Commodity Resin Prices Falling

Lower feedstock costs, improved supplies, lower export prices are among key factors.

Share

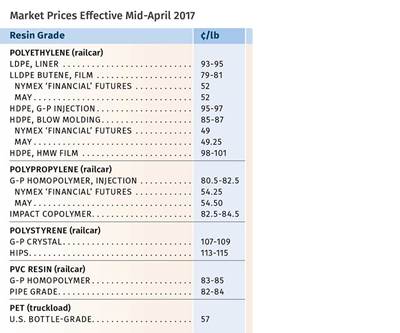

Overall, the trajectory of prices for commodity resins appeared to be downward last month. Prices of three of the five resins—PP, PS and PET, dropped. While prices of PVC and PE held even in April, the former was likely to decline before the end of May and the latter had potential for a decrease this month after remaining flat in May. Key drivers included lower feedstock costs, lower export prices and, very crucially, improved feedstock and resin supplies.

That was the outlook last month from purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of Plastics Exchange, The in Chicago; and Houston-based PetroChemWire (PCW).

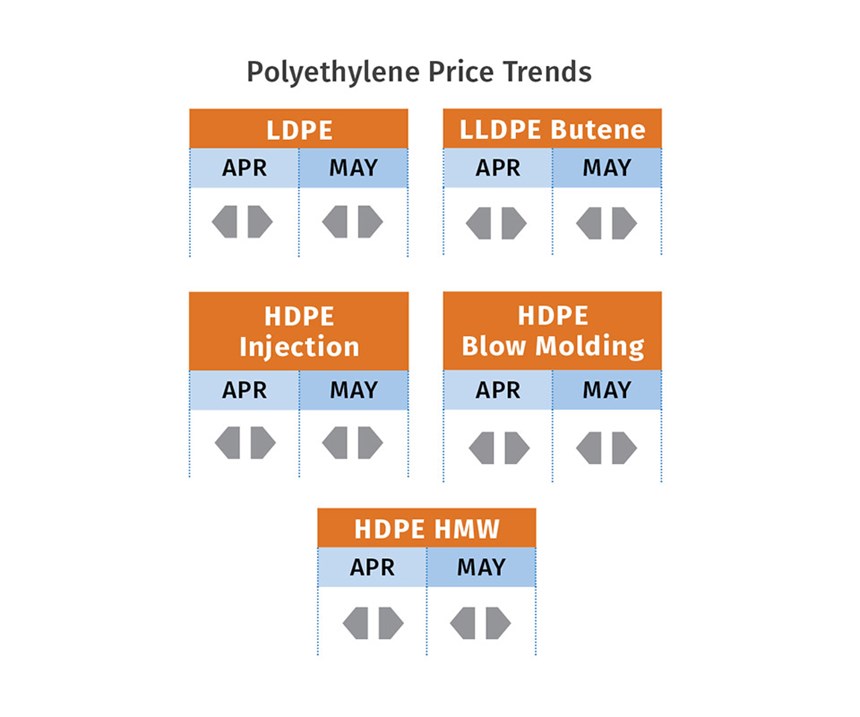

PE PRICES FLAT FOR NOW

Polyethylene prices were flat in April, after moving up 3¢/lb in March as suppliers split their 6¢/lb increase into two steps, but delayed the second increment to May. So far this year, PE prices are up 8¢/lb due to tight supplies.

Mike Burns, RTi’s v.p. of client services for PE, said implementation of the May increase was unlikely, as inventories have been improving. He expected PE prices in May to remain flat with possible downward pressure this month. But he cautioned, “If oil remains at $50/bbl, we may expect a return of the March 3¢/lb increase.” His message was that the slow but steady recovery of inventories will keep prices less volatile and perhaps lower. He also cited new PE capacity scheduled to be brought on stream at summer’s end by both Dow and CPChem.

The Plastics Exchange’s Greenberg supported this view: “Many market participants believe that peak pricing is already in place. Market momentum has turned towards bearish as several of the new or expanded petrochemical complexes get closer to completion.”

PCW reported that PE spot prices moved lower in export and wide-spec channels, while domestic prime price levels appeared to hold firm. “Availability continued to improve, led by HDPE blow molding and film grades. May was expected to be a turning point for HDPE injection molding, LLDPE, and LDPE supply balance.”

