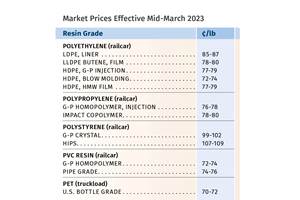

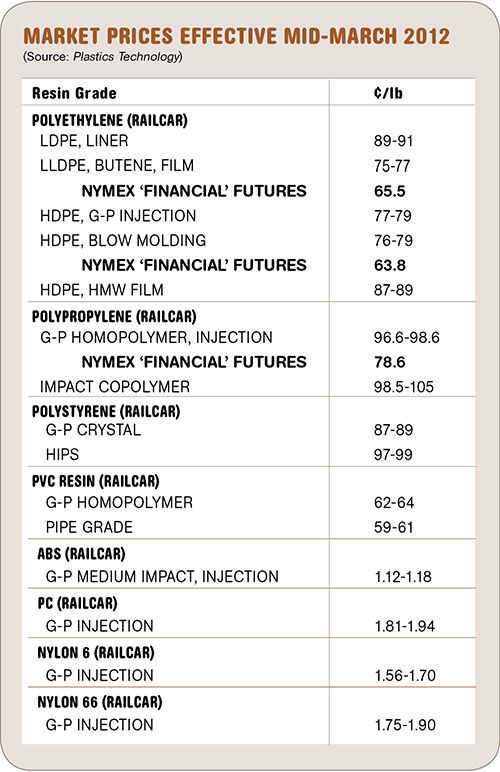

Commodity & Engineering Resin Prices Climb Higher

Prices of major commodity thermoplastics continued to move upward through end of first quarter.

Prices of major commodity thermoplastics continued to move upward through end of first quarter. This trend was already evident for ABS, as well, and appeared imminent for nylon 6 and possibly

for nylon 66 and polycarbonate. This movement was driven primarily driven by feedstock cost increases—some of them substantial—along with feedstock or even resin supply tightness in some cases. Planned and unplanned cracker outages are one contributing factor, as are lower production rates for most resins, except PE. What appears to be an increase in domestic demand for some resins is termed “artificial” and due largely to prebuying in anticipation of more price hikes, according to consultants at Resin Technology Inc. (RTi), Fort Worth, Texas (resinpros.com), and Michael Greenberg, CEO of The Plastics Exchange, Chicago (theplasticsexchange.com). Here’s more of their insight as we enter the second quarter.

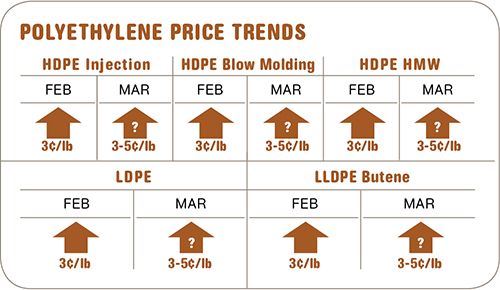

PE HIKES IN DOUBT

Polyethylene prices moved up 3¢/lb in February, implementing half of suppliers’ 6¢ January price hike. Besides the remaining 3¢, a 7¢/lb hike was announced for Mar. 1. By the second week in March, suppliers were posting a variety of price initiatives. Most were pushing for 3¢ or 5¢/lb in March, followed by 7¢ or 5¢/lb, respectively, in April. How much, if any, of these increases will take place was an open question at press time.

Market fundamentals were no different than in the previous month, according to Mike Burns, RTi’s v.p. of PE. Nothing appeared to support price increases, with ethylene monomer contract and spot prices both trending downward in March. Plastics Exchange’s Greenberg adds that once all the ethylene plant maintenance turnarounds are completed in May, monomer prices will decline much more. Moreover, PE supplier inventories grew by 450 million lb in January and February, the largest two-month gain in at least two years, Burns said. He also noted that global demand is flat or soft, and exports in the first two months of this year were 40% below the monthly average in the last two years.

Burns expects to see global oversupply of PE this year, with all the planned new capacity in the Middle East and elsewhere now in operation. He does note that the export picture could change if oil prices spike anew. Domestic demand for PE has risen only slightly in 2012—between 1% and

4% in different markets.

Most processors stopped prebuying in the first quarter and buy only cautiously now to avoid higher prices in inventory. According to Plastics Exchange’s Greenberg, processors added to their resin inventories last December, which helped them resist the January price increase by limiting contract

purchasing.

