Higher Prices for Commodity Thermoplastics

PP leads pricing surge.

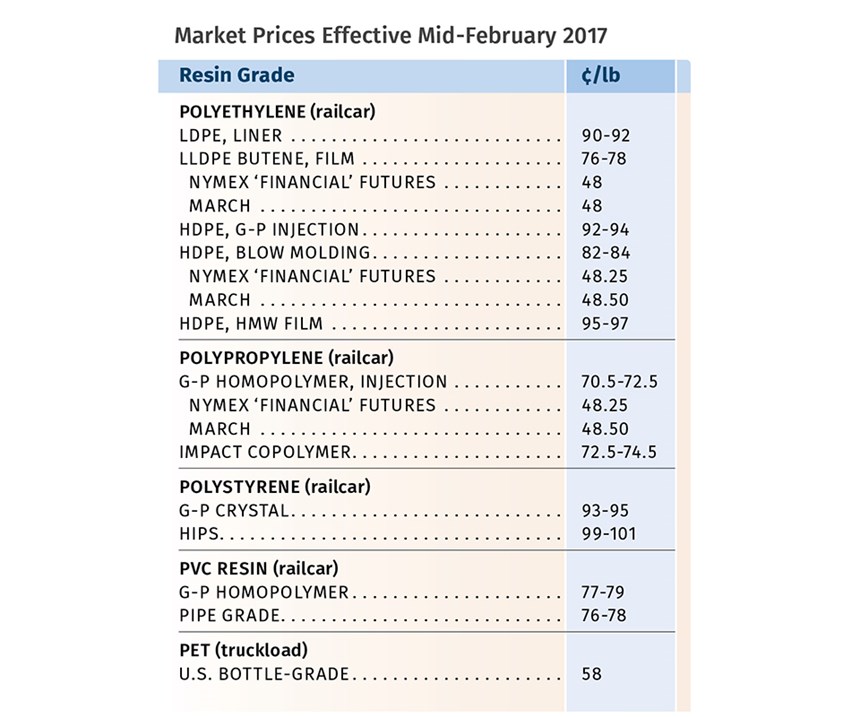

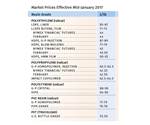

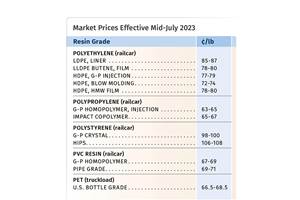

Prices of the five major commodity thermoplastics were expected to be higher by the end of last month, with PP leading the way in severity of the increase, followed by PE. The market was driven not by demand— typically slow in the first two months of the year—but by a combination of higher global oil prices, planned and unplanned plant shutdowns of several key feed- stocks and, in some cases, resins. With the exception of PP and possibly PVC, prices of the other commodity resins may flatten out in the next couple of months.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The in Chicago, and Houston-based PetroChemWire.

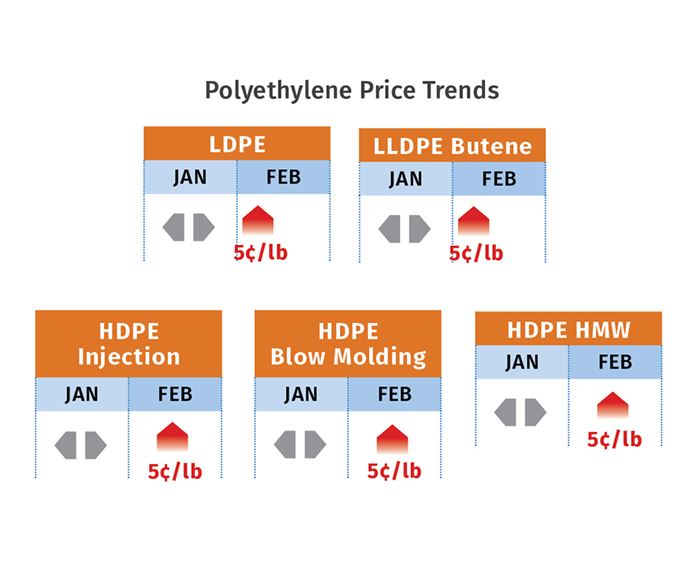

PE PRICES UP FOR NOW

Polyethylene prices were flat in January, but a February 5¢/lb hike was expected to be implemented by the end of last month. A 6¢/ lb increase for March 1, issued by one supplier, went unsupported. “This was not a demand-driven increase,” said Mike Burns, RTi’s v.p. of client services for PE.

