Contraction After Q1 Growth

By The Numbers: Plastics Processors' Business Index

Decline in the index driven by diverging performance among plants of different sizes.

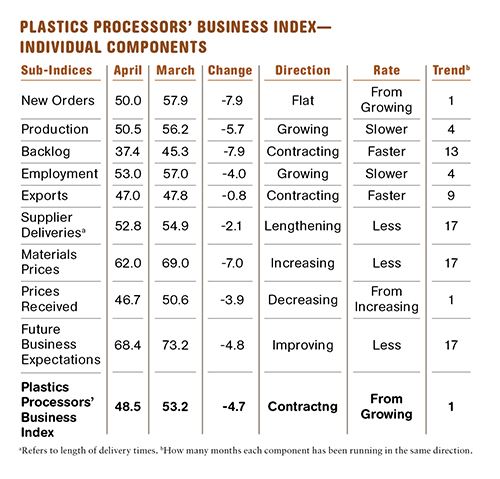

With a reading of 48.5, Gardner’s Plastics Processors’ Business Index contracted inApril after growing through the first quarter of 2013. The index dropped to 48.5 from 53.2, which is a fairly significant decline. (A value below 50 indicates contraction, while values above 50 indicate expansion.)

The decline in the index is being driven by diverging performance among plants of different sizes. Facilities with over 100 employees have grown at a very strong rate in the last four months. The smallest facilities, with fewer than 19 employees, have contracted at a fairly consistent rate since August 2012. But facilities with 20-99 employees went from growing at a strong rate in February and March (a total index around 54.5) to contracting significantly in April (a total index of about 46.8). There was also a significant decline in the index of custom processors (the total index includes captives). This is likely explained by overcapacity in plastics processing as capacity utilization has fallen the last three months.

After three strong months of growth, new orders were flat in April and production barely grew in that month. Backlogs contracted much faster in April. They have contracted since April 2012 despite periods of strong order growth. This is a further indication that there is available capacity at plastics processing facilities. Employment continues to grow at a good clip in 2013. Because of the relative strength of the dollar, exports continue to contract at a fairly consistent rate. Supplier deliveries are lengthening but at a slower rate in the last two months.

Material prices continue to increase, but the rate of increase has fallen off significantly since February. Prices received by plastics processors for their products declined for the first time since December. This is yet another indication that there is too much capacity in the industry. Combine increasing material prices, declining prices received, flat new orders, and growing employment, and you get significant pressure on profits. Future business expectations remain relatively strong, though.

While most regions were growing in March, only two regions were growing in April. Both the New England and Pacific regions have grown at significant rates for the last three months. The East North Central, South Atlantic, and West North Central regions had grown for most of 2013 but began contracting in April. The Middle Atlantic region contracted for the second consecutive month.

April’s future capital spending plans were at their second highest level since the survey began in December 2011. Predicted average spending per plant for the next 12 months was almost $1.1 million in April, which is roughly 25% higher than the historical average. Future spending plans have been trending up since September 2012.

About the Author

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800; email: skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog.

.JPG;width=70;height=70;mode=crop)