Precision Tool Technologies’ routine order for labels laid bare the vagaries of the global supply chain as it barely functioned in 2021. Instead of next day, next week or next month, Jim Goerges, president of the Brainerd, Minn., injection molder was informed that the labels his company applied to a marine part — which he was ordering one year in advance — were back-ordered for 18 months due to the lack of a component in their adhesive, which was itself back-ordered from China.

“We were all shocked,” Goerges says. “Thank God we had inventory for enough orders that this didn’t become a bigger nightmare than it was.”

For Precision Tool and other participants in Plastics Technology’s annual Top Shops benchmarking survey of injection molders, those supply-chain shocks and nightmares would give way to a grudging acceptance of the new post-COVID “normal” and a shift in how they conducted their businesses. Perhaps nowhere was this new normal felt more acutely than in the resin market.

“Some resins did not increase in price; some doubled; some resin lead times went to four months,” explains Bruce Borstmayer, owner of Alberta-based custom molder Qualicase Ltd. “All our customers are businesses themselves, and they are aware of the current business climate, so nobody was surprised. Now, however, we have to requote every time we get a new order.”

Standing orders and penciled-in quotes went by the wayside in 2021, as constant customer contact took over. “Our customers required weekly reports on our inventories—both for finished goods and resin,” says Tom Moneta, owner and president of Bridgville Plastics in Stevensville, Mich. “We had to keep them posted continually if our resin suppliers were going to be late on shipments.”

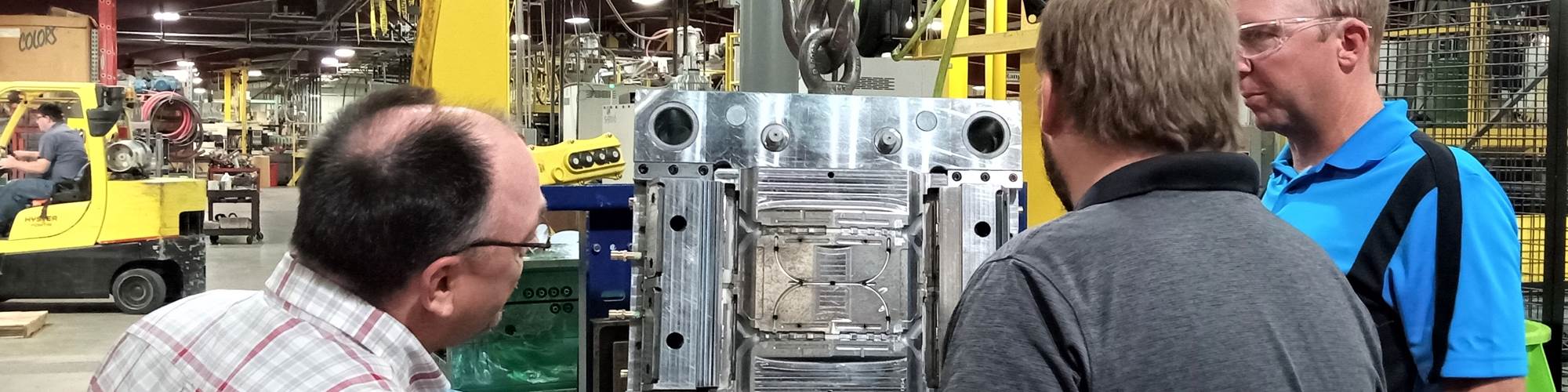

Despite the many market challenges, many of 2022’s Top Shops, including Plastikos Medical picture here, expanded operations. (Photo: Plastikos Medical)