In fact, Burns could not cite any solid driving factors behind the 5¢ hike, other than lower supplier inventories. In their aim to reduce inventories by end of 2016, suppliers exported 10% more material than usual. This resulted in a tightening of the PE market, with off-grade material selling at or above prime resin prices.

Burns expected the market to be more balanced in March and April, noting that many processors were working off inventories in January and would buy only as needed through last month. Supporting that notion was The Plastics Exchange’s Greenberg, who reported in late January that PE spot trading was very strong ahead of the February increase. At the same time, PetroChemWire (PCW) reported that higher domestic spot prices and sales volumes in January were aggravated by a flurry of PE production issues as well as planned outages.

Once the PE market comes more into balance, any further upward pressure would come from higher oil prices. That would boost global PE prices and the export market, according to Burns. Oil prices through January hovered between $50 and $53/bbl despite reported production cutbacks. Burns maintains that direct impact on PE prices will not materialize until oil approaches $60/bbl.

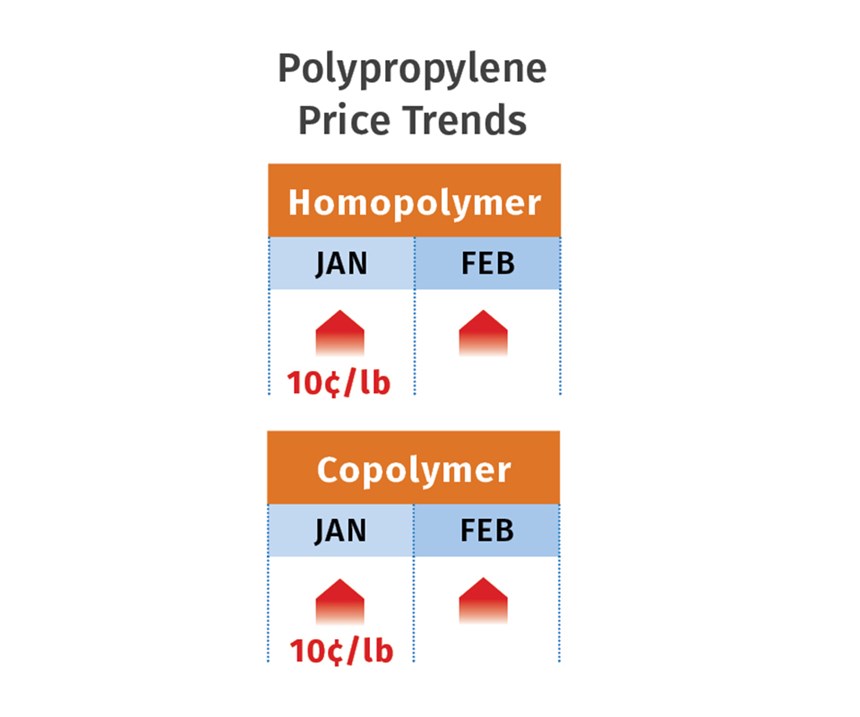

PP PRICES SURGE; MORE TO COME

Polypropylene prices jumped a whopping 10¢/lb in January, in step with the late-January settlement of propylene monomer, which rose to 41.5¢/lb. Based on continued upward movement in spot monomer prices, February monomer contract prices were expected to increase further, with PP following once again, according to both Greenberg and Scott Newell, RTi’s v.p. of PP markets. Newell ventured that February PP prices could move up 5-8¢ in step with monomer but with no margin increases attached.

Greenberg reported at the end of January that the PP market went from bear to bull even before monomer costs began to soar, attributing the sharp market turnaround and tighter supplies to months of lowered production output and heavy exports.

Spot prime PP prices shot up by 11¢/lb and offgrade even more, Greenber reported.

Explaining the monomer price surge, PCW cited tightness due to throttling back of production at the end of 2016, along with a spate of planned and unplanned outages. PCW also reported that Formosa was about to restart a PP unit after a maintenance outage, while two other suppliers were said to experience lingering effects from outages in late 2016, such as delayed shipments and limited spot resin availability.

Newell said the market is likely to become more balanced in April, and prices would settle down a bit. Still, he and Greenberg expected PP prices to reach as high as the low 60s (¢/lb) before the end of March. Both concede that the low prices of 2016 are unlikely to recur this year. Newell foresees prices in the high 40s to low 50s.

Higher monomer prices were expected to cause PP demand destruction through the first quarter, noted Newell, who saw PP processors working off inventories and buying only as needed.

