“It’s fun to be us right now. We’re very difficult to compete with.” So says Chad Lewis of Peak Nano Systems. It’s no wonder Lewis feels this way. He and Jim Welsh—two Texas A&M graduates with backgrounds outside the plastics industry—cofounded this Ohio-based company, which is upending the film market with revolutionary nanolayer structures—some with tens of thousands of layers—that have already grabbed the attention of the optical- and capacitor-film markets, with high-end packaging the next target.

Not that it was easy. The roots of Peak Nano’s technology go back to 2003, in Case Western Reserve University’s polymer program in Cleveland, under professors Eric Baer and the late Anne Hiltner. Their research over the years on feedblock layer-multiplication technology resulted in numerous patents and technical presentations. The Case Western research, partly funded by the U.S. government, developed the technology for optical lenses and capacitor film. Case Western spun off this research into a commercial entity called Polymer Plus in 2010. Also based in Cleveland, Polymer Plus started with 10 employees, making 800,000-nanolayer film on a prototype line in a clean room for test lenses for the U.S. military.

Both Welsh, Peak Nano’s CEO, and Lewis, its president, are graduates of Texas A&M. Neither are plastics industry lifers. Welsh was in product development for companies such as Compaq and Hewlett-Packard, where he led teams that developed server, storage and networking solutions. Welsh says he got the “entrepreneurial bug” in 2010, and reached out to Lewis, whom he had known for 30 years.

They worked together at a Texas company called MW2 Defense, a nanomaterials venture focused on a carbon nanotube technology, called Molecular Rebar, for the global aerospace and defense markets. His work in the nanoadditive space was the igniting spark for Peak Nano, founded to commercialize nanotechnology and to create its own differentiated manufacturing solutions.

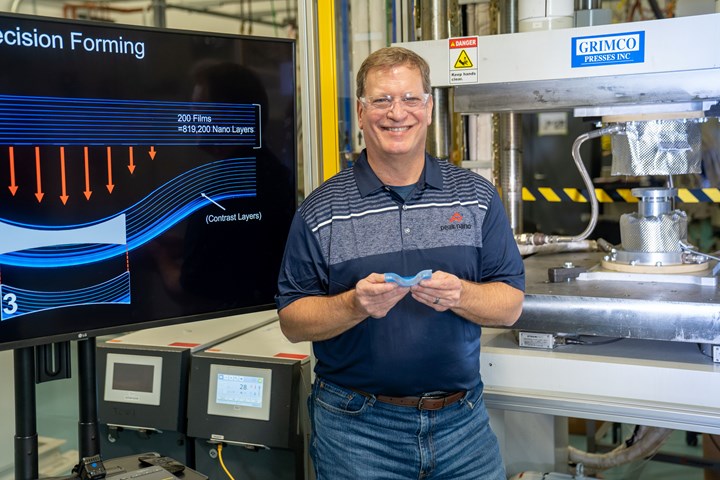

PeakNano’s Mike Hus, sr. v.p. of engineering, holds a nanolayer lens after it is formed but before the finishing step. (Photos: Peak NanoLayer Systems)

Lewis has an investment-banking background and has established companies focused on military and biomedical applications. He helped form Black Diamond Structures, a joint venture between Molecular Rebar Design and SABIC. MW2 Defense’s work to integrate discrete carbon nanotubes into a variety of existing technologies resulted in breakthrough performance in battery technology, coatings, composites, and EMI applications.

The two cofounded Peak Nano Systems in 2016. Driven by career desires to innovate, disrupt and dominate, they became aware of Polymer Plus’ groundbreaking work and formed a joint venture with the Cleveland company that same year. Recalls Welsh, “When we met Polymer Plus, we were vested in battery technology, and we thought pairing it with dielectric functionality would be interesting. Then we saw the capabilities in optics and decided to start there. We had a strong customer base in defense, so we focused on that market.”

They launched applications utilizing nanolayer lens technology, first for the military in uses that included night-vision glasses. Replacing glass, these lenses were dubbed by Case Western “Nanolayer Gradient Refractive Index” (GRIN) lenses and represented a leap forward in optics design and manufacturing.

In late 2018, the technology was approved for commercial applications. The immediate results were optics that are as much as 80% lighter, deliver greater contrast, and in many instances provide a wider field of view and better resolution than traditional glass lenses, Peak Nano officials say. GRIN lens technology can be used in many optics applications, offering improved performance in military night-vision and surveillance cameras; smaller-sized medical-imaging and diagnostic equipment; and lighter weight in sporting optics such as riflescopes, telescopes and binoculars.

In April 2020, Peak Nano acquired the remainder of Polymer Plus as part of a $25 million round of capital funded by Squadron Capital. “We always intended to go back to buy Polymer Plus,” Welsh says. “They realized they needed scale, production, marketing, capital. That is what led to the joint venture and the final acquisition.”

