Global Warming: New Challenge for Polyurethanes?

‘Zero-ODP’ is no longer enough. Now, PUR foamers are being asked to consider blowing agents with ‘low-GWP’ (global warming potential). Another environmental push is to expand use of bio-based polyols in rigid and flexible foams. Both were key topics at this year’s PUR conference.

Just when the multi-year conversion to urethane foam blowing agents with zero ozone depletion potential (ODP) appeared all but complete, intensified concern over climate change is spurring a new push to adopt yet another new generation of blowing agents that are said to have lower “global warming potential” (GWP). Concern for the environment has also cultivated rapidly growing interest in natural-oil polyols (NOPs) made from renewable raw materials for both rigid and flexible foams. These were major themes of the recent 51st annual conference of the Center for the Polyurethanes Industry (CPI) in the American Chemistry Council, held in San Antonio, Texas.

LOW-GWP INSULATION FOAMS

Conversion to zero-ODP blowing agents for rigid foams has left North American PUR processors with several choices: chemical blowing with water or methyl formate; physical blowing with HFC-245fa, HFC-134a, or hydrocarbons; or combinations of any of these. However, each of these zero-ODP blowing agents also has some degree of GWP, spurring the industry to seek “fourth-generation” blowing agents characterized by zero ODP and lower GWP values.

The trend of current environmental regulations indicates the need for low-GWP blowing agents as well as refrigerants and solvents. In fact, HFC-134a will soon be phased out in Europe as a refrigerant for mobile air-conditioning units, which could foreshadow a review of foam blowing agents by global regulatory agencies in the not-so-distant future.

Although such action remains only speculative, chemical suppliers are being proactive and came to the conference to discuss low-GWP alternatives. They said interest is high in North America and not just in Europe. Although the suppliers did not identify the nature of these low-GWP blowing agents, industry sources said they are generally fluorochemicals.

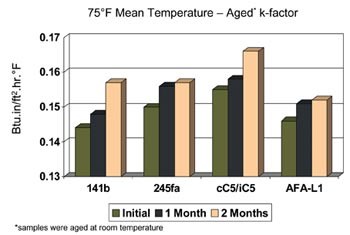

Arkema, for one, reported on its investigation of a range of new low-GWP blowing agents for most rigid PUR applications—appliances, pour-in-place, spray, and PIR boardstock. This AFA series includes both liquid and gaseous products that possess very low GWP (<15). This compares with GWP of 11 for cyclopentane, 1300 for HFC-134a, and 950 for HFC-245fa. Industry sources note that the relatively high GWP values of HFC-134a and HFC-245fa could lead the U.S. EPA to decide that they do not have an indefinite lifespan of use in the PUR industry. Also, the high smog formation potential (SFP) of the pentane isomers could lead to restrictions on their use in heavily developed areas prone to air pollution.

Arkema’s results show that gaseous AFA-G1 can compete with HFC-134a in terms of polyol solubility, foam dimensional stability, and k-factor. Even more interesting were results for the liquid AFA candidates in replacing the more popular HFC-245fa and hydrocarbons. AFA-L1 shows similar blowing efficiency, some improvement in dimensional stability, and significantly better k-factor.

DuPont Fluoroproducts has a novel blowing agent for polyurethane foams in construction and appliance insulation. It is said to show low vapor thermal conductivity, non-flammability, low toxicity, zero ODP and a very low GWP value of 5. Chemical and thermal stability, polyol solubility, low diffusion rate, and favorable economics are also claimed.

DuPont’s FEA-1100 is a liquid at room temperature, eliminating problems with the use of lower-boiling agents such as HFC-245fa. ASTM E 681 tests indicate non-flammability at 60 C and 100 C. According to DuPont, rigid PUR and PIR foams produced with FEA-1100 blended with either HFC-365mfc or cyclopentane show good dimensional stability and uniform cell size. R values were said to match or exceed those obtained with current agents such as HFC-245fa.