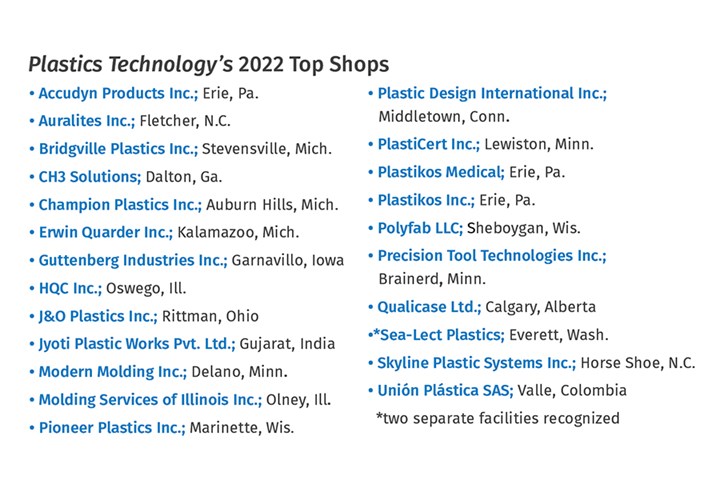

Amid these supremely challenging conditions, PT once again named its Top Shops honorees, including Qualicase, Bridgville and Precision Tool. These molders were able to exceed strict production benchmarks in areas like on-time delivery when their own suppliers were most certainly not on time. The 24 Top Shops of 2022 hailed from three continents, four different countries and 11 different states, ranging south to Colombia, north to Canada and east to India, with three each from Michigan, Minnesota and Pennsylvania. In total, the survey, which is in its sixth year, drew responses from 19 different states—three Canadian provinces—and eight different countries.

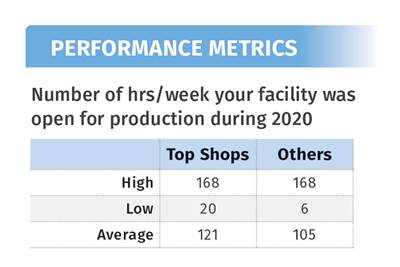

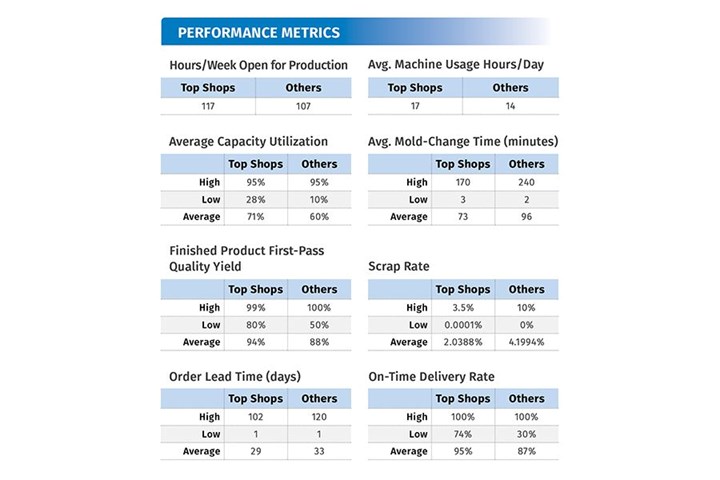

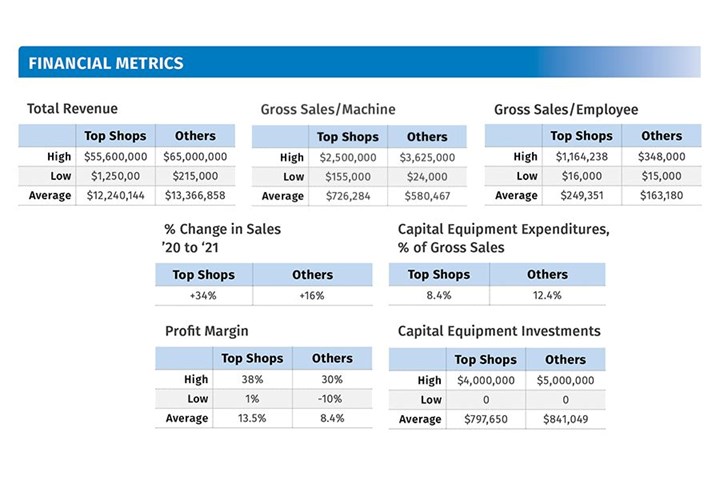

The Top Shops benchmarking survey of injection molders queries participants on demographic data, performance indicators, and business and process strategies. A selection of those performance metrics are then scored, with the highest scoring companies named Top Shops for 2022 based on their 2021 operations.

Rising Costs

Given the breadth of geographies and markets the survey participants serve and the materials they use, it is rare to see unanimity in a question response, but when asked if their average resin price increased, decreased or stayed the same in 2021, 100% of Top Shops reported paying more for material, while 92% of the other participants did as well. It wasn’t just resin prices that marched higher, either.