The challenge Welsh and Lewis faced at first was taking game-changing technology developed and nurtured at the university level and scaling it up to a leading-edge manufacturing enterprise. Lewis explains. “This nanolayer structure is one core technology that is accomplishing different things, depending on the composition of the polymers that are in there. Polymer Plus did amazing things, but like lots of companies spun out of academia, they were pursuing funding, either directly from the government or through government partner projects. These were $100,000 to $500,000 research projects aimed at advancing the technology incrementally. They were focused more on proving that it could be done as opposed to ‘Can it be scaled?’

PeakNano’s extrusion capacity includes market-development lines across its entire product range.

“By default, that adds a lot of time to the process,” Lewis continues. “In late 2015, Polymer Plus had gotten to the point where they didn’t know what else to do with it. They had taken it about as far as they could. Jim and I were approached to take a look at the next step for the technology: Can it be commercialized? Given our background in military, we said we think it can. But going from development to commercialization is a travel through that ugly valley of death where so many companies die as they try to scale up. We were willing to wade in that morass, to bring the capital and technical expertise.

“Going from development to commercialization is a travel through that ugly valley of death where so many companies die as they try to scale up.”

“It wasn’t pretty, and it wasn’t linear,” Lewis adds. “It took a lot of money and a lot of people, but we saw an opportunity and came to the realization that many companies said they wanted innovation in the nano area, but they really didn’t. They didn’t want to know how the sausage was made; they just wanted sausage. But we had to perfect the technology in terms of reliability and repeatability because the yields were extraordinarily low. The truth is, in order to further develop and commercialize the technology, you must have discipline—that six-sigma black-belt mentality to knock down the thousands and thousands of items that you need in order to make reliable and repeatable product at a high yield.”

Chief Technology Officer Mike Ponting came to Peak Nano with the Polymer Plus acquisition and has been lead scientist and primary investigator on several Dept. of Defense and commercially funded multilayered materials technology-development programs. In addition to the development of Peak Nano’s nanolayered gradient refractive-index optics, he’s focusing research efforts on additional microlayered and nanolayered polymer thin-film technologies, including nanolayered dielectric capacitor films and coextruded nonwoven nanofibrous materials for filtration applications. Peak Nano hired another Texas A&M alumnus, Casey Fisher, as COO. Welsh says Fisher helped develop the company’s core values and culture. “What we are doing is not easy, Welsh says. “Like Chad said, it’s not linear. There are lots of ups and downs so it’s important to stay grounded.”

Later on, Peak Nano brought on some folks steeped in plastics-industry experience. Mike Hus was brought in as sr. v.p. of engineering. Hus was most recently Dow Chemical’s R&D M&A Integration lead for the Dow/DuPont merger and subsequent spinoff. Welsh says Hus and his engineering group “fundamentally changed our organization from development to production, and ‘cleaned up’ our extrusion process by instituting equipment maintenance procedures and disciplined operator processes.”

Peak Nano also added Wendy Hoenig as chief marketing and sales officer. She had worked with Welsh and Lewis for the M2 Defense projects, and for 25 years before that for Dow in executive leadership positions in North America and Europe. These included stints as global R&D and business director for ventures and new business development for the performance plastics and chemical businesses; and v.p. of R&D for Dow Coating Solutions. Hoenig is considered an expert in flexible packaging development, market segmentation, films processing and building customer relationships.

Two Operating Divisions

Peak Nano Systems has two operating divisions: Peak Nano Optics and Peak Nano Films. “In optics, every company plays in the same sandbox,” Lewis says. “It’s like when you go to Baskin-Robbins and there are 31 flavors. Well, Peak Nano just brought a whole lot more flavors. Because of what we can do, we can make our customers stand out from their competition, whether it’s in size, weight, performance or a combination of all three. In many cases in optics, whenever you change out one element you affect another. For example, you might sacrifice performance if you want an optical device that is lighter or smaller. We can enable that increased performance without the traditional tradeoffs.”

“If I can offer a lens that broadens the field of view to 55°, I just made that soldier safer on the battlefield.”

Creating nanolayer lenses on a commercial scale required a huge capital investment by Peak Nano—$40 million in robotics alone. This is no typical extrusion operation. Peak Nano keeps its formulation and recipe knowhow and tooling technology secret, but lenses are coextruded on a dedicated line to create constant, highly customizable refractive indices. The film is then cut and inventoried. When it’s time a create a lens, a robot will grab all of the individual films—there maybe as many as 300, each with hundreds, if not thousands, of nanolayers—and stack them in a very specific order. The stack of film is then compressed flat to create 3-5 mm-thick sheet, which is then formed into a lens preform. Then the lens is machined to final finish.

PeakNano makes extensive use of automation for its Optics Division. Robots pick hundreds of multilayer films and stack them in very specific order before they are compressed and formed into lenses.

