Unilever’s Magnum ice cream tubs made from chemically recycled PP from SABIC are being rolled out commercially on a global basis.

The spotlight is shining brightly on chemical recycling. Over the last couple of years there were dribs and drabs of news about pilot projects and consortiums being set up, but of late the focus has shifted to new targets for technology scale-up as well as real-world examples of new products rapidly being commercialized (see Table 1).

A prominent example is Magnum Ice Cream Tubs. In 2019, 600,000 of these tubs were made from chemically recycled PP supplied by SABIC. That grew to more than 7 million in 2020 across Europe. In 2021, this recycled packaging is being rolled out globally.

Recent years have seen prototypes tested and other commercial products brought onto the market. With the greatest number of commercial product examples, SABIC and Eastman have forged partnerships across the value chain to boost the use of chemically recycled plastics in the fast-moving consumer-products sector.

Collaborations across the value chain continue to grow—from retailers and brand owners to petrochemical giants, chemical companies, processors, and recyclers. The first half of this year also witnessed some big investments in chemical recycling. One that stood out was the major bump in planned investment from 2.6 billion Euros in 2025 to €7.2 billion in 2030 announced by the PlasticsEurope trade association. This includes 44 planned projects in 13 EU countries.

Louisiana recently joined 13 other states in passing legislation that supports the adoption of chemical recycling.

Important developments in the legislative landscape, which will be crucial to scale-up of advanced recycling technology, have emerged this year. In February, the European Parliament adopted a report on the New Circular Economy Action Plan (CEAP), which acknowledges the potential of chemical recycling in closing the material loop while also defining clear criteria that must be fulfilled.

Meanwhile in the U.S., the legal stance on chemical recycling is unclear as of now. On one side, there is the Break Free from Plastic Pollution Act, introduced in the U.S. Congress, which aims to block advanced recycling technologies. And on the other side, Louisiana recently joined 13 other states in passing the legislation that supports the adoption of chemical recycling.

Nestle’s KitKat chocolate wrapper is made with LyondellBasell’s chemically recycled PP.

Construction of Commercial-Scale Plants Begins

One of the biggest announcements this year came from Eastman. After having commercially launched Tritan Renew copolyester containing 50% chemically recycled PET last year, Eastman has now shared its plans of investing around $250 million over the next two years to build one of the largest plastic-to-plastic molecular recycling plants in Kingsport, Tenn. The 200-million-lb/yr plant is expected to be completed by the end of 2022.

Plastic Energy, one of the most dynamic start-ups in the field of advanced recycling, currently has three commercial-scale plants under construction in partnership with leading industry players (see Table 2). Construction of its first plant started at the end of 2020, in partnership with Total. In January 2021, it announced with SABIC the construction of a pyrolysis plant under a joint venture called SPEAR (SABIC Plastic Energy Advanced Recycling). This was followed up with Plastic Energy’s announcement of a new plant in France with ExxonMobil in March 2021. Plastic Energy’s proprietary Thermal Anaerobic technology (TAC) process converts difficult-to-recycle mixed plastics from domestic, industrial or agricultural wastes into Tacoil, which is used to manufacture polymers and other high-value products.

ReNew ELP, the U.K. subsidiary of Mura Technology, is building a 160-million-lb/yr commercial plant in Teesside, U.K., expected to be operational by 2022. They have secured a strategic investment from Igus GmbH and the project has also been awarded £4.42 million by the U.K. government. Mura has entered into a partnership with Dow Chemical, which will support the rapid scale-up of their technology and will also be a user of recycled materials from this plant.

Mura’s proprietary HydroPRS process, utilizing Cat-HTR technology (developed and owned by Licella Holdings Ltd.), uses supercritical steam to convert plastics back into the oils and chemicals they were made from, ready to be used for new virgin-grade plastic products.

Mura has also planned a rapid global rollout that will see 2 billion lb of capacity in development worldwide by 2025. Sites are planned in Germany, the U.S. and Asia. The first license agreement has been signed with Mitsubishi Chemicals.

Plastic Energy has three commercial-scale plants under construction in partnership with leading industry players.

Meanwhile, recycling technology company Itero plans to build a commercial-scale plant in Geleen, The Netherlands, which will require an investment of €25 million. The 54-million-lb/yr plant is expected to be operational in 2023. Itero’s proprietary pyrolysis process converts plastic waste into four products: naphtha, waxes, pyrolysis oils and gas, and liquid hydrocarbons. The planned single-module recycling facility can be scaled up with the addition of more such modules.

Estee Lauder’s Clear Improvement Active Charcoal Mask is made with SABIC’s chemically recycled PP for the cap and chemically recycled PE for the tube.

More Projects Underway

Further details are awaited for the following projects, currently in the pipeline:

▪ Carbios, as part of a consortium featuring leading brand owners like L’Oréal, Nestlé Waters, PepsiCo and Suntory Beverage & Food Europe, is expected to launch a 80-million-lb industrial facility by 2025. The consortium’s aim is to bring Carbios’ advanced recycling technology to industrial scale. A major milestone was achieved recently when each of the brands launched food-grade sample bottles made from enzymatically recycled PET. (See last month’s Starting Up.)

