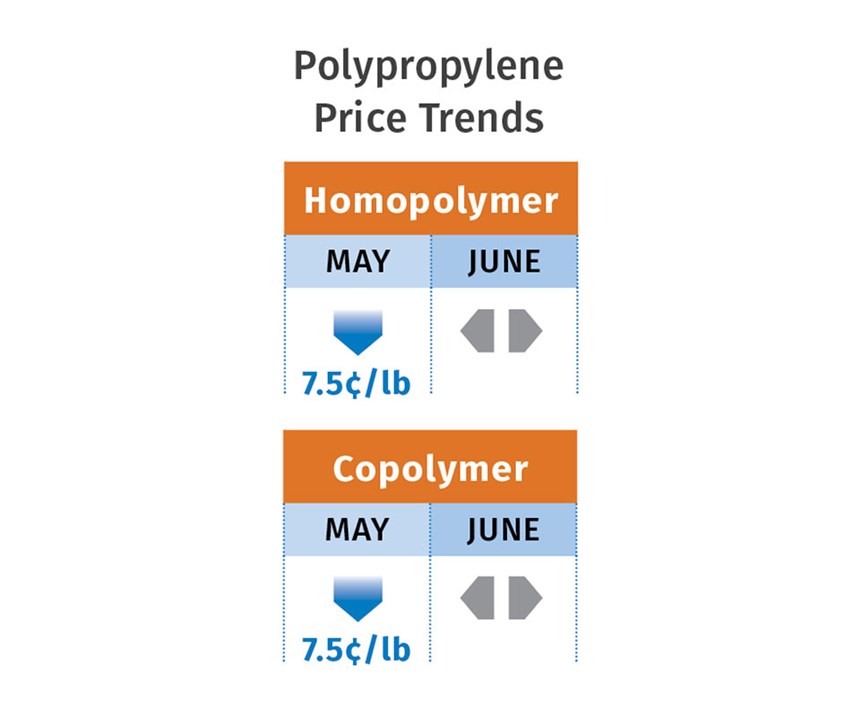

Most Resin Prices Down or Flat; PC and Nylon 66 Up for Now

Falling feedstock prices are a key driver as we enter the third quarter.

A combination of significant price decreases in key feedstocks and more balanced supply and demand overall brought down prices of PE, PP, PS, PET, and ABS. While PVC and nylon 6 prices held steady, PC and nylon 66 prices moved up in the second quarter. With indications that feedstock prices will continue to weaken and overall resin supplies will improve through the third quarter, all commodity resin prices are projected to be flat or lower.

Those are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of Plastics Exchange, The in Chicago, and Houston-based PetroChemWire (PCW).

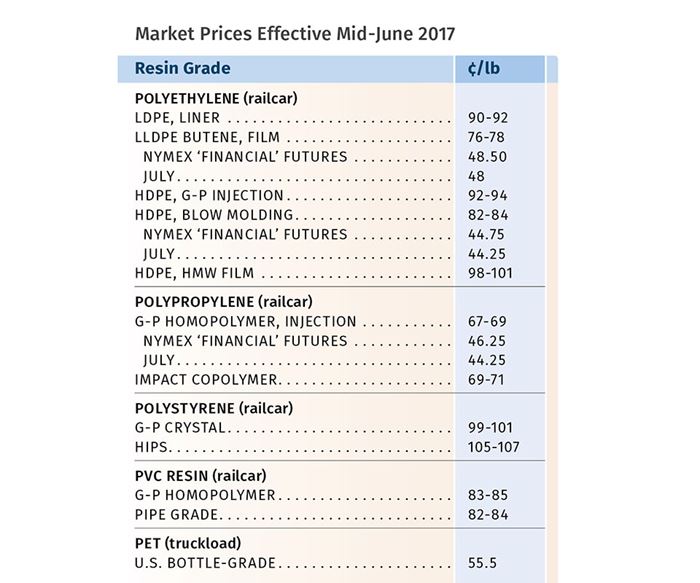

PE PRICES DROP

Polyethylene prices were trimmed 3¢/lb by some, but not all, sup- pliers. Some resin makers claimed HDPE injection-grade material was tight enough to retain the March 3¢/lb increases, according to Mike Burns, RTi’s v.p. of client services for PE. He expected all PE prices to drop 3¢/lb overall, perhaps excepting HDPE injection grades. PCW said no operating issues were reported; and while Nova has cracker maintenance underway at its Joffre, Alberta, site, no downstream outages were planned.

