Flat or Softer Prices Ahead

Ample resin supplies outstripping demand are likely to keep commodity resin prices flat to lower.

Barring any major production disruptions or a spike in crude oil prices, the third quarter is likely to end with softer prices for the top five volume commodity thermoplastics. Depending on the resin, key factors include supplies outstripping demand both domestically and globally, lower feedstock costs, and lower resin prices abroad. Even in the case of PS and PVC, where prices appeared to have moved up, the trajectory was more on the downslide.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from Houston-based PetroChemWire (PCW), and CEO Michael Greenberg of The Plastics Exchange in Chicago.

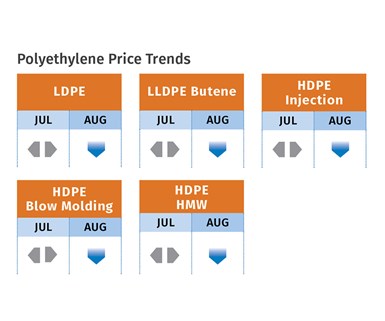

PE Prices Flat to Lower

Polyethylene prices in July were reported flat to down, while suppliers were still pushing for a 3¢/lb price increase. Mike Burns, RTi’s v.p. of PE markets, reported that PE suppliers denied there were contract prime price decreases in June, as had been projected by industry analysts, despite record PE inventories. And The Plastic Exchange’s Greenberg said, “Although a 3¢/lb contract price increase is on the table for July, an official decrease seems more likely for those that did not already receive relief in June. Spot prices are just too weak and discounts are too large to justify an increase at this time and a 3¢/lb decrease would just wipe away the surprise increase that took hold in April.”

PCW senior editor David Barry reported that PE spot prices were flat to lower as supply continued to outstrip demand. “With corporate earnings season in full swing, suppliers were touting strong PE export growth, especially to Asia, and expectations of continued low and stable feedstock costs in North America. The domestic market was sluggish, although it was unclear how much was due to the usual seasonal trend and how much was due to slower economic growth. Export channels continued to see abundant offers but tepid international demand, with some export buyers calling for lower prices in August.” All three sources generally conceded that prices in August to September were unlikely to change from a flat-to-lower trajectory.

Burns noted that processors were starting to build their inventories heading into the fall season. Off-grade resin prices were at near a 10-year low, with HDPE and LLDPE prices below 40¢/lb. Similarly, export prices for August were 1¢/lb lower than July. Still, he noted several factors that may keep PE prices flat into the late fall, including demand for exports from Southeast Asia for its agricultural season, domestic demand for packaging for the upcoming holiday season, weather, oil-price increases, and “supplier determination to maintain margins.”

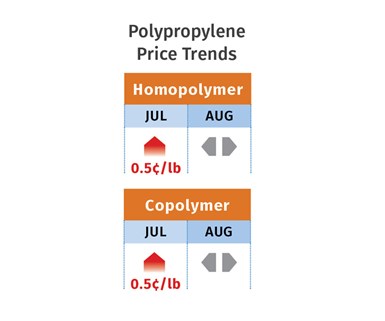

PP Prices Softer

Polypropylene prices in July increased by 0.5¢/lb, decoupling for the first time in a couple of years from propylene monomer contracts, which settled 1.5¢/lb higher, according to Scott Newell, RTi’s v.p. of PP markets, PCW’s David Barry and The Plastic Exchange’s Greenberg.

Noting that the major industry indices showed a 1¢/lb erosion of PP prices in July, Newell added that the industry had not seen any decrease in suppliers’ margins since 2015. Generally, these sources expect PP prices to hover 1-2¢/lb higher or lower, with potential for more supplier margin erosion before year’s end.

Both Barry and Greenberg observed a very active spot PP market with abundant supply, especially for homopolymer. “We are seeing some great deals out there and buyers clearly agree, as a sustained flurry of railcars and truckloads have been changing hands through our marketplace,” reported Greenberg.