Honeywell International (sole North American producer of HFC-245fa, sold as Enovate 3000) reported on its fourth-generation foam blowing agent with very low GWP of 6, which conforms with the European Union F-Gas Regulation. Its new HBA-1 blowing agent has been demonstrated in Europe as a replacement for HFC-134a in a one-component PUR foam. It reportedly also exhibits good performance in conventional two-component foams, imparting thermal performance similar to HFC-134a. Solubility of HBA-1 in a range of polyols is generally better than HFC-134a. Thus Honeywell expects that HBA-1 will find use as a co-blowing agent in applications where HFC-134a is dosed directly into the polyol stream.

Liquid methyl-formate based Ecomate from Foam Supplies is a zero-ODP, zero-GWP option that is already on the market. The company has been formulating foam systems with it for the last eight years, but for two years has been selling it in neat form as a blowing agent. Initial use was in spray foam insulation and integral-skin foams for bicycle seats, golf-cart tires, and auto headrests. Ecomate is now finding use in pour-in-place foams for commercial refrigeration units, construction panels, and metal-faced panels for building walls and coolers.

In a paper at this year’s conference, Foam Supplies noted that with the phase-out of HCFC-22, panel manufacturers are faced with the difficult decision to either stay with a froth-type blowing agent (HFC-134a) or switch to liquid or near-liquid alternatives such as pentane, water, HFC-245fa, or Ecomate. In one recent study, a PUR formulation designed for HCFC-22 was substituted on a molar basis with HFC-134a or Ecomate. The liquid blowing agents showed lower heat of vaporization than the froth blowing agents, which means they cause less cooling, and they also typically require tighter molds, especially for foaming in a vertical position. However, a liquid like Ecomate can provide better density distribution and better flow in molds, along with similar foam properties.

Foam Supplies’ new-product development manager John Murphy said froth foams will also cost more than liquids. First, there is a greater vapor loss with a froth, which means a higher price per finished part. Also, the molecular weight of fluorochemicals is higher than the liquid options, so that they are more costly on a molar basis, and the cost of the foam equipment can be more expensive, especially the high-pressure tanks (if that cost is passed on by the formulator). Finally, the cost to the environment is also higher. For example, HFC-134a with a MW of 102 requires 1.7 times more material than Ecomate to blow the same density foam. Multiplying that times the GWP value of 1300 for HFC-134a results in over 1 metric ton of CO2 equivalent GWP value saved for each pound of Ecomate substituted. Similar arguments apply to converting from HFC-245fa to Ecomate, said Murphy.

NOP’S FOR RIGID FOAMS

Progress on the use of NOPs in rigid PUR foams was addressed in several papers. While they have done well in flexible foams, NOPs have had some drawbacks in rigids. Since most NOP technology is based on fatty-acid tryglycerides, they have very different solubility characteristics than polyether or polyester polyols. Their fatty acid portion increases their solubility with hydrocarbon blowing agents but at the cost of limited compatibility with conventional polyols.

One highlight of the conference was the introduction of a new tri-functional NOP from BioBased Technologies, whose Agrol NOPs have achieved wide acceptance in spray foam insulation, automotive uses, and carpets. Agrol Diamond was developed specifically for rigid foams, where the search is for NOPs with required reactivity and hydroxyl number while maintaining a high biobased content. A soy-based amber liquid, Agrol Diamond has a hydroxyl number range from 320 to 350 mg KOH/g and 86% biobased content. In addition to secondary hydroxyl groups, this NOP contains primary hydroxyl groups that have been shown to dramatically increase its reactivity and ability to form rigid PUR networks. It is completely miscible with a wide variety of NOPs, traditional polyether polyols, and hydrocarbon blowing agents, making it suitable for many biobased rigid PUR foams.