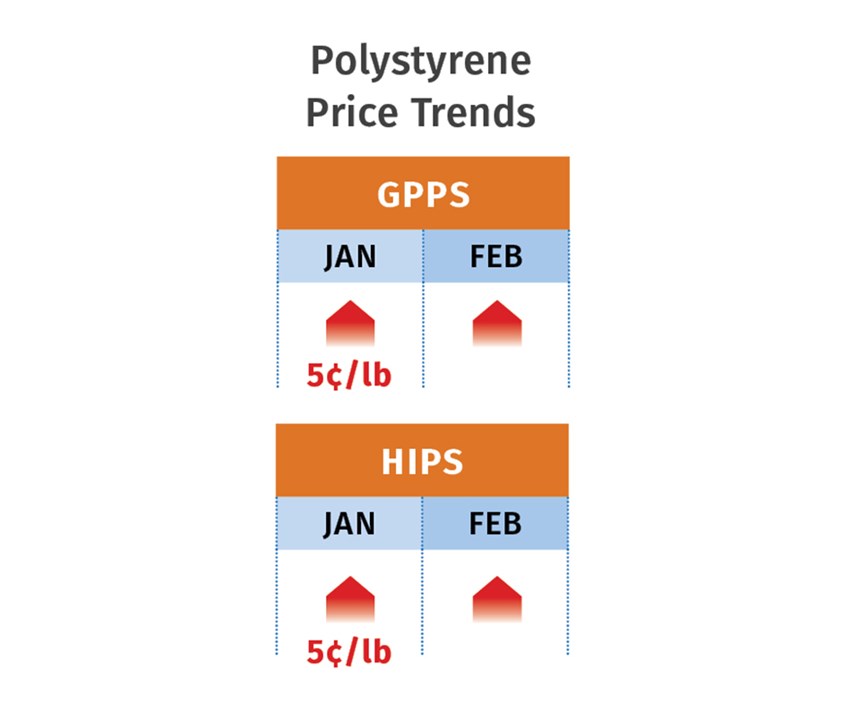

PS PRICES TAKE TWO STEPS UP

Polystyrene prices moved up 5¢/lb in January, following a near 60¢/gal increase in January benzene contracts to $3.33/gal. PS suppliers also issued increases of 8¢/lb for February. Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, expected that suppliers would get at least 6¢ of that hike.

Aside from rising benzene prices, styrene monomer and butadiene (which affects HIPS) tabs are also higher. Kallman attributed the situation to a global tightness in benzene, monomer, and butadiene supplies, primarily due to planned and unplanned production outages and higher oil prices. He also noted that there have been no lower-priced PS imports coming in. He expected some softening in PS prices during the second quarter, possibly as early as April.

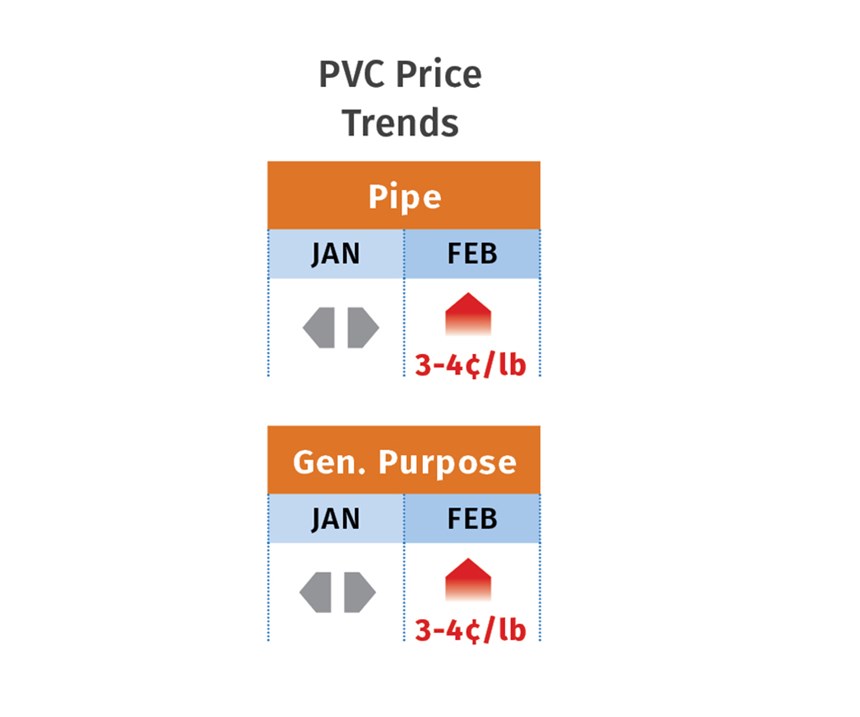

PVC PRICES STARTING TO MOVE

PVC prices were flat in January, as they were for eight months of 2016, but change was coming. With January ethylene contracts expected to settle 2¢/lb higher after a similar move in December, PVC suppliers were aiming to implement their February 4¢/lb hike and also issued 3¢ increases for March 1.

