All Quiet on the Resin Pricing Front— But Watch Out for PP

2015 ended with lower prices, even for high-volume engineering resins, but PP is already turning the corner.

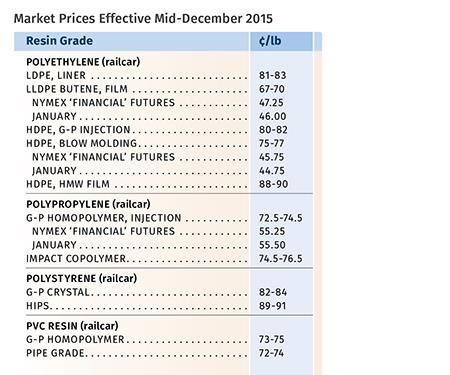

As last year was coming to an end, prices of all major commodity resins were lower than in the previous year, driven by significantly lower feedstock costs along with relatively balanced supply-demand fundamentals. Polypropylene was in step with this trend, but there was a reversal in the trajectory of its pricing in the fourth quarter as demand outstripped supply, an issue that will continue through this year. These are among the views of purchasing consultants at Resin Technology, Inc. (RTi) of Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago, supported by comments from Houston-based PetroChemWire and IHS Chemical.

PE PRICES FLAT

Polyethylene prices were flat in November and were expected to remain so last month, despite PE suppliers’ third attempt to push through a 5¢/lb price increase. Industry sources agree that suppliers can be expected to continue to pursue increases in the first and second quarters if the opportunity presents itself.

There are no drivers to support any increase at this time, according to Mike Burns, v.p. of client services for PE at RTi. Yet he expected that strong demand and depleted supplier inventories would prevent any late-year discounts. He added that suppliers would be testing the secondary markets with higher prices through the end of 2015.

At November’s end, Greenberg reported that spot PE buying had slowed, as buyers appeared to recognize that PE suppliers would have little success in implementing their 5¢ increase. He also noted that some film grades—including fractional-melt LDPE, octene LLDPE, and metallocene grades, had become difficult to come by, with supplies being “soaked up by the Latin American region, which is reeling from local outages.”

During that same time frame, PetroChem Wire reported that production of HDPE blow molding grades got a boost when Formosa’s PE-2 unit in Point Comfort, Texas, was restarted following a planned turnaround, while a nearly two-week unplanned LLDPE outage there also came to an end.

Looking ahead, Burns noted that while strong domestic demand (expected to continue) is typically a driver for price increases, weak global feedstock prices, soft global demand, and improving supplier inventories will prevent this. He advised processors to manage their inventories to meet demand and to watch for any increases in oil prices. “Resin prices should remain flat until oil approaches $60/bbl,” said Burns. “According to the RTi formula, every $10/bbl change in either direction equates to a 4-5¢/lb move in PE prices.” Oil prices were below $38/bbl early last month.

PP PRICES TURN UPWARD

Polypropylene prices moved up 2-3¢/lb in October, when propylene monomer contracts rose 0.5¢/lb. PP contract tabs were expected to gain another 1-3 ¢/lb in November after monomer contracts settled 1¢/lb higher. A third increase was possible for December.

This price movement in the fourth quarter signaled a reversal in PP pricing, which had been on the decline through the first three quarters of 2015—down a total of 15¢/lb—although suppliers actually expanded their margins by not matching the monomer’s decline penny for penny. “Demand is still strong, operating rates are high, and, the industry is close to running out of resin,” said Scott Newell, RTi’s director of client services for PP.

At the end of November, PetroChem Wire reported, “While November propylene [monomer] contracts went up 1¢/lb, PP suppliers continued to implement margin expansion initiatives totaling 5-6 ¢/lb in October and November. Some end users were facing PP price increases of 2-4¢/lb with contract resets in January 2016, in addition to any change in monomer.”

Reporting on the spot market, The Plastics Exchange’s Greenberg noted in early December that while production levels continued to improve, as did availability of offgrade PP—albeit at higher prices—overall PP supplies were still falling short of healthy domestic demand.

As time for 2016 resin contracts approached, Newell noted that PP suppliers had the leverage and would continue to seek margin expansion while they could. He said that by the fourth quarter, the global cost advantage of both domestic propylene and PP was gone. “We are now the highest priced in the world, with domestic PP resin at about a 20¢/lb premium to that of China’s, for example.”