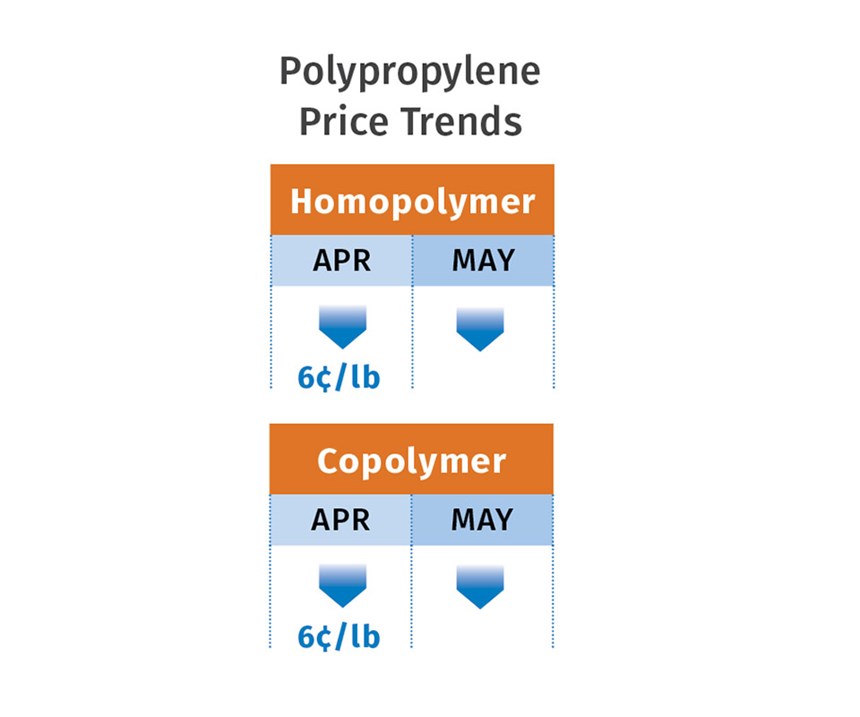

PP PRICES DROP

Polypropylene prices dropped 6¢/lb in April, in step with March propylene monomer contracts, which settled at 46¢/lb. Based on declining spot monomer prices in early May, April monomer contracts had the potential to drop another 6¢/lb, with PP following penny for penny, according to Greenberg and Scott Newell, RTi’s v.p. of PP markets. Newell discounted reports that suppliers might be aiming for PP margin expansion, which he said the market would not support. Moreover, he sees potential for further price decline this month. “PP prices are going to look a lot better for processors in the second half of 2017, as monomer supplies continue to improve and Enterprise brings on its propylene plant in October.”

PCW reported lower PP spot prices at the end of April and signs that offgrade availability had tapered off and that spot prime availability appeared to be concentrated in mid-range homopolymer grades. Greenberg observed that the market’s high volatility “has created risk, which generally translates into lower-volume transactions.”

Both he and RTi’s Newell reported that there were several well-discounted spot opportunities, yet processor demand appeared to remain “cautious.” Said Greenberg, “The first quarter’s extreme cost- push price increases, which totaled just over 20¢/lb, crimped resin demand as processors were concerned about their ability to pass along higher resin costs and their ultimate profitability.”

A rebound in PP demand was expected last month, after a very soft April, as many buyers delayed purchases in anticipation of lower prices, explained Newell. “The question is, how strong will that rebound be and how much of its will be real demand vs. restocking?” He pegged PP plant operating rates through the first quarter at around 93%, up 3% from the 2016 average. Inventories grew in March and April to 150 million lb.

“There’s been some capacity debottlenecking that has given some breathing room to the market.”