Average mold-change time is one metric Top Shops are measured on. Pictured here, Qualicase swapping out a tool. (Photo: Qualicase)

“The wide-range impact of inflation throughout the past 12 to 18 months has definitely been a challenge,” explains Philip Katen, general manager and president of Plastikos, Erie, Pa., who noted that Plastikos paid more for packaging materials, utilities and people, along with, at times, monthly resin-price increases.

When it came to bearing the burden of higher resin costs, Top Shops reported a general ability to pass along higher prices to their customers. “Our customers across the board have been quite understanding, supportive and overall agreeable to production price increases,” Katen says.

“For almost all of our customers, Accudyn was able to pass resin increases through to our clients,” says Don Stolarski, v.p. sales and business development of Accudyn Products in Erie, Pa. “It was not always easy, but we engaged our customers, providing the data they needed to approve the increases.”

“Guttenberg Industries sought to mitigate some of the inflationary pressure by focusing on efficiency and waste elimination,” says Dave Kreul, president of Guttenberg Industries in Garnavillo, Iowa. “But ultimately, certain costs had to be passed on to customers.”

In addition to carrying a bigger price tag, resins were often simply not available, forcing molders and their customers to rethink the material of choice for a given product. “We partnered closely with our customers to identify, sample and qualify alternative lower-cost raw materials,” Katen says.

The need for increased warehouse space, like this one from Guttenberg, was one area survey respondents said business shifted in 2021. (Photo: Guttenberg Industries)

For Moneta at Bridgville Plastics, getting alternative resins approved by the customers became the new norm to keep production going. “In all of Bridgville Plastics’ 35 years of operations,” Moneta explains, “we had more alternate resins used and approved during these past two years by our customers than in all of the other years combined.”

The full list of Plastics Technology’s 2022 Top Shops.

Warehouse Worries

Because of resin availability shortages and delivery delays, many survey respondents noted that 2021 forced them to take on more warehouse and inventory responsibilities, both for raw materials and molded parts. “The challenge for the past two years has been the need to warehouse additional inventory to account for delays in delivery so we could maintain production and revenue generation,” Guttenberg’s Kreul says.

“Our strategy to deal with inflationary pressure involved carrying more inventory to hedge any supply issues, combined with purchasing larger quantities to maintain pricing,” says Jeff Ignatowski, director of sales and marketing at Champion Plastics, Auburn Hills, Mich.

Skills Gap Meets Inflation

Against this backdrop of higher costs for utilities and materials, the ongoing labor difficulties felt across manufacturing could only exacerbate the financial challenge of 2021 for the molders surveyed. At Bridgville Plastics, Moneta says the company raised its wages to keep current employees and try to attract new ones. “Wages were our single largest inflationary challenge over the past two years,” he says.

“Plastikos saw sizeable raises and increases in our hourly rates and entire compensation structure to support everyone on our team and position us as a leading employer in our local region,” Katen notes.

Finding, training and keeping experienced operators remains a challenge, even for Top Shops like Qualicase. (Photo: Qualicase)

“The shortage of people and high inflation is driving wages to unsustainable levels for businesses,” states Rodney Davenport, v.p. at CH3 Solutions, Dalton, Ga. At Champion Plastics, Ignatowski says the company asked managers to wear additional “hats” to try to hold labor costs in check, but it also invested in existing employees. “We also stepped up our internal continuous-improvement activities to lower costs and invested in additional training for our employees.” A tangible result: The lead process tech became a certified RJG Master Molder who went on to reduce cycle times and improve quality for the facility.

For 2021, Top Shops in the U.S. paid an average hourly wage of $18.06, while other U.S. respondents paid $19.74. Those figures were up from $17 and $16 per hour, respectively, in 2020. While hourly wages might have been lower, Top Shops benefits far exceeded those of other survey participants. Top Shops offered 401(k) plans (U.S. only), 401(k) matching, bonuses, education reimbursement and profit/revenue sharing at rates that were, respectively: 23%, 19%, 19%, 34% and 21% higher than other respondents.

Greater profitability is one metric that is used to determine Top Shops, and this year’s survey found that in 2021 fully 75% of Top Shops increased machine-hour rates while only 50% of other survey respondents did.