According to Burns, both secondary market prices and export prices dropped by May’s end—the former to the low 50¢/lb range, except for HDPE injection grade, which was selling at 58¢/lb; and the latter dropped by 4¢ to 43¢/lb. The Plastics Exchange’s Greenberg reported that spot prime PE prices dropped 1¢ toward the end of May, with HMW-HDPE for film dropping 2.5¢/lb, which brought it a bit closer to the price of blow molding grades. He also cited HDPE injection as the anomaly due to “super- scarce spot supply,” with prices surging by 1.5¢/lb. Greenberg noted that this resulted in an unprecedented premium of 11¢/lb over The Plastic Exchange’s benchmark blow molding price.

Meanwhile, Burns ventured that PE contract prices could be down 3-5¢/lb by this month, particularly if oil prices continue to hover near $50/bbl. He noted that higher supplier inventories and good production conditions appear to support downward movement. And Dow was due to bring on new capacity by August, which will likely stop prices from moving up in the near term.

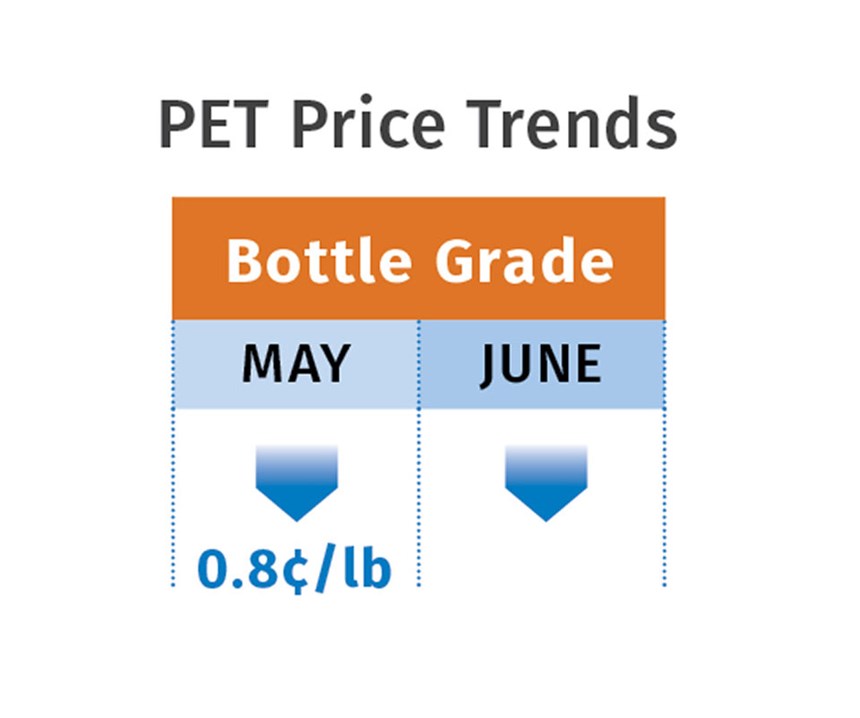

PP PRICES BOTTOM OUT

Polypropylene prices dropped another 7.5¢/lb in May, for a total of 13.5¢/lb since March. Scott Newell, RTi’s v.p. of PP markets, thought prices were near bottoming out, with the potential of another penny drop possible, He expected prices to remain relatively flat in June and this month as well: “I think we’ll see less volatility for the rest of the year.” Greenberg noted that even with the price reduction, PP contract prices were still up 7 cents/lb in 2017, after the first quarter's whopping 20.5 ¢ price hikes.

Newell characterized PP demand as soft in April, with May showing a rebound as prices dropped, though he admits it’s difficult to tell how much of the demand is real, rather than just processors restocking at the lower prices. He noted that in April, suppliers responded energetically to the lackluster demand, dropping production rates to 83% from the low 90s. However, Newell expected that production rates would again rise. He added that exports have been very weak, with prices lower but not quite low enough yet. He also noted that PP imports, after the big spike last year, are pretty much back to 2015 levels.

PCW reported that PP spot prices were firm amid growing signs that the price downtrend of the previous months was coming to an end. Prime direct-sales volumes were reported to be up in May and expected to remain so in June, yet secondary market activity was viewed as sluggish. Greenberg characterized PP trading as good at the end of May, but saw it becoming challenged by both a lack of quick-ship supply and buyers’ unrealistic pricing expectations. He noted that spot prices, after 10 weeks of decline, rallied upward by 1¢/lb.

