Growth Accelerates for Processors

By the Numbers: The Plastics Processors' Business Index

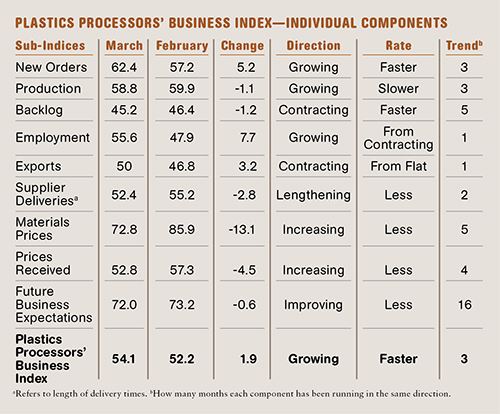

With a March reading of 53.2, the Plastics Processors’ Business Index showed growth for the third consecutive month.

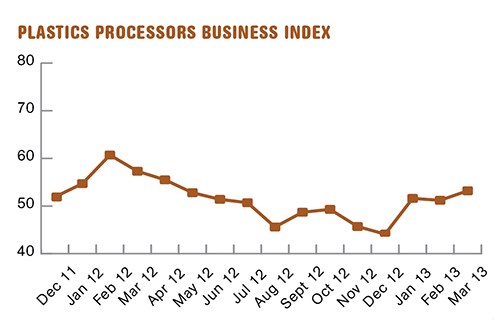

Since December 2006, Gardner Business Media, publisher of Plastics Technology, has computed a business index for the metalworking industry. In December 2011, Gardner began surveying facilities across all of its manufacturing publications. After tracking the index’s performance across various technologies and markets, we are now ready to present the results each month for the plastics processing industry.

The Plastics Processors’ Business Index compares business conditions in the current month to the previous month. Each month we survey plastics processors regarding new orders, production, backlogs, employment, etc. We weight the various sub-indices to create an overall index for the plastics processing industry. A reading above 50 indicates expansion while a reading below 50 indicates contraction. If you are familiar with the Institute for Supply Management (ISM) index (www.ism.ws), our survey asks the same questions and works in the same way. However, our survey focuses on plastics processing instead of all types of manufacturing.

With a March reading of 53.2, the Plastics Processors’ Business Index showed growth for the third consecutive month. I would categorize this as a strong recovery from the index’s low point in December 2012.

The last three months have shown very strong growth in new orders and production. Low and shrinking backlogs are weighing down the overall index more than any other sub-component. That is despite the growth in new orders, which indicates a significant amount of available capacity at plastics processors.

Another sub-index holding back the overall plastics index is exports, which have contracted for eight months. This will likely continue as the dollar remains strong due to weakness in the yen, Federal Reserve monetary policy, and fears for the euro’s health.

Contributing positively to the total index are employment and supplier deliveries. Employment has grown at an accelerated rate for three months, reaching its highest rate of growth since June 2012. Supplier delivery times continue to lengthen, indicating strong demand throughout the manufacturing supply chain.

Material prices have increased sharply since November 2012, although the rate of growth cooled off in March. Prices received by plastic processors for their goods have not grown nearly as fast. The combination of these two trends and rising employment is putting pressure on profits. Future business expectations have improved significantly since October 2012, reaching their highest level in March.

Processors with more than 50 employees have been growing at a strong rate in the last three months, and even more so for those with more than 100 employees. Processors with 20-49 employees have been growing in the last two months. But those with fewer than 19 employees are still mired in contraction.

All but two regions were growing in March. The Pacific and South Atlantic regions had the strongest growth. The two regions that contracted were the Middle Atlantic and W. South Central.

About the Author

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800; email: skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog.

.JPG;width=70;height=70;mode=crop)