Design Demand

Top Shops and other survey respondents were similar in one respect: providing product design as a value-added service. Some 67% of all survey respondents, Top Shops or otherwise, provided design services for their customers.

At Precision Tool, “Product design has increased for us, it’s a big deal,” Goerges says. When the company starts a new project with a customer they internally call the process “Struggle Street,” as they work to understand the customer’s struggles. Goerges adds, “When we know upfront all the issues and pain points, it gives us a new understanding, and many times we can creatively solve many potential issues to keep them from ever becoming a problem.”

Borstmayer at Qualicase is more blunt about the need to help with design, particularly when it comes to manufacturability: “Most customers have no idea what is required to make an injection molded part. We will always have to modify their drawings to design a part that can actually be molded.”

The average machine age at 2022’s Top Shops was just nine years compared with 14 for other respondents. (Photo: Champion Plastics)

“We have seen some increase in the number of requests for design support for new projects with several customers,” Accudyn’s Stolarski says. “This has largely been caused by the lack of engineering resources at our customers’ facilities.”

Ignatowski at Champion Plastics says his company has seen huge demand for design-for-manufacturing (DFM) services. “Many of the young design engineers don’t have the experience to properly apply the needed drafts, uniform wall thicknesses, etc., for injection molding.” In Champion’s case, the company typically revises part CAD files, modifying the design to enable easier molding before tool steel is cut.

“Almost Normal”

Despite the myriad challenges posed by a molding sector emerging from the pandemic, many respondents said 2021 was a banner year in terms of business. “2020 was very challenging for Precision Tool,” Goerges says, “yet we somehow pulled off our best in the the history of the company. And 2021 was even better — go figure.”

“2021 was an extremely busy and challenging year with lingering COVID issues, numerous supply-chain difficulties, price increases, labor shortages, etc.,” Katen at Plastikos says. “It was extremely busy with all our customers, whether due to pent-up COVID demand or just continued growth.”

“I believe that successfully navigating all of the variables that hit us in 2021 actually made the business environment in 2022 almost normal,” Accudyn’s Stolarski concludes.

On average, Top Shops run smaller machines, with only 4% utilizing machines over 1000 tons, 18% fewer than other respondents. (Photo: CH3 Solutions)

Related Content

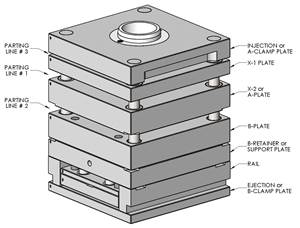

How to Design Three-Plate Molds, Part 1

There are many things to consider, and paying attention to the details can help avoid machine downtime and higher maintenance costs, and keep the customer happy.

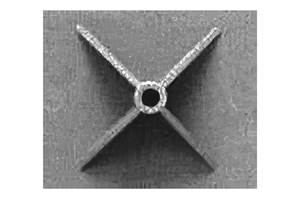

Read MoreHow to Reduce Sinks in Injection Molding

Modifications to the common core pin can be a simple solution, but don’t expect all resins to behave the same. Gas assist is also worth a try.

Read MoreProcess Monitoring or Production Monitoring—Why Not Both?

Molders looking to both monitor an injection molding process effectively and manage production can definitely do both with tools available today, but the question is how best to tackle these twin challenges.

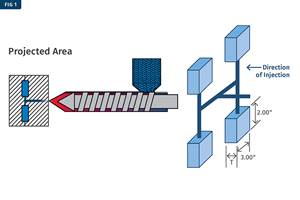

Read MoreIs There a More Accurate Means to Calculate Tonnage?

Molders have long used the projected area of the parts and runner to guesstimate how much tonnage is required to mold a part without flash, but there’s a more precise methodology.

Read MoreRead Next

Top Shops 2020: Molding More from Less

Plastics Technology’s 2020 Top Shops benchmarking survey reveals that the most effective molders are, not surprisingly, the most efficient, accomplishing more than their peers from a smaller manufacturing footprint.

Read MoreTop Shops: Benchmarking Injection Molding in a Pandemic Year

At the start of 2021, as it does every year, Plastics Technology asked injection molders to look back on the year prior and take stock of their operations. The only difference this time: COVID-19.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More