Industry sources expect PP resin imports and finished goods to increase through the new year. So far, the only announced PP capacity expansion in many years is Formosa Plastics’s new 1-billion-lb/yr unit and its associated monomer production unit at Point Comfort, Texas, slated for startup sometime in 2017.

PS PRICES FLAT FOR NOW

Polystyrene prices were flat in November and were likely to remain so last month, despite the fact that December saw the third modest incremental increase in benzene prices. “While this has put pressure on styrene monomer, it would be somewhat of a stretch to see PS prices move up in December,” said Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

Kallman noted that at least one PS supplier attempted a 3¢/lb increase for December, and only for EPS beads, which went unsupported. But at the same time, Kallman cautioned that PS prices are likely to firm up in this first quarter due to anticipated upward pressure from benzene, as that market has gone from an oversupply to a much more balanced scenario. So, while the traditional seasonal demand for PS is not expected until the second quarter, higher prices for monomer and PS may well be in the offing before end of March

PVC PRICES FLAT TO DOWN

PVC prices were flat in November, following 2¢/lb decreases in September-October. A penny was expected to fall off in November, but plant outages into that month served to keep prices steady. RTi’s Kallman ventured that there was still potential for a 1¢/lb drop last month.

“It’s kind of a mixed-bag situation,” he observed. “We are at a slower part of the season for PVC, and domestic demand is not great. At the same time, Asia is oversupplied, so prices for U.S. exports to that region have to be kept low.” Also ethylene monomer contracts for October settled down by another 0.25¢/lb and looked fairly flat for November. So Kallman expected flat-to-lower PVC prices this month, though he noted that the latter part of the first quarter is promising to be very busy with a host of ethylene cracker turnarounds. This always serves to tighten the market and boost feedstock prices. Kallman said a stronger domestic construction market is largely expected for 2016, but pricing will depend a lot on the global PVC market situation.

ABS PRICES LOWER

ABS prices continued to erode in September to November, with prices dropping 5-10%, depending on the market, according to RTi’s Kallman.

Lower prices of feedstocks—benzene, butadiene, and propylene—were the key factor. Moreover, lower-priced Asian imports to North America exerted further downward pressure last month. Kallman predicted mainly flat pricing through much of the first quarter, though he says a lot will depend on the global oversupply. Domestic demand for ABS, he said, was expected to remain healthy, as it was through 2015, owing primarily to automotive and appliances.

PC PRICES FLAT OR LOWER

Polycarbonate prices dropped 1-5% in October, depending on the market, following sharp drops in key feedstocks benzene and propylene. November and December PC prices flattened out, according to RTi’s Kallman, owing to slight increases in feedstocks.

Kallman expects that domestic demand for PC will remain as strong in 2016 as last year, bolstered by the automotive sector. While that might be expected to keep PC prices firm, oversupply in Asia resulted in U.S. PC exports dropping 14% in 2015, while lower-cost imports increased by 24%. Kallman believes that the oversupply will continue, as nearly all suppliers plan to expand capacity.

NYLONS 6 & 66 PRICES DOWN

Nylon 6 prices dropped by 4-7% in October due to sharp drops in benzene costs. Prices then flattened out in the last two months of the year, largely due to incremental benzene price increases. “With benzene prices going up, and expected to continue to do so in the first quarter, there is upward pressure on nylon 6 prices,” said RTi’s Kallman. “But expect this to be offset by the competitive nature of the current market, despite good domestic demand.”

IHS director of engineering resins Paul Blanchard noted at his firm’s Global Plastics Summit in October that nylon 6 supply was adequate, but new capacity to be brought on stream soon by Honeywell will pull down nylon 6 plant operating rates industrywide to 60% over the next two years. Blanchard projects competitive pricing for nylon 6 base resins but relatively stable prices for compounds.

Meanwhile, nylon 66 prices dropped about 5% in the fourth quarter due to sharp drops in key feedstocks, and “there is potential for some further erosion” in first quarter, according to Kallman. Even so, both he and IHS’s Blanchard expect good demand to continue into 2016. Blanchard characterizes nylon 66 supply as adequate in North America and pegs recent demand growth at 3%/yr. While he expects this to continue, he foresees prices to be flat or soft, with base resin prices more competitive and more stable prices for compounds.

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More