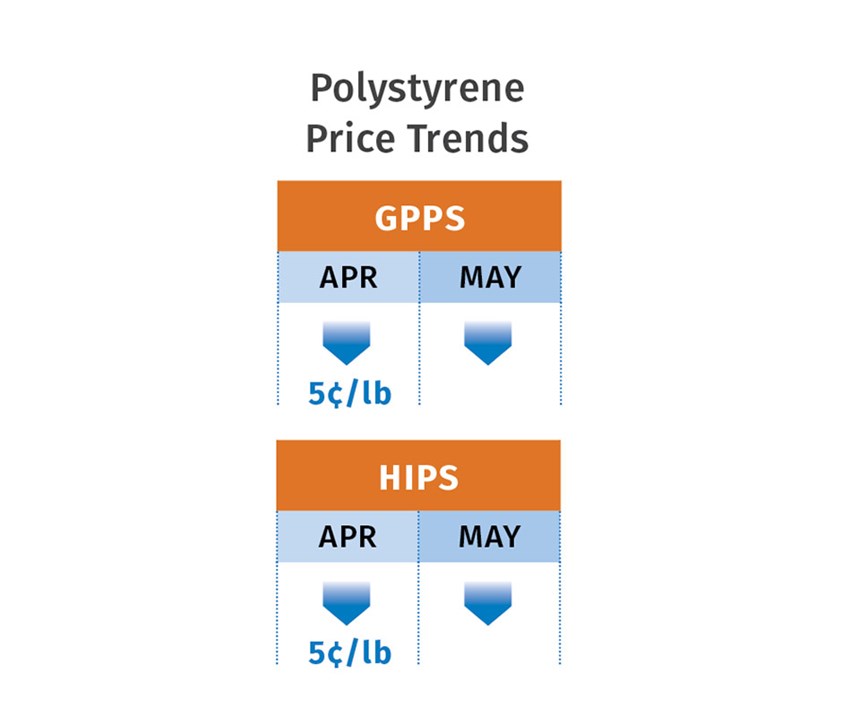

PS PRICES DROP, MORE TO COME

Polystyrene prices dropped 5¢/lb in April, after spiking a total of 19¢/lb in the first quarter. At least one supplier announced a 2¢/lb decrease for May. Both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, expected prices to go lower. Kallman forecasted at least a 2¢/lb drop in May and again in June.

PCW reported that PS spot prices were falling and that availability appeared to be adequate to meet forecasted demand, in addition to a reported surplus of off-grade crystal PS. May benzene contracts dropped 1-3¢/gal from April, to $2.69-2.70/gal, and forward bids were nearly below $2.60/gal.

Suppliers would need to give up some of the hefty profit margin incurred during the first quarter in order to avoid demand destruction. Global PS prices have been dropping. Meanwhile, demand for EPS home insulation was said to be at a 10-yr high for the month of March alone.

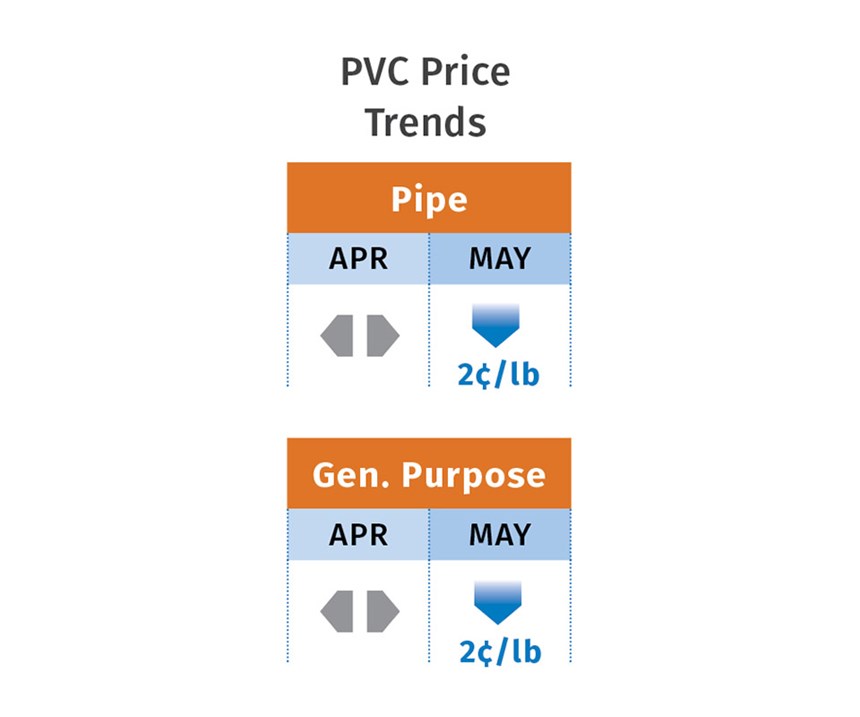

PVC PRICES FLAT-TO-DOWN

PVC prices moved up 2¢/lb in March, rolled over in April, and May saw potential for a reduction. RTi’s Kallman ventured that PVC prices would drop 1-3¢ in the May-June time frame.