Says, RTi’s Burns, “Market indicators are saying that PE prices peaked in January and should now be lower, but suppliers’ determination to keep prices high has dominated the market.”

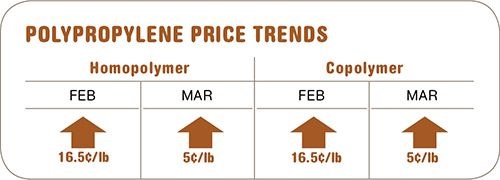

PP PRICES UP AGAIN

Polypropylene prices rose 5¢/lb last month, after surging by 16.5¢ in February. The latest movement mirrored the increase in March propylene monomer contract price to 77.5¢/lb. Greenberg ventures that propylene supply will continue to be tight as a result of planned cracker maintenance turnarounds through May. Even afterward, he anticipates continued tightness in supply as cracker operators opt to process more profitable ethane rather than propane, resulting in less propylene end product.

According to Scott Newell, RTi’s director of client services for PP, domestic PP prices are once again amongst the highest in the world, and exports are now at a minimum level. Meanwhile, Greenberg reported that although most buyers had stocked up ahead of the whopping February increase, downstream inventories were starting to wear thin and buyers were facing sticker shock from prime railcar offers priced in the mid-to-high 80¢/lb range. He predicts that the PP spot market is likely to remain discounted relative to rising contract prices, but the lower-priced offers are most likely to disappear because this monomer-driven resin market will remain relatively costly for the forseeable future.

In the face of weak demand, PP suppliers have throttled back production rates to as low as 83.5% of capacity, according to Greenberg. Newell expects domestic demand to be softer over the next month or two. “How this balances against the capacity outages will determine where prices go from here,” he says. He also notes that there is potential for future price increases in April-May.

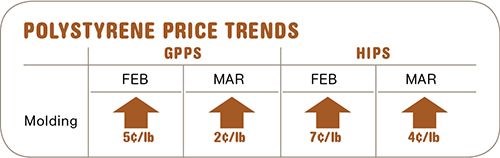

PS PRICES CLIMBING

Polystyrene prices continued to rise last month, with year-todate prices up 14¢/lb for GPPS and 19¢/lb for HIPS, according to Stacy Shelly, RTi’s director of business development for engineering

resins, PS, and PVC. Following January price hikes, February prices rose another 5¢/lb for GPPS and 7¢/lb for HIPS. March hikes of 2¢ for GPPS and 4¢ for HIPS were being implemented at press time.

The current delta between GPPS and HIPS is once again up to around 11¢/lb. According to Shelley, the historical 4-5¢ delta between the two has not been seen since 2010, though it did drop to around 7¢/lb for a short time earlier this year.

The biggest driver behind the PS increases is styrene monomer, whose price is up 14¢/lb since the beginning of the year. Those were driven by benzene prices that jumped from $3/gal in December

to $4.23 in March. But this could reverse, barring any major global events, since benzene and styrene prices appeared to be flattening out. Styrene monomer global demand is pretty low.

Domestic PS demand, in the meantime, has been “artificially strong,” according to Shelly, who attributed it to heavy prebuying in the first two months of the year ahead of impending price hikes. For second quarter, Shelly predicts that prices will be flat to down, mirroring flat demand.

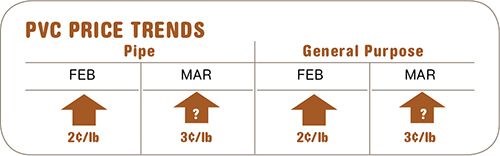

PVC PRICES UP, TOO

PVC prices rose 2¢/lb in February. A new 3¢ hike emerged for Apr. 1 and appears to have a chance at partial implementation—1¢ to 2¢, according to Mark Kallman, RTi’s director of client services for engineering resins and PVC. He notes that March contract and spot prices for ethylene—a key PVC feedstock—both dropped by $1.25/lb.

Another critical factor is how tight PVC supply remains. Another planned maintenance turnaround in February, and suppliers throttling back on plant operating rates to the low-to-mid-70% range through much of the first quarter, made for a tight market last month. Domestic demand was up by as much as 9%, owing largely to the construction sector, which showed some earlier than usual rebound due to the warm winter. That offset a decline in exports compared with last year’s first quarter.

Domestic demand is expected to improve in the second quarter, which is historically stronger. RTi’s Kallman notes that April is typically a time where most “real buying” takes place, but many processors were pre-stocking in the first quarter due to impending price hikes. He thinks domestic demand could be more consistent in the coming months, so that pricing may also prove more stable.

