Part 3: The World of Molding Thermosets

Thermosets were the prevalent material in the early history of plastics, but were soon overtaken by thermoplastics in injection molding applications.

Figure 1: At room temperature, the PPS is superior. At the elevated temperatures at which the two materials are likely to be used, the phenolic outperforms the PPS and at a lower cost per pound.

Thermosets dominated the early history of plastics. This was foreshadowed by the emergence of the rubber industry in the mid-1800s fueled by the development of vulcanization. Attempts to introduce early thermoplastics based on cellulose were met with fierce and sometimes questionable competitive strategies by the entrenched rubber industry.

While some of the thermoplastic offerings did become commercial, the most successful early introductions were crosslinked materials, the most notable of these being the first truly synthetic polymer, phenolic. This was followed in the first half of the 20th century by the introduction of epoxies, unsaturated polyesters and silicones.

In parallel, many of the commodity thermoplastics were being developed in the 1920s and 1930s, including polyethylene, polystyrene, PVC and acrylic. The performance profiles of these early introductions were relatively unimpressive, particularly when it came to heat resistance, and the two classes of materials coexisted. But with the introduction of nylons, things began to change. Here was a material with a melting point of 260oC (500oF) that could replace some of the thermoset materials.

Thermoplastic polyesters soon followed, and by the 1950s and early 1960s the development of new thermoplastic polymers with higher performance profiles became an avalanche. By the mid-1970s there was a general sentiment within the industry that sooner or later a thermoplastic could be developed that would replace any thermoset. Polyimides represented the pinnacle of performance in crosslinked materials, but were closely matched with similar thermoplastic chemistries that included polyamide-imide, thermoplastic polyimides, polyetherimide and even higher heat variants.

The drive to seek these alternatives was due in large part to productivity concerns. While thermosets offered impressive properties, they were not readily converted into molded parts by the big up-and-coming processing method, injection molding. The traditional thermoset molding processes — compression molding and transfer molding — were slower, more manual processes. In addition, because of the low viscosity of the pre-gelled materials, the parts almost always required the secondary process of deflashing, much like aluminum and zinc die casting. Thermoplastic parts came out of the mold quickly and required little to no secondary finishing.

Injection molding of thermosets did start to become feasible in the late 1970s. I can remember at NPE1979 watching a Cincinnati Milacron injection molding machine producing phenolic parts. A sign prominently displayed at the machine warned attendees not to pick up the parts coming out of the tool, as they were ejected at temperatures of around 150oC (302oF). And, yes, they still had to be deflashed.

While thermosets offered impressive properties, they were not readily converted into molded parts by injection molding.

Thermoplastics Gain Momentum

But there was another element that drew the industry toward the thermoplastic market. The material suppliers developing these materials represented an all-star lineup of the major chemical companies and included General Electric, Bayer Material Science, DuPont, Dow, Union Carbide and Celanese. These companies produced a wealth of information on part design, mold design, material properties and processing, and they did so in attractively packaged brochures and technical documents delivered by polished sales people and knowledgeable tech service personnel.

The thermoset manufacturers were outgunned when it came to resources. Many of the thermoset manufacturers had qualified experts who understood very well the parameters associated with good design and processing practices. But most of them worked behind the scenes developing formulations and customers rarely saw them.

To make matters worse, thermosets tried to compete with thermoplastics on the terrain of short-term data, with a focus on room-temperature properties. This was a losing proposition because properties like tensile strength and impact resistance are not generally strong points for thermosets. These materials offer advantages at elevated temperatures that are not addressed by short-term properties published on datasheets.

One of the prominent advertisements that one thermoset material supplier ran during the late 1970s and early 1980s demonstrated the large deflections that flexural bars molded in thermoplastics exhibited when compared with phenolic. I recall sitting through a presentation where the case being made on behalf of phenolic was a head-to-head comparison with unfilled ABS. The two materials exhibited comparable tensile and flexural strength at room temperature and, of course, the phenolic displayed a higher heat deflection temperature.

Injection molding of thermosets did start to become feasible in the late 1970s.

Unmentioned was the substantial advantage in toughness that the ABS possessed. This type of comparison of a rigid, filled thermoset with an unfilled and ductile thermoplastic like ABS or polycarbonate missed the point that these tough, unfilled materials were not the competition.