▪ Borealis is conducting a feasibility study together with Stena Recycling for a new chemical recycling facility in Sweden, which is expected to be operational by 2024.

▪ Brightmark has agreed with SK Chemicals to undertake feasibility studies and evaluate commercial viability of Brightmark’s plastics renewal technology in South Korea. Upon completion of the evaluation this year, final plans to establish a joint venture and construct a plastic-to-plastic pyrolysis plant with a capacity of 200 million lb will be announced. Brightmark is also expected to invest more than $680 million for a new chemical recycling plant in Georgia (U.S.).

▪ Synova has partnered with Technip Energies to commercialize its plastic waste-to-olefins technology, which has the ability to convert contaminated plastic waste, eliminating the need to remove inseparable biogenic materials. Cleaning and purification steps are included in the process, offering better integration with existing cracker plants.

▪ Agilyx and AmSty will jointly build an advanced PS recycling facility in the U.S. Agilyx has also entered into an agreement with NextChem to accelerate development of chemical recycling facilities across the globe.

Zur Muhlen Group’s Gutfried cheese packaging is made with BASF’s chemicall recycled nylon and SABIC’s chemically recycled PE.

Industry Giants Take Big Strides

ExxonMobil announced that it aims to market commercial volumes of certified circular plastics later this year. In preparation, the company has joined with Agilyx to become a founding member of the joint venture, Cyclyx International LLC, a post-use plastic feedstock management company that will provide aggregated and pre-processed plastic waste to Exxon’s advanced recycling projects. The company has also completed the initial phase of a plant trial of a proprietary chemical recycling process in Baytown, Tex., and has obtained certifications through the International Sustainability and Carbon Certification Plus (ISCC+) process.

Eni's chemical company Versalis has received ISCC+ certification for production from bio-naphtha and chemical recycling (pyrolysis oil). The monomers, intermediates, and polymers. produced from pyrolysis oil will be part of the “circular attributed” range to be put on the market.

Together with Servizi di Ricerche e Sviluppo (S.R.S.), Versalis is developing a cost-effective valorization process of mixed plastic waste that cannot be mechanically recycled. The project titled Hoop is currently ongoing and a demonstration plant at the company’s Mantova, Italy, site has been designed with a capacity of 12 million lb/yr.

OMV has partnered with Borealis for the ReOil chemical recycling project. To further accelerate the supply of circular products, including base chemicals and polyolefins, Borealis has signed an agreement with Renasci Oostende Recycling NV for the supply of ISCC+ certified chemically recycled feedstock. It is being used to manufacture products under the Borcycle C brand, commercial volumes of which have been available since May.

Having demonstrated commercial-scale production of its circular PE range at the end of last year, Chevron Phillips Chemical (CPChem) received ISCC+ certification this year. The company aims to reach an annual production volume of 1 billion lb of circular PE by 2030. CPChem has also signed long-term agreements with Nexus Fuels and Braven Environmental for pyrolysis oil supply.

Henkel’s Perwol laundry packaging is made with rPE using BASF’s ChemCycling process.

70+ Companies & Research Institutes Advance Chemical Recycling

Here’s an overview of some of the more significant collaborative chemical recycling projects now underway:

▪ A multi-million-dollar Circular Plastics Fund was recently launched by Closed Loop Partners, LyondellBasell, Dow Chemical, and Nova Chemicals. It aims to accelerate plastics recycling in U.S. and Canada with a multi-pronged approach to boost collection, sorting, and the overall infrastructure, including logistics, facilities and equipment. The focus is on recovery and recycling of food-grade and medical-grade PE and PP.

▪ BASF has been very active in this area of technology since 2018, when it launched the ChemCycling project. This year, it is collaborating with more stakeholders globally and pursuing joint feasibility studies to expand chemical recycling in Central Europe with Quantafuel and Remondis and in Japan with Mitsui Chemicals Group. The goal is to accelerate discussions with related ministries, agencies, and industry groups and promote the use of recycled materials.

▪ SABIC has joined with P&G and Fraunhofer for a pilot project on closed-loop recycling of single-use facemasks. Using the pyrolysis oil received from Fraunhofer, SABIC manufactures Trucircle high-quality PP. This PP is then used by P&G to produce nonwoven fibers for new masks.

▪ MMAtwo is a four-year project funded by EU Horizon 2020 Research & Innovation Program with 13 partners including Heathland, Arkema, and JSW Europe. In November 2020, small-scale depolymerization trials, corresponding to a capacity of about 2 million lb/yr, were carried out. Two or three additional experimental test campaigns are on the agenda for 2021.

▪ PUReSmart is another 4-yr project funded by EU Horizon 2020 with nine partners across the polyurethane value chain, including Reticel and Covestro. They are focusing on chemolysis technology that allows reuse of PU’s building blocks, polyol and isocyanate. The consortium targets recovery of over 90% of end-of-life PUR and hopes to develop the first recycled isocyanate in the world.

