Plastics Processing Contracts

By the Numbers: Plastics Processors' Business Index

But future capital spending plans were about 15% above the historical average in August.

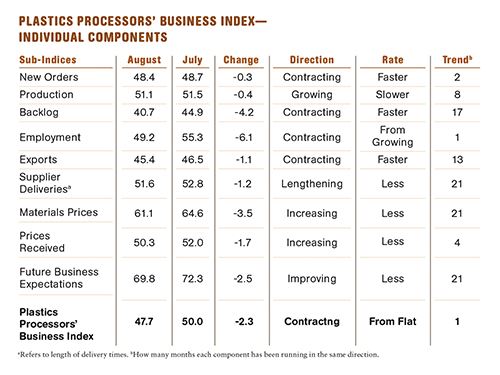

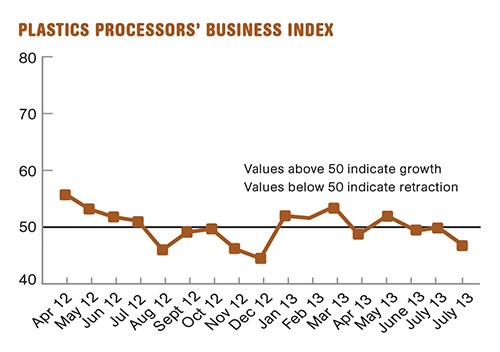

With a reading of 47.7, Gardner’s Plastics Processors’ Business Index contracted in August for the third time in five months.

After strong growth in the first three months of 2013, the plastics processing business has bounced between expansion and contraction.

Processors with more than 250 employees had seen rapidly expanding business conditions through the first seven months of the year (an average index of 58.0). However, in August these large facilities were flat (an index of 50). While facilities with 100-249 employees moved back into rapid expansion from one month of contraction, smaller plants experienced a downturn. Processors with fewer than 50 employees saw their fastest rate of contraction since December 2012.

New orders contracted for the second month in a row, at a fairly constant rate. Production grew for the eighth consecutive month. The combination of contracting orders and expanding production led to faster contraction in backlogs, which have contracted for 17 straight months. Employment contracted for the first time in 2013. Like backlogs, exports have been contracting for a significant period of time—13 months—and at a fairly constant rate. Supplier deliveries have lengthened since the inception of the Plastics Business Index.

Material prices continue to increase, but at a slower rate than in the first few months of 2013. Prices received have increased at a faster rate each of the last four months. Future business expectations have remained fairly constant in 2013, hovering around the 70 level, which is fairly strong.

New England has been the strongest region in 2013. It has expanded for seven consecutive months and had the fastest rate of expansion in August. The Pacific region expanded nearly as fast as New England in August after two months of contraction. The South Atlantic region expanded for the second month in a row and the fifth time in seven months. All other regions contracted in August.

Future capital spending plans were about 15% above the historical average in August. The month-over-month rate of change has been positive every month since December 2012. Compared with August 2012, planned capital spending was up 42.5%.

.JPG;width=70;height=70;mode=crop)