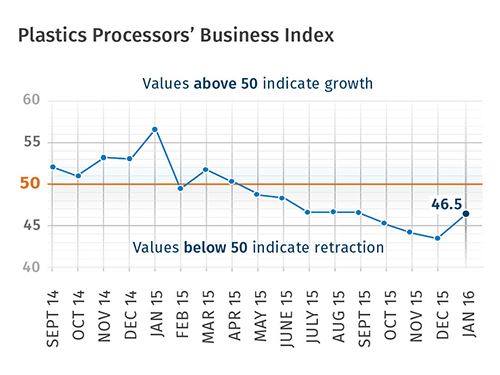

January 2016—46.5

Index reaches its highest level since last August.

With a reading of 46.5, Gardner’s Plastics Processing Business Index contracted at a notably slower rate in January than in previous months. In fact, the index reached its highest level since last August.

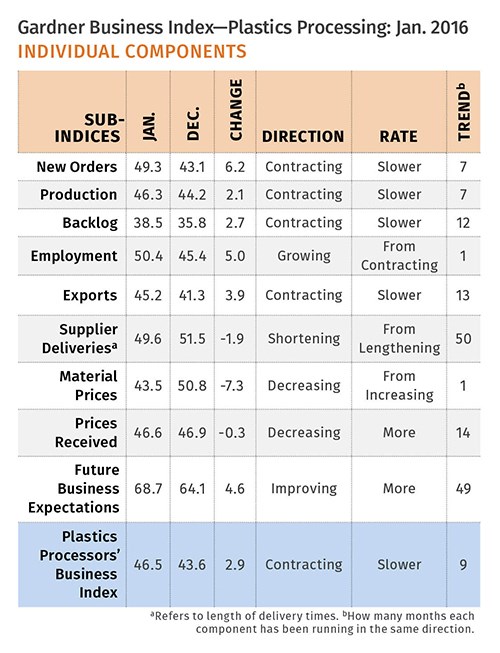

New orders contracted for the seventh month in a row. However, the index made a significant jump; orders were almost unchanged compared with December. Production also contracted for the seventh month in a row. But while the production index improved as well, it did not go up as much as the new orders index. As a result, the backlog contracted at a slower rate in January, which indicates that capacity utilization would decrease through at least the first half of 2016.

Employment increased for the first time since September. Because of the strength of the dollar, exports remain mired in contraction. However, the rate of contraction slowed notably compared with the previous three months. Supplier deliveries shortened for the first time since December 2011.

Material prices decreased for the second time in three months. Since August, the index for material prices has been bouncing around 50, but generally the decrease in prices has been greater than the increase in prices. Prices received by processors continued to decrease at a rate that has been fairly steady for the last four months. Future business expectations improved sharply in January, reaching their highest level since April 2015.

Larger plastics processors had performed quite well in the last couple of years, though conditions at these companies have weakened the last three months. Processors with more than 250 employees have contracted for three straight months, while those with 100-249 employees contracted in two of the last three months. However, facilities with 50-99 employees expanded for the third time in five months. Companies with 20-49 employees contracted for the eighth time in nine months. And the index at processors with 1-19 employees has hovered around 40 since August.

The Southeast was the only region to expand in January. It has grown in two of the last three months and its index was the highest since March 2015.

Future capital spending plans for the next 12 months were just shy of $1 million per plant in January, reaching their highest level since January 2015. The level of future spending was above the historic average but down almost 3% compared with a year ago.

ABOUT THE AUTHOR

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800; email: skline2@gardnerweb.com blog: gardnerweb.com/economics/blog

Related Content

-

How Inline Vision Inspection Can Minimize Scrap in Molding

Once viewed by injection and blow molders as a necessary evil, machine vision technology today can continuously monitor and improve production while reducing costs.

-

Foam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

-

How to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

.JPG;width=70;height=70;mode=crop)