RTi’s Kallman ventured that 3-4¢ of the February increase would go through, noting that he expected a third successive 2¢/lb ethylene price increase for February contracts. Ethylene tightness due to both scheduled and unplanned outages has been driving the higher prices. Kallman also predicted that if suppliers implemented the full February 4¢/lb increase, the March increase could be pushed off.

He also noted that although PVC suppliers had strong inventories going into this year, there may be some resin constrictions due to planned maintenance outages, particularly as processors would be looking to stock up before the start of the construction season in the second quarter. Kallman said all indications were that little resin is available for exports, but there is adequate supply for domestic consumption. He ventured that once ethylene and PVC maintenance turnarounds are completed, there may be some easing of prices; though if PVC demand is as strong as some predict, the price increases now going through might well be maintained for a time.

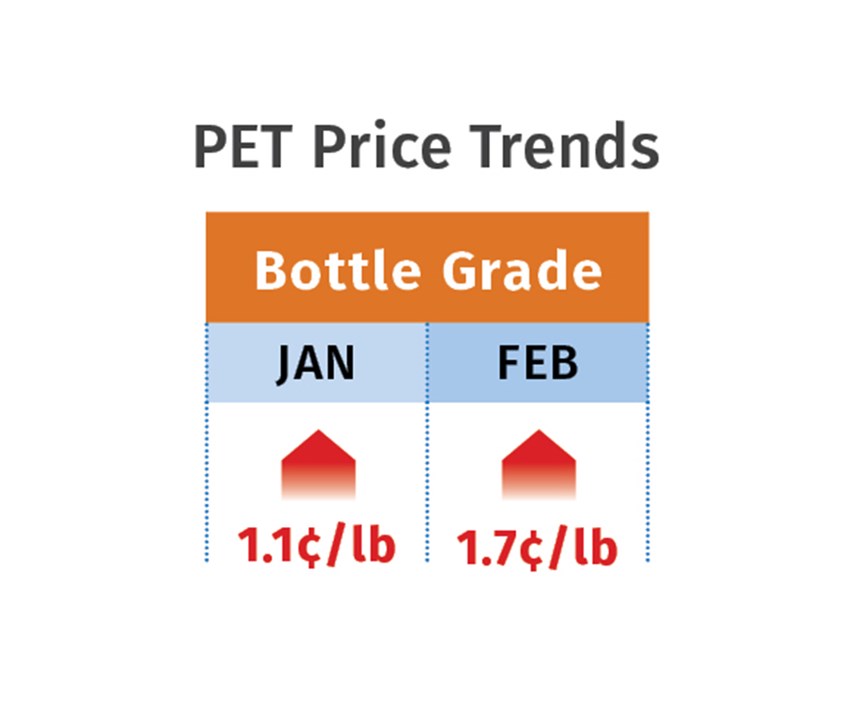

PET PRICES UP

Domestic bottle-grade prime PET resin in January averaged 56.3¢/lb, up 1.1¢ from December, based on PCW’s Daily PET Report. On Feb. 3, the price moved up to 58¢/lb (delivered Chicago basis). Prices rose primarily due to higher costs for feedstocks (including PTA, MEG, and paraxylene), driven by rising hydrocarbon prices. Xavier Cronin, senior editor for this PCW report, said the average cost of feedstocks in January was 55.8¢/lb, up 3¢/lb from December, according to one calculation used for monthly PET pricing tied to contracts. Meanwhile, DAK Americas successfully hiked its PET resins by 5¢/lb on Jan. 1. Imported prime PET averaged 52.45¢/lb in January, up 1.95¢ from December (delivered duty-paid U.S. port basis). The volume of imports was up 13% through November 2016 from 2015, according to USA Trade Online data, Cronin noted.

Related Content

PS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MorePrices of Volume Resins Drop by Year-End

Entering 2025, prices of major commodity and volume resins are generally in a ‘buyer’s market.’

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePrices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

Read MoreRead Next

Prices Bottom Out for Polyolefins; PET, PS, PVC Move Up

Flat or falling prices have turned upward for all five commodity resins.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More