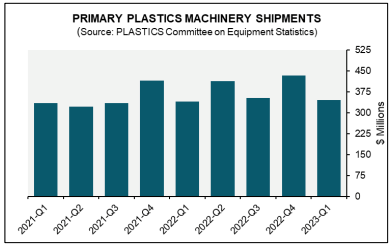

Plastics Machinery Shipments Decline

PLASTICS’ initial estimate for the second quarter showed a shipment value of $331.6 million, down 4.1% compared to the previous quarter and off 19.8% year over year.

The Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES) has released its second quarter Analysis and Outlook, showing quarterly and year-over-year declines in shipment data for primary plastics machinery in North America.

The initial shipment value estimate for the second quarter is $331.6 million, down 4.1% compared to the second quarter of 2022. The decline is steeper compared to year-ago figures, with the shipment value off 19.8%.

A notable bright spot was single-screw extruders, which surged 39.3% in a quarter-over-quarter analysis. Year-over-year, these extruders were up 40.9%. Twin-screw extruders, however, fell sharply, with shipments dropping 15% on a quarterly basis and 11.2% compared to 2023. Shipments of injection molding machinery slipped 6.1% in the second quarter of 2023 compared to the first quarter and were down 23.6% on a year-over-year basis.

In the most recent quarterly survey of plastics machinery suppliers conducted by CES, the number of participants anticipating an improvement or flat market conditions over the next twelve months compared to the previous year rose to 46.0%.

In terms of second quarter exports, plastics machinery saw a notable uptick of 10.2%, reaching a total value of $252.8 million. The prime destinations remained Mexico and Canada, accounting for $126.4 million, or 50% of all U.S. plastics machinery exports. Conversely, imports declined 10.5%, with a value of $458.6 million. This resulted in a reduction of the trade deficit by 32.0% to $205.8 million.

North American plastics equipment shipments were down compared to last year and the last quarter.

Photo Credit: Plastics Industry Association