Index Dips on Weak Exports, Employment

October’s number drops from September, despite expansion in new orders.

At 47.1, Gardner’s Plastics Processing Index moved marginally lower in October due to weaker export and employment activity. (Readings above 50 indicate expanding activity while values below 50 indicate contracting activity. The farther a reading is from 50 the greater the change in activity since the prior month.)

Analysis of the underlying components of the Index during October reveals that new orders expanded for the first time since June. Despite this improvement, all other components of the index registered contracting activity. The October reading was weighed down by an accelerating contraction in exports, backlogs and employment.

FIG 1 Both the overall Plastics Processing and Custom Processors Indices contracted during October. Both indices have been weighed down by strongly contracting backlog and export conditions.

FIG 1 Both the overall Plastics Processing and Custom Processors Indices contracted during October. Both indices have been weighed down by strongly contracting backlog and export conditions.

After recording a very mild contraction in September, employment activity contracted sharply during October. Employment readings often shed light on the mid-term business outlook of manufacturers, given the time and challenges associated with hiring new talent. For this reason, manufacturers tend to retain employees when conditions are only briefly challenging; however, in case of expectations for a prolonged downturn, managers are more likely to reduce payrolls.

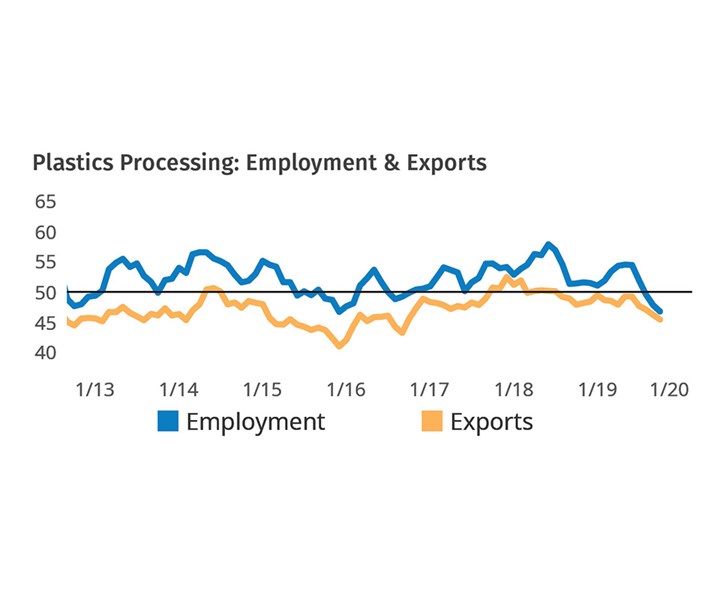

FIG 2 The trend in export activity since March has been accelerating contraction. This enduring trend may be affecting the long-run view of managers in the industry, causing processors to change their employment levels.

FIG 2 The trend in export activity since March has been accelerating contraction. This enduring trend may be affecting the long-run view of managers in the industry, causing processors to change their employment levels.

October’s expansionary reading for new orders, coupled with an accelerating contraction in exports, implies that domestic new orders expanded strongly during the month. The implied strength in domestic orders may in part account for the higher backlogs than in recent months. Although the latest backlog reading registered below 50, it was the highest in several months, indicating slowing contraction in backlogs.

The Index is based on surveys conducted each month of subscribers to Plastics Technology Magazine.

About the Author Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com. Learn more about the Plastics Processing Index at gardnerintelligence.com.

Related Content

-

US Merchants Makes its Mark in Injection Molding

In less than a decade in injection molding, US Merchants has acquired hundreds of machines spread across facilities in California, Texas, Virginia and Arizona, with even more growth coming.

-

Sheet Extrusion, Thermoforming Tips for PLA/aPHA Blends

Biopolymers like PLA and PHA are able to meet sustainability goals while also delivering the performance attributes needed in rigid food packaging. Here’s what testing has shown.

-

Novel ‘Clamtainer’ Extends Thermoformer's Reach in Packaging

Uniquely secure latching expands applications for Jamestown Plastics’ patented clamshell package design.

.jpg;width=70;height=70;mode=crop)