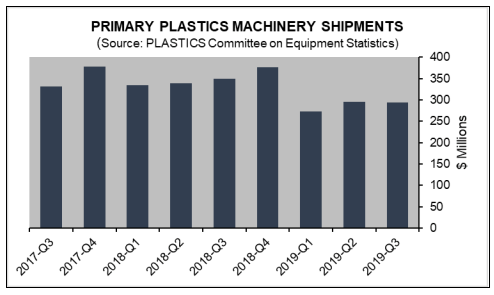

Plastics Machinery Shipments Finish 2019 Down Compared to 2018

A surge in the final quarter of 2019 could not salvage a weaker overall performance for North American plastics machinery and equipment sales compared to 2018.

The North American shipment value of primary plastics machinery—defined as injection molding and extrusion—increased in the fourth quarter by 7.7 percent to $316 million compared to the third quarter, but that strong finish was not enough to overcome an overall weaker market, according to the Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES).

Compared to the final quarter of 2018, the value of 2019 fourth quarter primary plastics machinery shipments was down 16.2 percent. In extrusion, the shipment value of twin-screw units fell 35.2 percent, while single screws were off 12.3 percent. In injection molding, the value machinery shipments was down 14.9 percent compared to the fourth quarter of 2018.

Perc Pineda, chief economist of PLASTICS, stated in a release that weaker business investment spending in 2019 could be attributed to “uncertainties from trade and tariffs and overall weaker manufacturing activity.” Pineda noted that PLASTICS’ forecast of 2.3% U.S. GDP growth in 2019 was inline with advanced GDP estimates from the U.S. Bureau of Economic Analysis. PLASTICS expects another year of moderate U.S. economic growth in 2020, but it noted that positive developments on trade and tariffs, as well as continued low interest rates, could result in better numbers for plastics machinery shipments.

Potentially complicating matters is the ongoing coronavirus outbreak, which began and remains most concentrated in China but is continuing to spread globally impacting travel—and trade—all across the world. Pineda and PLASTICS issued a statement regarding the outbreak and its potential impact on the North American plastics industry.

“While we cannot confirm today that the coronavirus has already impacted the U.S. plastics industry supply chain, it is reasonable to expect that if the coronavirus crisis in China continues and escalates, it will negatively impact the U.S. plastics industry. For business continuity reasons, U.S. plastics companies need to look at their current supply chain involving China and—as a precautionary measure—examine alternative supply sources.”

PLASTICS noted that trade and tariffs issues in 2019 negatively affected the plastics machinery business. Exports of plastics machinery were down 6.8 percent in the fourth quarter compared to the third quarter, totaling $352.8 million. PLASTICS noted that Mexico, Canada, and Germany remained the largest U.S. export markets, with combined shipments to these countries in the fourth quarter totaling $157.0 million. China was the fourth-largest market in the fourth quarter with plastics machinery exports totaling $22.7 million. Imports of plastics machinery fell 5.4 percent, and lower exports and imports have caused the plastics machinery trade deficit to decrease by 4.2 percent from the third quarter.

2019’s North American plastics machinery and equipment sales finished below 2018’s according to the Plastics Industry Association’s Committee on Equipment Statistics.

Related Content

-

Advanced Drainage Systems to Build New Florida Manufacturing Facility

New manufacturing facility will complement other ADS facilities in the southeast region.

-

Nova Makes Senior Leadership Changes

The company’s aim is to bolster sustainability ambitions

-

Infrastructure May Prove Big Landing Spot for Recycled Plastics

As the government funds infrastructure improvements, a hot topic at NPE2024 – exploration of the role recycled plastics can play in upcoming projects, particularly road development.