shops also enjoyed profit margins more than six times higher than the rest of the survey group.

Culture Club

Ascribing a company’s success to its “culture” can seem a cliché, but Top Shops contacted by Plastics Technology said it’s a shared—and communicated—philosophy that contributes greatly to their operational success. “I believe all of our success is attributed to our company culture,” says Matt Bachan, operations manager at Maple Mold Technologies. This molder and moldmaker, with operations in Rochester Hills and Auburn Hills, Mich., is family owned and operated, with many of its employees “beyond dedicated,” according to Bachan. “This dedication flows through our company—we all have the same goals,” he says.

For Jim Georges, president of Precision Tool Technologies Inc. in Brainerd, Minn., “100%” of the company’s success can be tied to its culture. He adds, “Having best fit our people for our needs leads to success,” Georges says, adding that goal-setting keeps the company focused on continuous improvement. “Thinking beyond today—we will take long-term over short-term every time.”

This work-handling tray molded by Precision Tool Technologies is used to hold prescription eyewear components, frames and lenses for automation processing in digital wholesale laboratories.

Top Shops also shared frequent and open communication as a common trait. Kevin Hogan, CEO of Diversified Plastics Inc., Minneapolis, says that’s part of the program at this 100% employee-owned company, which has monthly meetings where key metrics and financial results are shared with “employee owners.”

“The fact that Diversified is owned by the employees helps drive a strong culture and company success,” Hogan says. “We communicate the financial benefits of continuous improvement and benefits to our customers.”

“Ownership” of problems and their potential solutions also contributes to success at these companies. Isaac Trevino of Best Tool & Engineering, Clinton Township, Mich., says that’s key for continuous improvement at his business. “When you have ownership in the solution, you’re more likely to take action,” Trevino says. “Our employees understand this and have been creating processes and documenting and organizing internally.”

“We have always asked employees to be open with their comments and suggestions for making work better for customers and themselves,” says Paul German, director of quality at Bender Products Inc., Mishawaka, Ind. Eric Seebeck, operations manager at Modern Molding, Delano, Minn., says his company also seeks employee feedback—and accountability. “Our employees are first trained to know that they are part of making us a stronger company,” Seebeck says. Modern maintains a continuous-improvement board, and when suggestions are added to it, they are assigned to a departmental manager. “The employee that made the suggestion is kept informed of the progress towards that suggestion.”

Plastikos operates an ISO-7 cleanroom at its Erie, Pa., medical facility.

“Our largest costs are indirect and direct labor,” says Maple Mold’s Bachan, noting that continuous improvement typically reduces labor input. “People enjoy improving things, and the company reduces costs—win-win!”

New Metrics

Given that respondents were completing a benchmarking survey, it’s obvious that they regularly monitor various metrics around their operations. Some of these are familiar to molders, but other key performance indicators they shared were unique to their operations. At Precision Tool, Georges says the company asks itself whether a project is “168able.” That derives from one shift a day, 7 days/week multiplied by 24 hr in a day to equal 168 revenue hr/week. “Conventional manufacturing-think and new technology just don’t work well together,” Georges says. “Owners and managers must adopt 168-manufacturing thinking to drive profit into business.”

For Chris Morton, CEO of Medical Components of America in Sequin, Texas, operational efficiency extends to benchmarking itself. “I don’t measure anything I don’t have to, and I don’t add any complexity to the business that isn’t needed for end results,” Morton says.

Morton brings one metric to molding that was broadly used in his contract-manufacturing days: value-added margin (VAM). VAM essentially means sale price minus purchased goods. “So if I sell something for a dollar and 30% of what I’m selling I purchased—whether it be a box of raw material or an insert—the other 70% is the value I’ve created from the raw material to when I sell the item for a dollar,” Morton says, noting that his company “lives and dies” with that metric. “There’s nothing more important than knowing what that adds to the absorption rate of your organization.”

Molding in a Pandemic

Despite their status as a Top Shops, all the companies Plastics Technology contacted acknowledged they still face challenges, especially in the midst of the coronavirus crisis. “Like many small businesses during this time, there are ebbs and flows,” Trevino says. “One minute you think you don’t have enough work to keep everyone on, and the next minute there’s too much work but not enough to justify hiring someone full-time.”

At Diversified Plastics, in addition to hiring, Hogan says winning new business in a pandemic can be difficult. “One of the biggest business challenges we face is currently in COVID-19—re-energizing business development in a virtual world,” Hogan says.

Despite the difficulty of running a business in a pandemic, Top Shops have shown resiliency. When the company set out to establish its 2021 business goals, Precision Tool had to account for customer industries hit hard by the virus. “Our 2021 goal is 50% growth over 2020,” Georges says, adding, “2020 is a record-breaking sales year in spite of COVID-19.”

Related Content

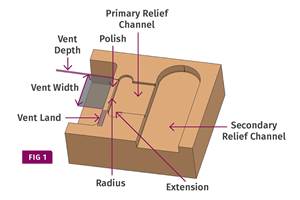

Back to Basics on Mold Venting (Part 1)

Here’s what you need to know to improve the quality of your parts and to protect your molds.

Read MoreInjection Molding: Focus on these Seven Areas to Set a Preventive Maintenance Schedule

Performing fundamental maintenance inspections frequently assures press longevity and process stability. Here’s a checklist to help you stay on top of seven key systems.

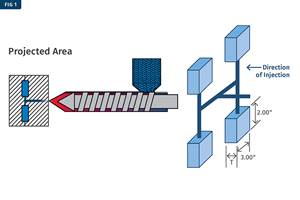

Read MoreIs There a More Accurate Means to Calculate Tonnage?

Molders have long used the projected area of the parts and runner to guesstimate how much tonnage is required to mold a part without flash, but there’s a more precise methodology.

Read MoreBack to Basics on Mold Venting (Part 2: Shape, Dimensions, Details)

Here’s how to get the most out of your stationary mold vents.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More