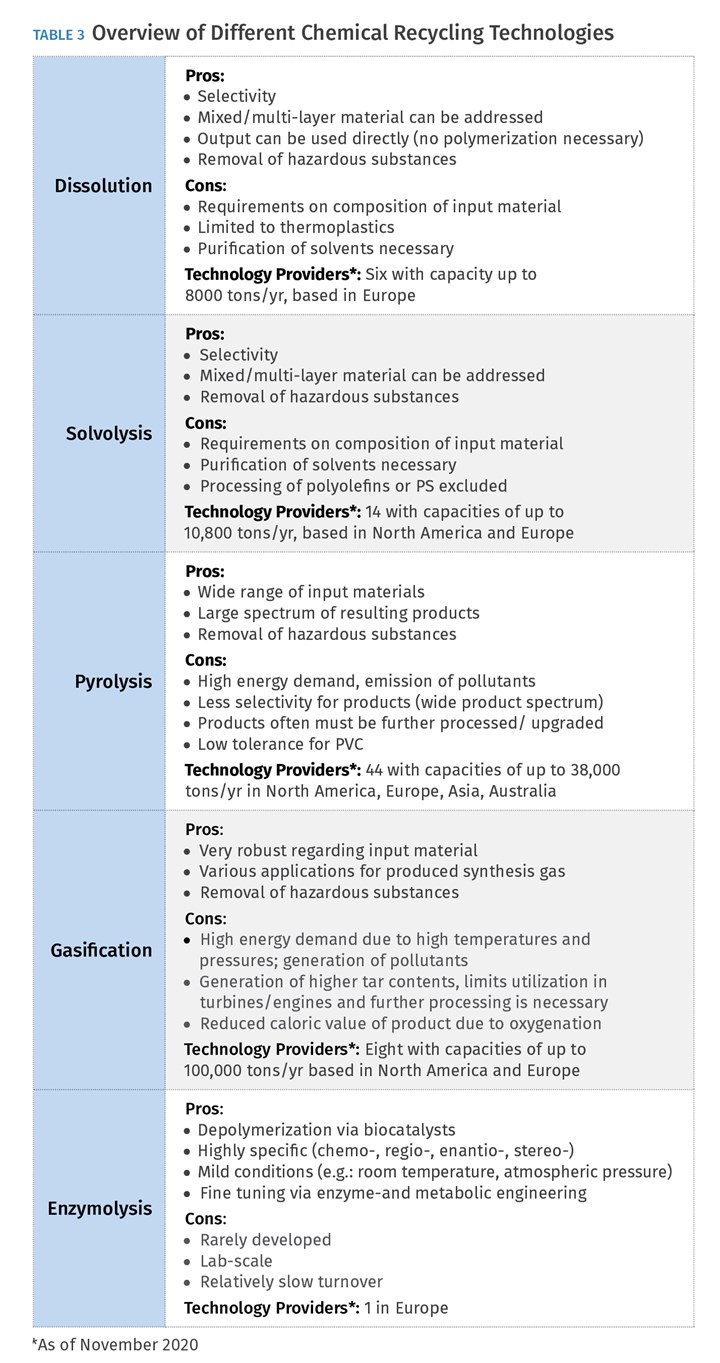

The latest market report on chemical recycling from German research institute nova-Institute features details of more than 70 companies and research institutes with information on technologies and status, investment and cooperation partners. The report, Chemical Recycling: Status, Trends and Challenges. Technologies, Sustainability, Policy and Key Players, also shares clear definitions and categorization of all advanced recycling technologies (see Table 3).

ABOUT THE AUTHOR: Sreeparna Das is an independent consultant, editorial specialist, and published writer with a Master’s Degree in Chemistry and 12 years of experience in the specialty chemicals industry and digital media. She specializes in mapping key trends and challenges with respect to materials and technology for the plastics and cosmetics industries, with a special focus on sustainable and smart innovations that can accelerate the transition towards a Circular Economy. Contact: sreeparna.das.pro@gmail.com.

Related Content

Fungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MoreEvolving Opportunities for Ambitious Plastics Recycler

St. Joseph Plastics grew from a simple grinding operation and now pursues growing markets in recycled PP, food-grade recycled materials, and customized post-industrial and post-consumer compounds.

Read MoreHow to Optimize Color Evaluation of Recycled Plastics

The right color measurement instrument and good working methods will minimize variability in color evaluation of PCR.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read MoreRead Next

Henkel, BASF Collaborate on Chemical Recycling

Henkel is evaluating further opportunities for integrating chemically recycled plastic in its product packaging.

Read MoreEastman Launches Chemical Recycling Innovation for Complex Plastic Waste

Eastman’s ‘carbon renewal technology’ can recycle difficult to recycle plastic waste such as flexible packaging and films.

Read MoreNeste and Remondis Partner on Chemical Recycling

Neste will work with recycler Remondis to build an ecosystem around chemical recycling.

Read More