Mid February Commodity Resin Prices Flat to Soft

Falling energy and feedstock costs and the threat of lower-priced imports are key drivers.

As February rolled in, it was evident that prices for all large-volume commodity resins were on a flat if not a downward path. Despite the hikes for maverick PP, there is downward pressure overall from lower energy and feedstock costs and concern about low-cost imports of resin and/or finished goods.

These are among the views of purchasing consultants from Resin Technology, Inc. (RTi) of Fort Worth, Texas, CEO Michael Greenberg of The Plastics Exchange in Chicago, and Houston-based PetroChemWire.

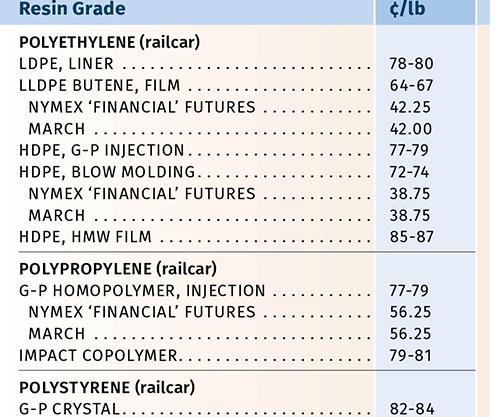

PE PRICES DOWN

Polyethylene prices dropped 3¢/lb in January and further softening was likely by the end of last month. PetroChemWire reported that last July’s 5¢/lb increase was delayed all the way to February; one supplier retracted it; and there was market talk of further decreases.

Mike Burns, RTi’s v.p. of client services for PE, expected prices to drop last month, driven by falling oil prices and soft demand in China, which could stabilize the U.S. PE market.

His current snapshot is that the domestic PE market is in a good spot, but if Asian prices erode, further price cuts will be needed here to protect against demand destruction from imported finished goods.

At the close of January, Greenberg reported a very active spot PE market, with ample supply of all grades of HDPE and LLDPE. Only LDPE remained on the snug side.

Looking ahead, Burns noted that domestic exports to Latin America have been challenged by Middle Eastern competition, so suppliers offered lower February prices. Also, Braskem’s substantial new HDPE and LDPE capacity in Mexico—slated to come on stream in May—will be the big challenge for domestic PE exports.

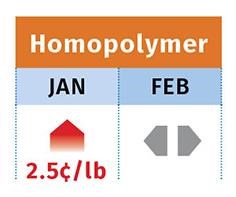

PP PRICES UP BUT COULD SLIDE

Polypropylene prices increased by 2.5¢/lb in January, as suppliers implemented nearly half of their planned 6¢/lb margin increases. Because January propylene monomer settled 0.5¢/lb lower, at 31.5¢/lb, PP prices didn’t move up the full 3¢. Suppliers were aiming to implement the other half of their increases last month.

PetroChemWire reported that depressed demand and competitively priced imports appeared to exert some downward pressure on spot PP prices. The Plastic Exchange’s Greenberg reported that a larger drop in monomer contracts was likely for February, due to ample supply. He said the forward curve for monomer prices is for continued monthly declines until they near 26¢/lb by year’s end. Scott Newell, RTi’s v.p. of PP markets, had a similar view, adding, “Further attempts by suppliers to implement new margin increases will be very unlikely to succeed.”

Newell pointed out that domestic PP demand was a bit off in the first couple of months, and cited possible contributing factors: first-quarter seasonal slowdown; economic slowdown; and, higher PP prices. He said that while the market is a bit more balanced, tight supplies are expected for the next two years. He said processors are looking at imported resin to respond to limited capacity ahead and to suppliers’ program of margin increases.

On that note, Greenberg said, “Processors frustrated with rising PP prices are out shopping for good spot opportunities and exploring alternative sourcing options. U.S. PP prices are well above those in most other regions, so imported resin has been flowing in.”

PS PRICES DOWN

Polystyrene prices were stable through January but were poised to drop last month. PetroChemWire reported at the end of January that February’s 27-28¢/gal plunge in benzene contracts was feeding speculation of PS price decreases of 1-3¢/lb last month.

Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, predicted that the February PS decrease would be closer to 3¢. He characterized the market as balanced but noted that PS suppliers’ planned maintenance turnarounds in late first quarter to early Second quarter could tighten up supply, particularly if there’s demand from an early construction season.

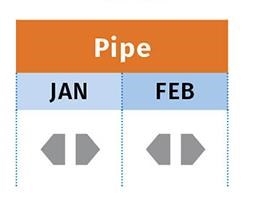

PVC PRICES FLAT TO DOWN

PVC prices appeared to have settled flat to 1¢ lower in January and were expected to do the same last month, according to RTi’s Kallman. He noted that late-settling December ethylene contract prices sank 2.75¢/lb, and January ethylene contracts were being nominated to drop by another 1¢/lb.

Meanwhile, PVC suppliers were expected to delay their announced January 2-3¢/lb increases. Kallman noted that if demand surges as a result of an early construction season coupled with planned PVC plant maintenance turnarounds in early second quarter, suppliers may try to implement their increases next month; otherwise they will aim to push them to May or June. At the same time, he noted that PVC suppliers’ export prices are quite low, which works against their being able to raise domestic prices.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More