Driving the downward movement are lower feedstock costs and export prices. Most notably, late-settling March ethylene contracts dropped by 5.75¢/lb. According to Kallman, April ethylene contracts had the potential to move up 1-2¢/lb due to some unplanned production disruptions. However, he noted that ethylene supplies are improving and we can expect to see lower vinyl chloride monomer prices from now on. (Ditto for styrene monomer.) Meanwhile, lackluster PVC export demand led suppliers to drop prices by 4¢/lb in April. Kallman expected an uptick in PVC demand as seasonal construction markets got underway.

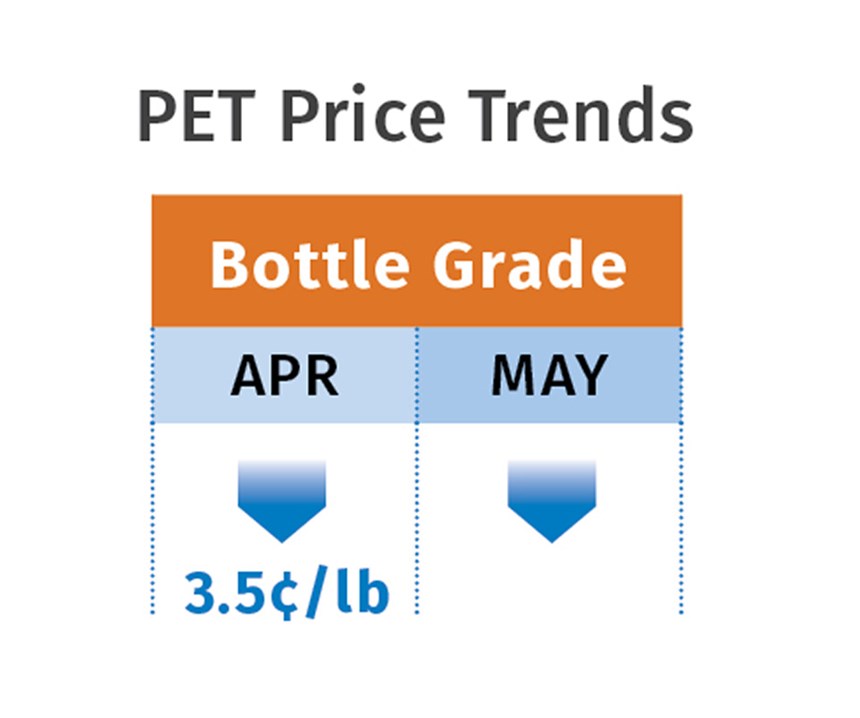

PET PRICES DOWN

Domestic bottle-grade prime PET prices in April averaged 56.5¢/lb, down 3.5¢/lb from March, based on PCW’s Daily PET Report. That price represents PET business on a delivered Chicago basis. The price on May 2 stood at 56.5¢/lb.

Meanwhile, prices of imported prime PET with an IV of 78 dl/g or higher also fell in April, averaging 56¢/lb, down 1.6¢ from March. This represented PET resin on a delivered duty-paid U.S. port basis. The price for imported PET on May 2 stood at 56¢/lb. Prices fell after an average decline in April’s feedstock costs to 52.86¢/lb, 2.67¢/lb lower than in March.

PCW noted that the world’s largest PET plant, under construction by M&G in Corpus Christi, Texas, is reportedly facing $100 million in legal claims filed against it from dozens of companies that have worked on this “Project Jumbo.” M&G has acknowledged it was “continuing to sort through the various claims” of subcontractors, but that this would not affect the midyear start-up schedule. Still, market sources close to the project have been told to expect a startup no sooner than the fourth quarter. DAK Americas LLC has “supply contract rights” for about 1.1 billion lb of Jumbo’s planned capacity, reported to be between 2.4 and 2.8 billion lb.

Related Content

Prices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Commodity Resin Prices Dropping

A reversal of several industry factors is likely to drive prices down this quarter.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More