Moderate Contraction, But Spending Plans Grow

By the Numbers: Plastics Processors' Business Index

Business is flat but processors indicate uptick in spending plans.

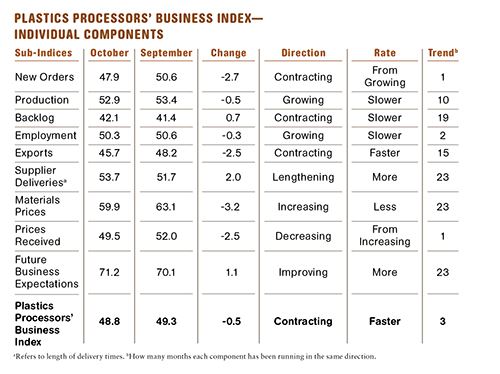

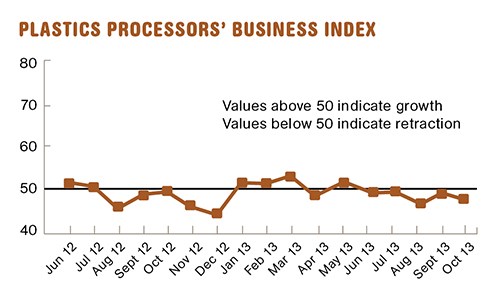

With a reading of 48.8, Gardner’s Plastics Processing Business Index for October reveals that the market has contracted for the third consecutive month. The contraction has been fairly moderate, but the index has trended down since its peak in March 2013. At the same time, processors strongly indicated they’d be investing in new capital equipment, suggesting they are optimistic that business conditions will be improving at some point soon.

New orders contracted for the third time in four months. This was the fastest rate of contraction in new orders since December 2012. However, production grew at its second-fastest rate since May 2013. Backlogs continue to contract, but the rate of contraction has slowed in the last two months. After one month of contraction, employment has expanded in the last two months. Exports continue to contract as the dollar remains relatively strong. Supplier deliveries lengthened the most since June 2013.

Material prices continue to increase, but they increased at their slowest rate since November 2012. Prices received by processors decreased for the first time since April 2013. While the industry has slowed recently, future business expectations have improved in the last two months.

Once again, smaller processors (fewer than 19 employees) lagged behind the bigger ones. This has been the case all year. After barely contracting in September, the rate of contraction at these smaller processing operations picked up significantly in October. Processors with 20-49 employees saw their rate of contraction slow in the last two months. Processors with more than 50 employees generally grew at a faster rate in October.

The New England and Pacific moved regions expanded in October after contracting in September. The West South Central also expanded. All other regions contracted.

Future capital-spending plans are growing rapidly. This month, capital-spending plans were 60.8% higher than they were in October 2012. This is the third straight month that the month-over-month rate of change grew faster than 40%. October’s planned capital spending was still nearly 20% above the historical average.

About the Author

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800; email: skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog.

.JPG;width=70;height=70;mode=crop)