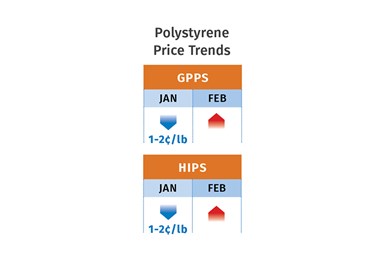

Prices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Prices of the five commodity resins were all heading up this month to some degree and certainly not because of demand/supply fundamentals. Initially, industry sources largely expected a rollover of prices for the first two months of first quarter for at least three of the five. Instead, and with the exception of PVC, prices of PE, PP, PS and PET all moved up in January. Further increases were possible for PP, PS and PET, largely tied to supply tightness in key feedstocks. There was a potential for price rollover for both PE and PVC, as there was no upward push from feedstocks and supply continued to surpass demand. As for this month, volatility from some feedstocks, planned plant turnarounds, and the potential of some surge in seasonal domestic and exports demand as we move into second quarter, generally appeared to indicate largely flat-to-upwards movement. Factors that could further contribute to this trajectory include production disruptions due to weather and/or unplanned plant shutdowns along with global strife issues affecting energy markets.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers, Mike Burns of Plastic Resin Market Advisors, and resin pricing expert Robin Chesshier.

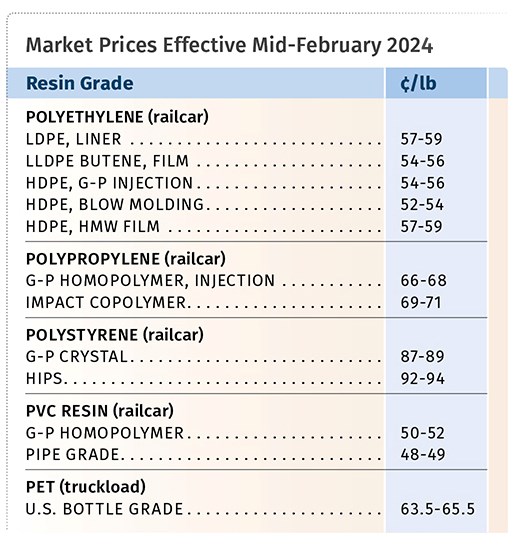

PE Prices on Way Up

Polyethylene prices in January were expected to move up by 3¢/-to-5¢/lb, and flat-to-up in the February-March time frame, though key fundamentals —supply/demand balance and feedstock costs — did not justify an increase, according to PCW’s associate director for PE, PP and PS, The Plastics Exchange Greenberg, Mike Burns of Plastic Resin Market Advisors, and resin pricing expert Robin Chesshier. Suppliers were out with increases of 5¢/lb each for January and February.

“ACC data for December showed suppliers inventory gains. This despite weak demand, a freeze event in the Gulf Coast which did not impact feedstock/resin availability, and operating rates between the mid-to-high 80%, noted Chesshier. As The Plastic Exchange’s Greenberg put it, “The vast majority of polyethylene plants skated through the Houston freeze without a notable impact.”

PCW’s Barry added that while suppliers had increased their PE export prices by 5¢/lb driven by rising freight costs (20% to 25% higher), he still characterized the domestic PE market as balanced-to-long. He ventured that domestic PE prices could decline if global PE prices drop. Reported Barry, “Demand indications for January were positive in some sectors where customer restocking was evident, but other sectors continued to see orders fall short of expectations.”

Plastic Resin Market Advisors’ Burns ventured that the January increase, should it go through, ought not be sustainable. “Early demand indicators do not support strong January and February processor or end-user restocking. End users remain cautious on new orders and inventory levels. After the January price outcome, the key indicators for the first half of the year will continue to be the ability to export excess record production.”

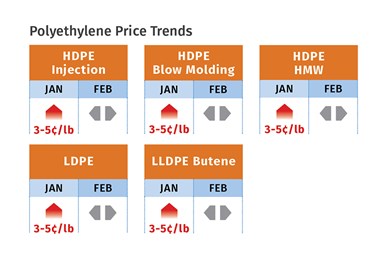

PP Prices Up

Polypropylene prices in January moved up by 3¢/lb in step with propylene monomer, with February-March time frame projections of flat-to-up, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. At least one supplier was out with a non-monomer/margin increase of 4¢/lb for February, a move not likely to get support due to supply/demand fundamentals. Greenberg cited ACC’s final December data which “confirmed that PP inventory build to a record 2 billion lbs, alongside with the second-lowest domestic PP sales volume of 2023.”