One of the conferences that reflected the vitality of the thermoset industry in the Midwest was an annual event held in Madison, Wisconsin, each October. In the 1970s and 1980s this conference drew more than 300 attendees every year to an event that included two days of presentations. Booths were hosted by processing equipment manufacturers and most of the major thermoset material suppliers located in Indiana, Illinois and Wisconsin. Some attendees came from as far away as Germany.

Figure 2: In comparing a thermoset polyester to a long glass fiber- reinforced thermoplastic polyester, the two materials have the same heat deflection temperature, but the full temperature map clearly shows the advantages of the crosslinked material.

‘New’ Approach to Material Characterization

In 1988, I gave my first presentation at this conference, providing data that compared the properties of thermoset materials with filled and reinforced semicrystalline materials and high-performance amorphous polymers using the relatively new tool of dynamic mechanical analysis (DMA). DMA had been developed as an analytical method in the 1960s, but much of the early equipment was custom built by individual researchers and little had been done to create test standards around the method. By the mid-to-late 1980s, instrument manufacturers had perfected forced oscillation devices that greatly enhanced the ability of the method to characterize material properties, and ASTM and ISO standards had been developed.

Figures 1 and 2 show typical comparisons that were made, focusing solely on a property that was readily understood, the modulus of the material as a function of temperature. Figure 1 compares the performance of a phenolic compound to a 40% glass fiber-reinforced PPS and shows that: while at room temperature, the PPS is superior; at the elevated temperatures (at which the two materials are likely to be used), the phenolic outperforms the PPS and at a lower cost per pound. Figure 2 compares a thermoset polyester to a long glass fiber-reinforced thermoplastic polyester. These two materials have the same heat deflection temperature, but the full temperature map clearly shows the advantages of the crosslinked material.

The response to this “new” approach to material comparisons was overwhelming, at least for the moment. But, ultimately, one individual pursued this line of thinking, Larry Nunnery. He was a newcomer to the thermoset side of the plastics industry, but Nunnery was no stranger to the world of polymers, having spent most of his career up to that point at GE Plastics. GE was a master at brand marketing, and Nunnery brought this tradition and know-how to a company he had just purchased, Bulk Molding Compound Corp. (BMC Corp.) in St. Charles, Illinois.

Like many thermoset resin manufacturers, BMC Corp was small when compared to the major thermoplastic resin juggernauts. For many years, it maintained a presence in the industry by catering to niche markets and always had a small booth at NPE because, at that time, the triennial show was held right down the road at McCormick Place in Chicago.

That all changed when Nunnery assumed ownership. He immediately understood the implications of the DMA data and how it could be leveraged into a competitive edge. We characterized some of his flagship materials at our lab along with some appropriate competitive thermoplastics such as highly glass fiber-reinforced nylons, PBT and PET polyesters, PPS and sulfone polymers. The comparisons showed the superior performance of the crosslinked materials at elevated temperatures and Nunnery and his people took it from there, running advertisements showing the graphs and highlighting the superior dimensional stability and resistance to warpage that the crosslinked materials exhibited.

This became a platform for a new type of presentation of thermoset materials to the industry that was unfamiliar to both the thermoplastic and the thermoset community.

ABOUT THE AUTHOR: Michael Sepe is an independent materials and processing consultant based in Sedona, Arizona, with clients throughout North America, Europe and Asia. He has more than 45 years of experience in the plastics industry and assists clients with material selection, designing for manufacturability, process optimization, troubleshooting and failure analysis. Contact: 928-203-0408 • mike@thematerialanalyst.com.

Related Content

Three Key Decisions for an Optimal Ejection System

When determining the best ejection option for a tool, molders must consider the ejector’s surface area, location and style.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

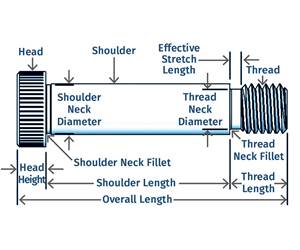

Read MoreWhy Shoulder Bolts Are Too Important to Ignore (Part 1)

These humble but essential fasteners used in injection molds are known by various names and used for a number of purposes.

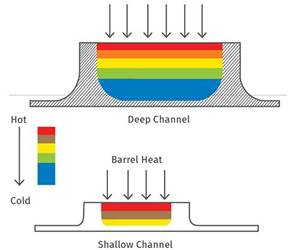

Read MoreThe Importance of Barrel Heat and Melt Temperature

Barrel temperature may impact melting in the case of very small extruders running very slowly. Otherwise, melting is mainly the result of shear heating of the polymer.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More

.jpg;width=70;height=70;mode=crop)