Processing Flattens Out

By the Numbers: Plastics Processors' Business Index

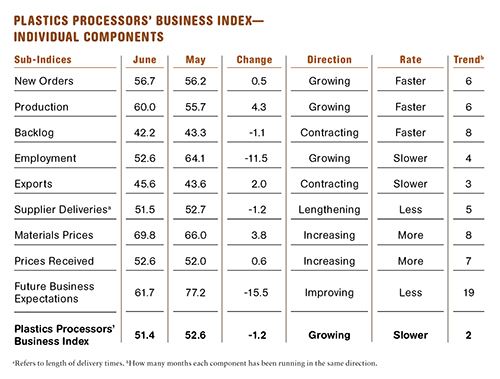

Exclusive survey shows flat June, mostly due to dip in business among smaller processors.

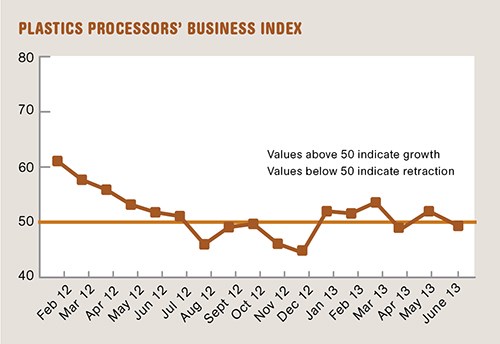

With a reading of 49.8, Gardner’s Plastics Processors’ Business Index indicates that business was essentially flat in June compared with May. This is only the second month in 2013 that the processing market did not register growth.

Here’s why: Unlike May, when the index climbed because smaller processors improved performance, processors with fewer than 100 employees saw their business dip in June. Conversely, the index for processors with more than 100 employees improved substantially in June. The largest facilities, those with more than 250 employees, recorded their strongest performance since March 2012.

New orders continued to grow in June, but at a much slower rate than in May. Production grew for the sixth straight month, but the growth rate was the second slowest of 2013. Since production has remained stronger than new orders in 2013, backlogs continue to contract at a significant rate.

Employment continues to expand, and has done so every month but two since December 2011. With the dollar maintaining its strength, exports continue to contract. Supplier deliveries lengthened at a slightly faster rate in June, indicating that there is still strong activity throughout the plastics supply chain. However, the continual contraction in backlogs indicates some excess capacity at plastics processing facilities.

Material prices increased at a slower rate, while prices received by processors for their goods increased at a faster rate in June. This combination is a sign of improving profitability. Future business expectations fell slightly but remained above the level of the second half of 2012.

Regionally, business activity slowed in New England and West South Central, which were the fastest growing regions last month. The Pacific and South Atlantic regions moved from growth to contraction. The East South Central and Middle Atlantic regions grew faster for the second straight month, while the East South Central moved from contraction to growth. The West North Central region remains the poorest performer, contracting for the third month.

In June, future capital spending plans fell to their lowest level since October 2012. However, they remained above the historical average. Compared with June 2012, planned capital spending by processors was up 21%. Month-over-month planned capital spending has increased every month since December 2012.

.JPG;width=70;height=70;mode=crop)