Bayer described the development of a rigid PIR foam based on a novel, low-viscosity NOP for use in insulated metal building panels. The foam reportedly met ASTM E84 Class I burn requirements. This NOP is a product of new Bayer technology that converts natural plant oils via a one-step process into NOPs with low viscosity and high renewable content at no sacrifice in performance.

For this PIR foam system, Bayer researchers developed NOPs that mimic the structure of a polyester polyol that is used in metal-faced panels. The polyester polyol had a hydroxyl number of 240 and functionality of 2, giving it a molecular weight of 470. The researchers prepared two NOPs with functionality of 2.1 and hydroxyl number of 210. Since some higher-functional polyols (e.g., crosslinking types) are generally necessary to improve mechanical properties, a third NOP with a functionality of 3 and hydroxyl content of 290 was prepared which simulated a mixture of polyester polyol and crosslinking polyol. All three NOPs showed excellent solubility with pentane blowing agents, suggesting storage-stable blends could be obtained.

Also addressing rigid PIR foam formulations was Stepan Co., which has developed NOPs using its proprietary SP3 polyol process, which has been shown to mitigate property deterioration that occurs when simply blending oils in PIR foam formulations. Researchers noted that the use of NOPs in PIR boardstock generally has a negative impact on physical properties, including initial (green) and fully cured compressive strengths, dimensional stability, and insulation properties (R-value).

Stepan’s SP3 approach of introducing NOPs at 20% or 25% levels in combination with aromatic polyester polyols minimized the deterioration of properties. Developmental “KP” and “MP” NOPs showed improved blowing efficiency, enhanced thermal stability, reduced polyol and B-side viscosity, and less catalyst needed to achieve foam reactivity similar to other commercial NOPs. The new polyols also processed well and with minimal adjustments on commercial laminate board lines.

Evonik Goldschmidt Chemical discussed the development of a novel emulsifying surfactant, experimental grade EP-S-140, that allows formulators to increase the percentage of NOPs in a system while also creating a larger process window. Researchers successfully tested the new surfactant with a castor-oil-based NOP and two soybean-oil NOPs. They noted how traditional polyether-modified siloxane surfactants, like Goldschmidt’s Tegostab B8589, have little or no effect on emulsifying NOPs in high-water systems with conventional polyester polyols. By contrast, EP-S-140 emulsified most of the NOP within each system, regardless of the type of polyester (PET-based or phthalic anhydride-based) or NOP.

OTHER CONSTRUCTION NEWS

A new line of aromatic polyester polyols unveiled by Oxid is said to allow production of rigid foams with a high polyol loading, which will reduce smoke evolution in the ASTM E-84 tunnel test without loss in foam strength or dimensional stability. These polyols display high solubility for both hydrocarbons and HFC-245fa, and are compatible with systems combining these blowing agents with significant amounts of water. Two polyols are already commercial: Terol 1154 for continuous flexible-face lamination and Terol DS-1326 for spray and pour-in-place applications. With its very high functionality, DS-1326 can make roofing spray formulations with very high compressive strength, even with ordinary polyol loading. The results point to the possibility of reducing roofing foam density while maintaining 45-psi compressive strength.

Two more developmental polyols from Oxid, DS-1465 and DS-1481, are being evaluated for rigid spray foams. Oxid says it has found a proprietary way to reduce viscosity while maintaining the same functionality and with only a minor reduction in aromatic content.

Air Products and Chemicals reported on new rigid PUR surfactants that can be balanced for flow, insulation properties, and flame/smoke reduction. The first of these is siloxane-based Dabco SPE DC5323 for HFC-245fa formulations. DC5323 was used to produce a discontinuous-lamination formulation with HFC-245fa that displayed a 2% to 3% reduction in k-factor and a 2% to 4% reduction in minimum fill density while providing equivalent Butler Chimney PMR char formation and NBS Ds(max) smoke rating. Compressive strength, dimensional stability, and cell size were also comparable to those achieved with the company’s workhorse Dabco DC193 surfactant. Several other experimental surfactants are said to show promise in experiments with an HFC-245fa discontinuous formulation and a pentane continuous-lamination formulation.