Barry noted that spot prices of PP homopolymer were 4-7¢/lb lower than prime PP prices, while Newell reported on a difference of as much as 5-10¢/lb in some cases. Said Newell, “Demand for PP continues to disappoint. June demand was off quite a bit, with a 66-million-lb supplier inventory buildup and a comfortable 36.7 days of inventory; and industry sentiment for July was that demand had not shown much life. We’re back to a well-supplied market.” Newell noted that because of lackluster demand and anticipated capacity increases next year, some suppliers are going after market share with competitive pricing while others are trying to maintain market share by reducing operating rates to below 90%.

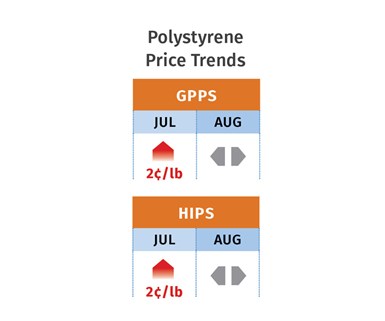

PS Prices Up for Now

Polystyrene prices appeared to be moving up 2¢/lb at the end of July as suppliers pushed to implement a 3¢/lb increase, according to both PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets. They noted that the move was in step with July benzene contracts settling 33¢/gal higher at $2.67/gal. Every 10¢/gal move in benzene equates to 1¢/lb in the production of PS, noted Barry, who also reported that supply was abundant, with PS demand off as more and more companies look to shift to alternative resins, particularly for packaging.

Added Chesshier, “While suppliers have some legitimacy for this increase, buyers are pushing back hard because they feel they ought to have gotten back 2¢ of the 4¢/lb April increase, which suppliers attributed half to benzene increases and half to flooding.” She noted that all industry indices show both production and demand down; that ethylene prices are at record lows; and butadiene prices, affecting HIPS grades, have also dropped. Both sources expected PS prices in August and September, barring any major disruptions, to be flat to lower.

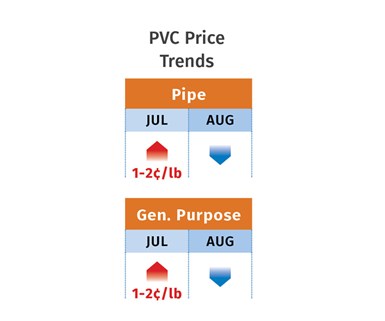

PVC Prices Up

PVC prices for June were unresolved nearing the end of July, after remaining flat through May and June. PCW senior editor Donna Todd reported that June contract resin prices appeared to be settling 2¢/lb higher, as suppliers pushed to implement their June increase. “The rationale behind the price bump was that planned and unplanned downtime this year had caused a significant drawdown of producer inventories, meaning supply has not kept up with demand. However, converters said they were not seeing a big increase in domestic demand this year.”

Mark Kallman, RTi’s v.p. of PVC and engineering resins, noted that July prices would be flat and August was likely to see at least 1¢/lb trimmed from the already implemented price hike. “By July, production issues had been resolved and output was up while demand fell.” He noted that the construction market had not been as strong as had been expected and export prices had also dropped. Ethylene monomer dropped a bit more in June and was expected to be flat. “Suppliers had a good first half of the year with record low ethylene prices that increased their margins.” He ventured that September PVC prices could be flat to down if the global market softened further.

PET Prices Down

PET resin prices—both domestic and imports--hovered in the low-to-mid 50s, driven by a global glut, reported PCW senior editor Xavier Cronin. He noted that July ended with PET prices at 52-55¢/lb delivered to locations east of the Rockies and ports in California. Cronin ventured that PET prices in August would stagnate at these levels.

Typically, PET prices rise in summer due to robust consumption of single-use PET bottles for carbonated beverages, water and other drinks. Cronin reported that PET resin imports in the first five months of 2019 were actually down 10.6% from Jan-May 2018 (mainly on a plunge in imports from the top source, Mexico), but U.S. supply is still robust due to domestic production and competitively priced imports from the likes of Egypt, S. Korea, Vietnam and Malaysia.

Related Content

Prices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MorePrices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More