ABS PRICES RISE

ABS started the year with a series of price increases, rising an average of 5¢/lb in February, with extrusion grades generally on the higher end, according to RTi’s Shelly. Suppliers followed up with March price hikes of 7¢ to 11¢/lb, which were being implemented at press time last month. One supplier, Ineos, had also issued a 6¢ increase for Apr. 1.

Driving these moves were spikes in all key feedstock prices, so that the cost to manufacture ABS is up 19¢/lb so far this year. (In contrast, last December’s cost to produce ABS was down by more

than 28¢ from the highs in May 2011.) Butadiene prices, which had dropped significantly by end of 2011, were as high as $1.47/lb for March contracts, with spot prices at $1.60/lb. (However, April contracts were down 10¢, and new butadiene capacity is coming on stream.) And acrylonitrile prices were up 17¢/lb in February and expected to rise another 5-6¢/lb last month, both moves in step with prices of propylene precursor.

Styrene monomer last month was up 14¢/lb for the year to date, following the sharp rise in benzene prices to $4.23/gal. RTi’s Shelly and other industry pros venture that, barring any major world events, oil and benzene prices will start going down.

Meanwhile, the ABS imports from Asia that had flooded the market in the fourth quarter are no longer an issue, as Asian ABS prices are themselves up 18¢/lb. Shelly says the North American

ABS market has been “artificially tight,” with demand up because of a lot of prebuying that took place in the first couple of months of the year in anticipation of price increases. Shelley thinks ABS prices are likely to increase through this month, but will flatten and then soften at the end of the second quarter.

NYLON PRICES UP FOR NOW

Prices of nylon 6 and 66 appeared to be on the way up last month, although it was unclear how much of suppliers’ posted increases would be implemented. In the case of nylon 6, suppliers had issued price increases totaling as much as 10¢/lb. There were some indications that an increase of 5¢ was being implemented in February and March. Some suppliers were attempting to push through another 5¢ this month. “Prices are definitely trending upwards, but it’s hard to say by how much,” notes RTi’s Kallman. He thinks an increase of 5¢/lb is more likely than a higher amount. The increases were driven by suppliers’ efforts to catch up with price increases in benzene, propylene, and caprolactum from Asia (a secondary source for the domestic market). But benzene prices are now flattening out, and butadiene contract prices were expected to drop by 10¢/lb this month.

Meanwhile, nylon 66 prices actually dropped by about 3-4% early in the first quarter, as suppliers had gained quite a bit of margin due to low feedstock prices in fourth quarter. The price erosion stopped with the sharp increases in benzene, propylene, and butadiene prices. A price increase of 7¢/lb was issued by one supplier but this did not appear to have widespread support.

Domestic demand for nylon 6 and 66 is up this year, primarily in automotive. But demand in the Asian automotive market has slowed and in the European automotive sector is now “negative,”

according to RTi’s Kallman. This is further fueled by a downturn in demand in the global textile sector.

PC PRICES MOVING UP?

Polycarbonate prices are expected to be moving up this month, too, as suppliers were pushing strongly for increases of 17¢ to 25¢/lb, originally planned for the first quarter. Suppliers attribute

the hikes to higher benzene and propylene feedstock costs. Prices may go up, but not nearly as much as suppliers seek. Says RTi’s Kallman, “Demand is not strong globally and there is new

capacity coming on stream, so that this market is well supplied.” Domestic demand has seen a modest improvement in the automotive sector, but demand has slowed in both optical-media and

construction sectors, according to Kallman.

Related Content

ICIS Launches: Ask ICIS Generative AI Commodities Assistant

Said to be the first of its kind, this AI assistant will enhance access to ICIS’ intelligence and insights for the energy and chemical markets.

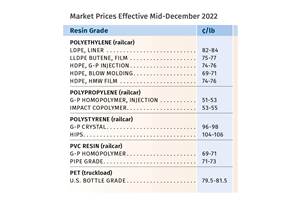

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

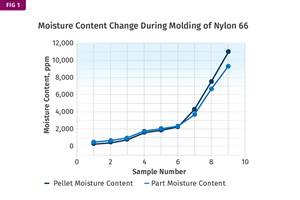

Read MoreWhat's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MorePrices of Volume Resins Drop--Except for PE

The downward trajectory appears to be continuing into the first quarter for most resin prices, though PE and possibly PP may remain somewhat stable.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More