NOPs FOR FLEXIBLE FOAMS

Bayer reported on two new slabstock foam polyols, Multranol R-3524 and R-3525, which contain 20% renewable content. The products are made by direct alkoxylation of castor oil, soybean oil, and glycerine, converting them into polyether polyols of around 3000 MW.

According to Bayer’s tests, these polyols are suitable substitutes for up to 100% of conventional polyols, like Bayer’s Arcol F-3040, a 56-hydroxyl polyol. They have the same hydroxyl number, functionality, and foaming reactivity as 3000-MW commodity polyols, as well as similar MW distributions, viscosities, glass-transition temperatures, flash points, and compatibility with water and other polyols.

Foam processing studies show that new R-3524 provides essentially the same latitude as standard F-3040, with minimal changes required in formulation or processing conditions. New R-3535 is said to process acceptably in most formulations, but requires some optimization with high-pressure liquid-CO2 processing to achieve the same cell structure.

Foams made with both of these polyols are reported to closely match the density and air flow of foams produced with F-3040. Also comparable are foam durability, strength, surface liveliness, modulus-temperature profiles, VOC emissions, odor, and fogging tendency. TGA indicates these foams are more stable to thermal breakdown in air and nitrogen than standard F-3040 foams.

Cargill reported on a new NOP designed specifically for high-resilience flexible slabstock. The most common way to increase load-bearing or hardness properties of HR formulations has been to use a solids-containing copolymer polyol. But Cargill’s BiOH Experimental Load Bearing Polyol is a solids-free option that is said to deliver at least 97% renewable content, wider processing latitude, and foam physical properties comparable to conventional HR foams, but with enhanced load-bearing capacity compared with SAN copolymer polyols.

The HR formulations in this study were formulated to the target density and hardness (IFD) of two common commercial foam grades: “1830 grade” (1.8 pcf, 30 IFD) and “2340 grade” (2.3 pcf, 40 IFD). BiOH load-bearing polyol showed 25% IFD results in the 1830 formulation comparable to a conventional SAN copolymer polyol and similar to slightly harder IFD values in the 2440 formulation. The researchers noted that the IFD results of foams made with experimental BiOH polyol were achieved with 10% less crosslinker. Support factor in both the 1830 and 2340 HR formulations was comparable or slightly better with experimental BiOH polyol. In addition, tensile, tear, and elongation values in both formulations were comparable to SAN copolymer foams.

BASF discussed its new “Balance” family of castor-oil-based polyols for slabstock and molded foams for furnishings and transportation seating. The first product to be introduced in North America is Pluracol Balance 50 polyol with 31% renewable content. Two years of commercial use in Europe show that Balance 50 can be formulated with TDI and/or MDI, and with a non-amine slabstock inhibitor package to reduce emissions and NOx color formation.

Dow reported on the development of NOPs for viscoelastic (memory) foams using its Renuva technology, a proprietary method to produce polyols from renewable seed oils. Launched commercially last year, this technology is said to eliminate past issues with NOPs of color, odor, reproducibility, and reactivity control. A key difference in Dow’s process is that the seed oil is disassembled into constituent parts, functionalized and reassembled to make novel polyol structures. The process is said to allow control of functionality and equivalent weight.

Dow evaluated viscoelastic foams made with 18% to 42% NOP content in both TDI and MDI systems. Results showed the physical properties and viscoelastic response of these foams can be controlled by tailoring the structure of the NOP and by adding copolymer polyol to the formulation. Dow’s seed-oil-based polyols reportedly show good oxidative and UV stability, resulting in odorless polyols and foams as well as fine cell structure for good hand and touch. Also reported are improved IFD characteristics or comfort levels, a broader glass-transition region, which translates to viscoelasticity over a wide temperature range, and controllable molecular structure, resulting in control over mechanical properties.