Said Barry, “Monomer issues continue to impact polypropylene, which is overpriced, and if further increases go through, there will be demand destruction.” This, including processors switching to lower cost resins like HDPE, as well as PP imports. He also noted that structurally, the PP market will remain balanced-to-tight unless on-purpose propylene units are fully operational. Scheduled plant turnarounds were expected to further tighten supply. Barry also noted that export sales were challenged by high monomer costs. “Sustained monomer costs above 50¢/lb were expected to invite further imports of PP resin and finished goods.”

These sources had anticipated seeing a correction in PP prices within early first quarter, but they see the market as vulnerable due to the monomer’s volatility and other fundamentals. Plant operating rates have been about 76%, driven by significant new capacity coming on stream and lackluster demand. Says Newell, “Suppliers will need to throttle back production even more.” He noted that a general sentiment among PP processors for this year is that they will be lucky if it turns out similar to 2023. Added Greenberg, “Producers (PP suppliers) are keen to rebuild margins, but they collectively entered January with record inventories, so we expect to see resin reactors throttled back even more.”

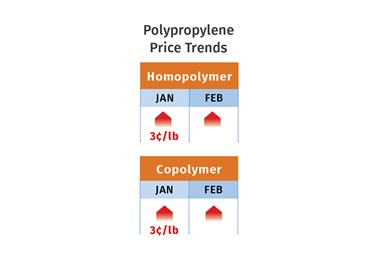

PS Prices Down, Then Up

Polystyrene prices in January dropped about 1¢/lb to 2¢/lb in step with a drop of 16¢/gal in benzene contract prices to $3.15/gal. However, benzene spot prices were on the way up and there were expectations that February benzene contracts would rise by as much as 40¢/gal-to-50¢/gal, reaching $3.60/gal, which would translate to an increase of PS production costs of 4¢/lb-to-5¢/lb, according to PCW’s Barry and resin pricing expert Robin Chesshier. As such, they ventured an increase in February PS prices was very likely and projected March prices to be flat-to-up. This while PS demand continued to be very sluggish and operating rates that had dropped to below 60% by end of last year. Both sources ventured that suppliers would be increasing production within March in anticipation of the seasonal uptick in demand that typically starts in second quarter.

Meanwhile, both sources anticipate continued upward pressure from benzene. Says Barry, “Expect benzene prices to be more volatile within the rest of first quarter and beyond.” Planned turnarounds for both benzene and styrene monomer were among contributing factors, along with lower benzene imports and the gasoline fuel changeover that takes place in March, further tightening supply for benzene derivatives, notes Chesshier. By end of January, Barry reported the implied styrene cost based on a 30% ethylene/70% benzene spot formula was at 39.1¢/lb, up 0.7¢/lb from just one previous week and the highest level since Oct. 2023.

PVC Prices Flat, Then Up?

PVC prices in January were generally expected to roll flat, following a drop of 1¢/lb in December. However, PVC suppliers were out with January increases of 3¢/lb to 5¢/lb and two suppliers issued an additional 3¢/lb for February, according to Paul Pavlov, RTi’s v.p. of PP and PVC and PCW’s associate director PVC & pipe Donna Todd.

Todd reported that comments from both some resin buyers and market watchers indicated that they viewed suppliers’ inability to coalesce on a “common price increase goal” appeared as though the effort wasn’t serious, but instead served to stop any further decline. Pavlov ventured that prices in February would be a rollover, with March movement most likely flat-to-up. He noted that for the first two months, there did not appear any restocking taking place, adding that inventories were pretty high, feedstock costs pretty flat along with slowed global demand. Still, he ventured that suppliers could implement at least part of their increases in March depending on energy markets being impacted by global conflicts and domestic demand showing a bit of a surge as we march to seasonally stronger second quarter.

PET Prices Up

PET prices in January moved up 1¢/lb, having fallen a total of 5¢/lb in 2023’s fourth quarter. Moreover, a combined increase of another 2¢/lb-to-3¢/lb was expected withing the February-March time frame, according to Mark Kallman, RTi’s v.p. of PVC, PET and engineering resins. This he attributed primarily based on raw material formulation costs, and to seasonal demand that picks up in second quarter and summer season. “Demand for PET is steady, despite the slow season, and while attractively priced imports continue to come in, higher freight costs of 2¢/lb-3¢/lb somewhat curtail their advantage. Kallman characterized the PET market is well-to-over supplied.

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More