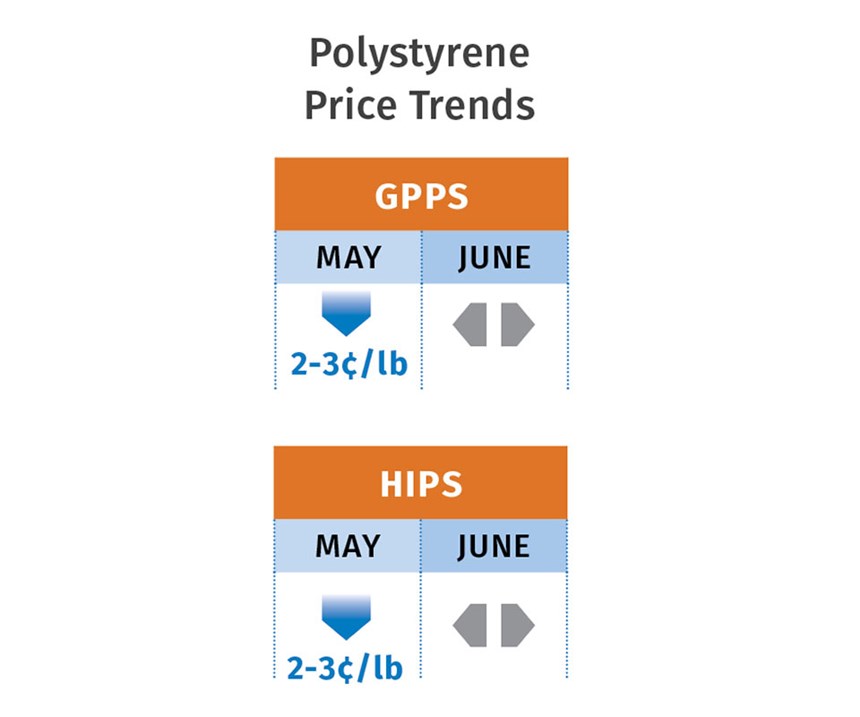

PS PRICES DOWN

Polystyrene prices dropped 2-3¢/lb in May, following the April 5¢ decrease. Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, attributed the decline to lower feedstock costs in the second quarter, including benzene and styrene monomer. He noted that falling prices of butadiene were expected to shrink the price delta between GPPS and HIPS.

PCW reported that PS spot prices continued to move lower at the end of May—a trend that started in March. Kallman added that spot styrene monomer prices were down by 12% and spot benzene prices were also dropping, so that July benzene contracts were likely to be lower than the June $2.71/gal contract price. He did add that some planned global maintenance in the third quarter could tighten up monomer supply and put some upward pricing pressure on the resin.

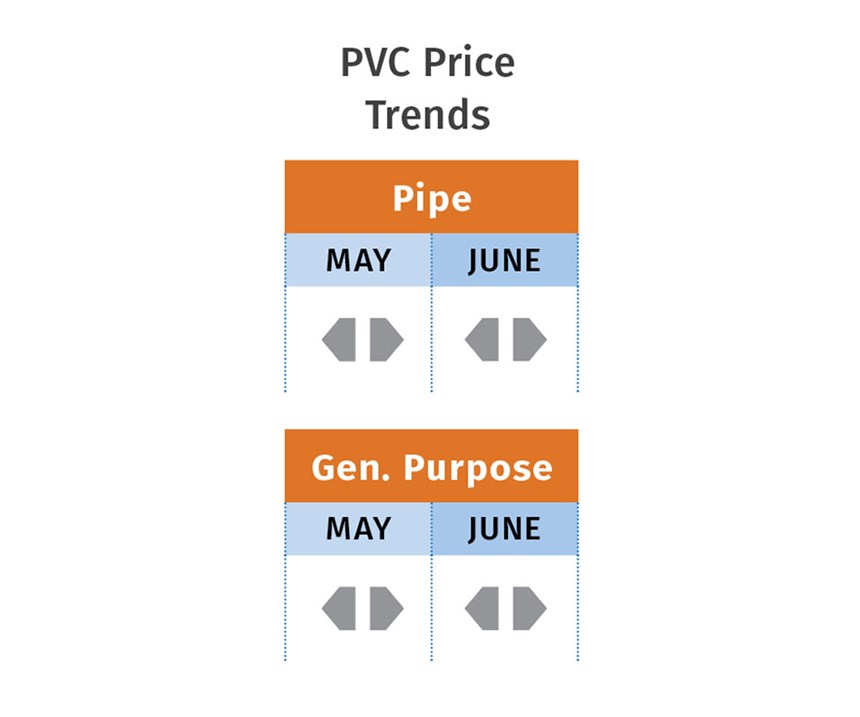

PVC PRICES FLAT

PVC prices remained flat in May and were expected to hold even in both June and July. This was despite lower prices for ethylene and vinyl monomer. RTi’s Kallman noted that planned and unplanned plant shutdowns caused some supply tightness, though he expected the supply situation to improve in the third quarter. Meanwhile, domestic PVC demand was expected to increase through the quarter, following a wet spring that affected the construction market. Kallman also noted that there were indications that demand for exports would also be good in this quarter.