NEWS IN AUTOMOTIVE

Polyols with renewable content for molded automotive seating foams and other applications were addressed by both Dow and Cargill. Using the flexibility of its seed-oil polyol technology, Dow researchers reported that they were able to achieve major improvements in NOPs for molded foams, addressing processing issues such as compatibility with conventional polyols and foam tightness. These benefits were demonstrated with TDI, MDI, and TDI/MDI blends.

Dow developed a “second-generation” NOP that appears to be much closer to a “drop-in” for conventional polyols in molded foams than Dow’s first-generation NOPs. Problems with phase separation were reportedly eliminated, foam tightness was decreased, and in some cases cell structure was improved. Physical properties were generally unaffected or improved. In addition, foams made with the new NOPs reportedly have good hydrolytic stability.

In a joint paper with Woodbridge Foam Corp., Woodbridge, Ont., Cargill reported on its second generation of BiOH bio-polyols for TDI-based flexible molded foams. They are said to allow for previously unachievable levels of NOP incorporation in such foams. NOP use level is typically limited in TDI systems, but now has been increased by up to 20 phr in the resin blend, for about 15% renewable content in the foam, with no sacrifice in processing or foam properties.

High-density foams with low firmness (LF) and high firmness (HF) prepared with a conventional 5500 MW polyether triol, a first generation BiOH, and the new BiOH X-0001 all passed fogging, staining, and flammability requirements. Foam incorporating BiOH X-0001 had significantly improved tear strength—5% to 10% higher in the LF group and 23% higher in the HF group—with a beneficial effect on processability. In addition, tensile properties of both LF and HF foams showed up to 23% improvement with the higher level of BiOH X-0001.

Momentive Performance Materials has discovered a new class of cell-opening surfactants that can stabilize low-density water-blown foams during the early stages of foaming and then open the cells late in the reaction. These silicone-polyether copolymers reportedly produce foams with good cell structure, excellent dimensional stability, and reduced density.

In a microcellular steering-wheel formulation, three new cell-opening surfactants made dimensionally stable foams with finer cell structure and lower free-rise densities than did Niax silicone L-6164, a high-MW commercial cell-opening silicone surfactant. In an energy-absorbing formulation, four new surfactants all made dimensionally stable foams with significantly better stress-strain properties than either Niax silicone L-6900 or L-6164. In an automotive headliner system, Niax silicone L-6164 and two of the four new surfactants all produced dimensionally stable open-cell foams.

Dow reported on its latest progress in fast-cycle, low-density NVH (noise, vibration and harshness) foam with excellent acoustic properties. Such foams reportedly can be manufactured with demold times of about 60 sec and molded densities of 45 to 50 g/l (0.45 to 0.50 g/cc). A critical factor is flowability in the mold, particularly for closed-mold applications, while maintaining low density, consistency, and open cells. North American customer trials show that Dow’s new Specflex NS 648 LD polyol blend with Specflex NS 1540 isocyanate can replace the current NVH foam systems at several large molders. The results were so impressive that the conversions took place very quickly. Specflex NS 648 LD gave a 10% weight reduction vs. the former Dow DNS 648.01 formulation. It also met all OEM requirements and processed as well as or better than the older Dow NVH systems.

At two other large Tier I NVH foam plants, Specflex NS 648 LD gave 5% to 10% lower fill weight than the current low-density NVH foam system. This polyol blend was shown to offer improved processing with respect to short shots, under-fills, and other typical foam defects. The blend also met all physical property requirements of multiple OEM platforms, including GM, Ford, Chrysler, Mitsubishi, and Subaru.

Read Next

Injection Molding: Taiwan Machine Builders Focus on All-Electrics, Hybrids and IML

There was a brand-new emphasis at this year’s Taipei Plas, the premier plastics exhibition for Taiwanese injection machine builders.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More