The ability to use nanolayer polymer structures allows lenses to be highly tailored by refractive index and also improves overall performance. Says Lewis, “In the military, for example, the desire is for night-vision devices that are lighter and provide a wider field of view. If I’m looking at a 40° field of view, that’s like looking through a toilet-paper roll. But if I can offer a lens that broadens that field of view to 55°, I just made that soldier safer on the battlefield. And we can take that exact same concept and apply it wherever lenses are used, such as medical devices like endoscopes, or security cameras, where everyone is looking for ‘wider and clearer’ in a smaller and lighter package.”

Hoenig was brought on board to add muscle to the films division, in which the same basic nanolayering technology is used for capacitor films and those used in packaging. She would not divulge the particulars of the materials science used to create capacitor films, except to note that they are commercially available polymers and that the nanolayering effect raises dielectric performance while increasing temperature resistance. She explains, “Typically, the biaxially oriented PP and PET films used for capacitors have not been able to achieve the same temperature performance as can some of the more exotic polymers. But films made from these exotic polymers don’t provide optimum dielectric performance.

“What we are providing in the capacitor market is the power of ‘and,’” Hoenig says. “We give end users better dielectric performance and higher temperature performance to increase the lifetime of capacitors. Plus, our films open the window to more design flexibility. If you’re providing twice the energy density, you can offer a capacitor that is up to half the size in volume. In this end use, smaller is better because in electric vehicles or planes these capacitors go in small places. But energy density is still needed. Also, the capacitors used in electric vehicles generate a lot of heat and have to be equipped with cooling systems. With ours you don’t have to do that. With our films a customer can optimize the whole solution to lower costs.” Hoenig says Peak Nano has forged relationships with film metallizers to speed its launch into this market.

“We give the end user better dielectric performance and higher temperature performance to increase the lifetime of capacitors.”

Hoenig says Peak Nano Films is in the early to middle stage of supplying the high-performance flexible-packaging market. Here, simpler structures are becoming a huge trend, and nanolayer structures help pave the way for just that. Adds Hoenig, “Higher recycled content is crucial. So, by using nanolayers you can sandwich and create simpler, polyolefin-based structures—perhaps without the need for barrier materials. Or, if barrier materials are needed, you can use them more judiciously, thanks to nanotechnology.”

Hoenig also notes that nanolayering can provide barrier properties without the need for barrier resins. “By choosing the right polymer(s) and layering structure you can create a boundary system in the film. With nanolayering you can manage the crystallinity of the overall structure and create a torturous path where the crystals are providing barrier in a structure with no barrier resins. In high-performance packaging for pouches, meat and cheese, over the course of my 35-year career we’ve moved to making films as complex as we could—from polyolefins to adding barriers to making complex films of up to 13 layers in blown film. Now we are going to hundreds of layers, but in simplified structures to optimize recycle and reusability.”

Adds Lewis, “In flexible packaging, we are coming up on a time where we the market has to adapt. Our specialty-films business is taking off like a rocket ship.” Peak Nano is talking about its films across the entire packaging supply chain and is also open to discussions about licensing its technology to processors and converters that have capacity in place.

Peak Nano capacitor film rolls are stored in a clean room.

Peak Nano has two plants in Ohio that employ 62, along with a handful of contractors. All of its extrusion capacity is in a 25,000-ft2 plant in Valley View, along with development lines for optics, capacitors (in a clean room), several pilot lines and a thick-film line for another project it is working on with the U.S. government. It runs a 50,000-ft2 plant in nearby Macedonia, where it has a clean room and automation for lens finishing. It has room for an additional 50,000-ft2 expansion in Macedonia. At some point this year, it expects to move an optical metrology lab, lens finishing and vacuum lamination to Macedonia.

The firm is supported by investment group Squadron Capital. “They are a dream partner,” Lewis says. “They have a long-term vision of building sustainable companies that are doing things the right way to achieve profitability and market disruption. But as we move forward, because our technology is so differentiated, we are getting approached by the ‘strategic investors.’ There are companies that are realizing across the markets we serve that a massive disruption is coming, and they don’t want to be the last ones without a chair. We’re very difficult to compete with. We are evaluating some next-phase partners. It’s a lot of fun to be us.”

Related Content

How to Select the Right Cooling Stack for Sheet

First, remember there is no universal cooling-roll stack. And be sure to take into account the specific heat of the polymer you are processing.

Read MoreWhat to Know About Your Materials When Choosing a Feeder

Feeder performance is crucial to operating extrusion and compounding lines. And consistent, reliable feeding depends in large part on selecting a feeder compatible with the materials and additives you intend to process. Follow these tips to analyze your feeder requirements.

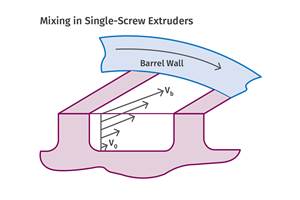

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreSingle vs. Twin-Screw Extruders: Why Mixing is Different

There have been many attempts to provide twin-screw-like mixing in singles, but except at very limited outputs none have been adequate. The odds of future success are long due to the inherent differences in the equipment types.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More