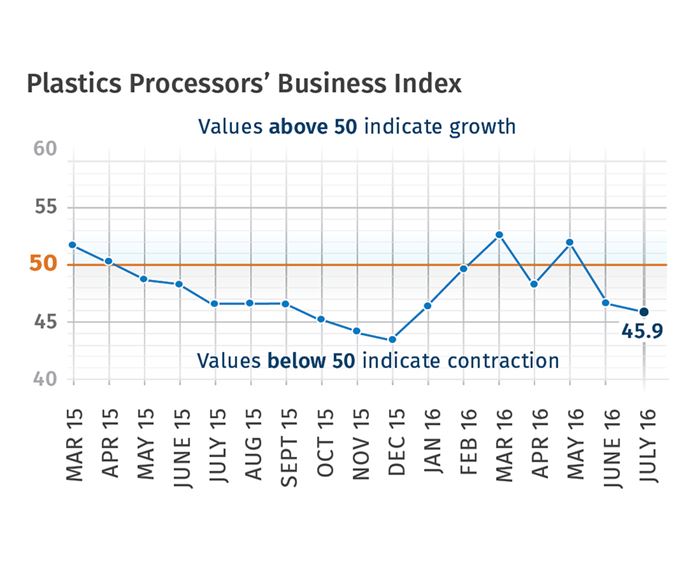

July’s Index—45.9

Plants with 50-99 employees expand for eighth straight month.

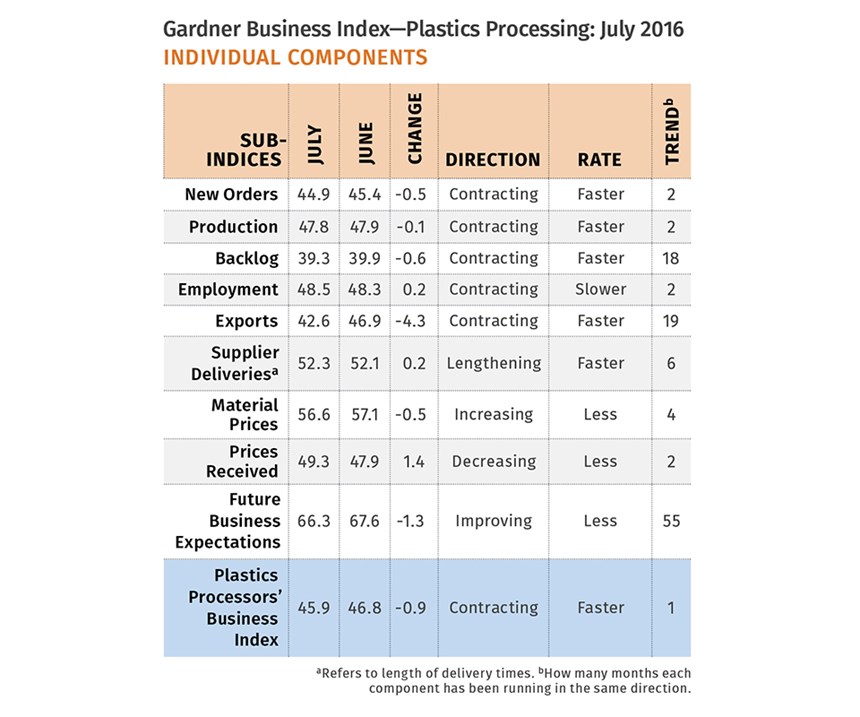

With a reading of 45.9, Gardner’s Plastics Processors’ Business Index contracted in July for the third time in four months. The index suggests the plastics processing industry has been on a downward trend since March. New orders contracted for the third time in four months, falling significantly since their peak in March.

The new-orders index was near its lowest level since January 2013. Also, production has contracted three times in the last four months, although the index was unchanged from last month. While the backlog index had contracted at a steady rate for four months, it dropped notably in June and only slightly in July. The employment index contracted for the second month in a row, although the contraction was moderate in both months. The export index dropped notably for the last two months, but overall the trend is one of decelerating contraction since November 2015. Supplier deliveries lengthened for the sixth month in a row.

Material prices increased for the fourth month in a row. Those four months have seen the fastest increase in material prices since November 2014. However, the rate of increase decelerated in June and July. Prices received decreased for the second month in a row. The general trend in prices received has improved steadily since June 2015. The future business expectations index fell to its lowest level since December 2015.

Processors with more than 250 employees contracted for the second straight month. Plants with more than 100-249 employees contracted significantly after expanding in the prior four months. Facilities with 50-99 employees expanded for the eighth straight month. Their growth has been strong every month. Companies with 20-49 employees contracted for the third time in four months. The index for processors with 1-19 employees continued to contract, as it has since February 2015.

The Southeast was the fastest growing region for the third month in a row. It has grown in six of the last seven months. The Northeast also grew in June for the sixth consecutive month.

Future capital spending plans were below average for the second month in a row. But compared with one year ago, they increased for the fifth time in six months. As a result, the annual rate of growth accelerated for the second month, reaching its fastest rate of growth since August 2014.

ABOUT THE AUTHOR

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800; skline2@gardnerweb.com blog: gardnerweb.com/economics/blog

Related Content

-

Three Key Decisions for an Optimal Ejection System

When determining the best ejection option for a tool, molders must consider the ejector’s surface area, location and style.

-

Process Monitoring or Production Monitoring—Why Not Both?

Molders looking to both monitor an injection molding process effectively and manage production can definitely do both with tools available today, but the question is how best to tackle these twin challenges.

-

Understanding the Effect of Pressure Losses on Injection Molded Parts

The compressibility of plastics as a class of materials means the pressure punched into the machine control and the pressure the melt experiences at the end of fill within the mold will be very different. What does this difference mean for process consistency and part quality?

.JPG;width=70;height=70;mode=crop)