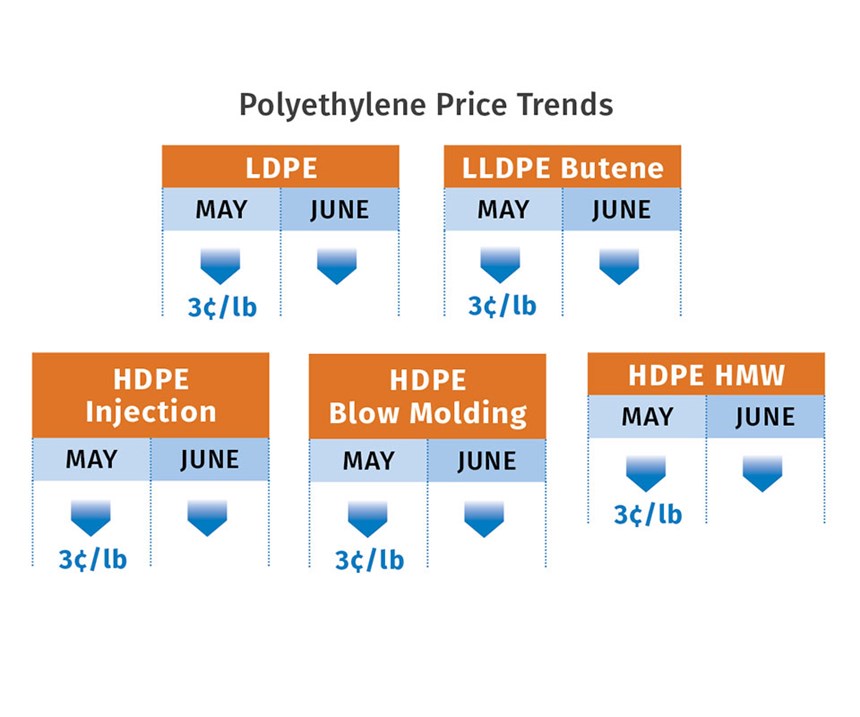

PET PRICES DOWN

Domestic bottle-grade prime PET prices in May averaged 55.7¢/lb, down 0.8¢ from April, based on PCW’s Daily PET Report. That price represents PET business on a delivered Chicago basis. The price on June 2 dropped to 53¢/lb, owing to supply outpacing demand. Nonetheless, two of four PET suppliers had proposed a 3¢/lb increase for June 1. Also, suppliers had tacked on a surcharge of 1-1.5¢/lb in May, due to the doubling of the price of isophthalic acid (IPA) feedstock.

Meanwhile, prices of imported prime PET, with an IV of 78 dl/g or higher, also fell in May, averaging 53.9¢/ lb, down 2.1¢ from April. This represented PET resin on a delivered duty-paid U.S. port basis. The price for imported PET on June 2 was down to 52¢/lb. PET imports in the first quarter were up 7% from first-quarter 2016. In May, feedstock cost for PX, PTA, and MEG averaged 51.81¢/lb of PET resin, according to a calculation used to price prime PET for monthly invoicing by suppliers and distributors.

ABS PRICES DROPPING

ABS prices increased 15-20¢/lb through April, and then prices dropped 5¢/lb in May and were heading down by at least another 5¢, according to RTi’s Kallman. He ventured that by mid-third quarter, prices would be down a total of 12-13¢/lb.

The reverse trajectory is the result of significant reduction in prices of key feedstocks, including styrene monomer, acrylonitrile, butadiene, and ethylene since their March peaks, as well as pressure from lower-priced imports.

PC PRICES UP FOR NOW

Polycarbonate prices moved up between February and the end of April by a wide range of 10-20¢/lb. This was despite rapid and substantial feedstock price decreases, owing to a tightly balanced market, according to RTi’s Kallman. However, Kallman ventured that between the third and fourth quarters, prices will move down as supply improves, demand eases up during the summer, and feedstock prices continue to drop.

NYLON 6 PRICES FLAT; NYLON 66 UP

Nylon 6 prices held firm through much of the second quarter after rising 14-20¢/lb in the previous quarter. Some suppliers had issued 6¢ price increases, but RTi’s Kallman expected that effort to fail, due primarily to sharply falling feedstock prices. He said resin prices did not retreat in the second quarter because of strong demand from the automotive sector and relatively tight supply. He expected flat to downward pricing through August.

Nylon 66 prices moved up 15-20¢/lb in March and April, according to RTi’s Kallman. The increases were driven by higher feedstock costs, tight supplies of raw materials and resins, and strong demand. Kallman expected to see reduced resin prices this month due to the sharp reversal in feedstock prices, a less tight market, and some easing of demand.

Related Content

Prices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreThe Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreRead Next

Commodity Resin Prices Falling

Lower feedstock costs, improved supplies, lower export prices are among key factors.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More