Outlook - April 2009

2009 Pipe Forecast: PVC Down, HDPE Up

Despite the high hopes that prevailed at the beginning of 2009, it is increasingly apparent that a self-sustaining recovery in the U.S. economy will not get under way until 2010.

Despite the high hopes that prevailed at the beginning of 2009, it is increasingly apparent that a self-sustaining recovery in the U.S. economy will not get under way until 2010. This outlook is based in large part on the sharp declines in manufacturing and construction activity during the fourth quarter of 2008 and the first quarter of 2009. The only good news is that these two quarters should be the worst in terms of the severity of the decline. However, it will still take a couple of quarters for the economy to stabilize and for expectations to turn positive. If all goes well, this process should be noticeable in the fourth quarter of 2009.

Few industry segments were hit harder during the past few months than plastic pipe producers. According to our Pipe Business Index (available at www.ptonline.com/extrusion/forecast), North American production of plastic pipe plummeted more than 25% in the fourth quarter of 2008, and was down 15% for last year as a whole.

The downward spiral in pipe mirrors the trend in the construction. The number of new houses started in 2008 was just over 900,000 units. That was 35% fewer than in 2007, which was 25% below 2006. In other words, new house construction has dropped by more than 50% in the past two years. The latest forecast calls for a more moderate decrease of 10% in 2009 followed by a rebound of 10% in 2010.

Spending on residential construction, which includes alterations and repairs, dropped 27% last year. Spending on nonresidential construction actually increased by 12% in 2008, but that sector was losing momentum at the end of the year. Residential spending will not improve until 2010, but nonresidential spending will be bolstered in the second half of 2009 by projects funded with money from the new Federal stimulus package. These include projects for water supply, sewers and waste disposal, highways and streets, communications, and transportation. Our forecast calls for another decline of 10% in residential spending, but an increase of at least 10% in the nonresidential spending.

TRENDS IN PVC & HDPE

The two largest segments of the plastic pipe market, PVC and HDPE, both saw decreased demand last year, but HDPE fared better than PVC. Output of PVC pipe dropped 35% in the fourth quarter of 2008 and was down 20% for the year as a whole. This downtrend will find a bottom in 2009, but the next uptrend will not begin until 2010. The forecast calls for another decrease of 7% in PVC pipe production in 2009.

The outlook is mixed for the various segments of the HDPE pipe market. Total output of HDPE pipe declined by 20% in the fourth quarter of 2008, and it was down 8% for 2008 as a whole. In 2009, the market for HDPE pipe will be greatly affected by the stimulus package. The exact timing of the stimulus spending is still unclear, but we expect market demand for HDPE pipe to jump at least 10% in 2009, and the increase could be much greater than that once all of the “shovel-ready” projects ramp up this spring.

Production of corrugated HDPE pipe plummeted at least 40% during the fourth quarter of 2008, and it fell by 20% for the whole year. Drainage pipe and similar products for residential projects will continue to struggle in 2009, but the larger diameter products used in nonresidential projects should do well.

Non-corrugated HDPE pipe held up much better than average, and the outlook is also better. In the fourth quarter of 2008, total output of non-corrugated pipe declined by 15%, but output for the year as a whole was just about the same as in 2007.

In 2009, the market for non-corrugated pipe is expected to rise by 15% as projects ramp up for supplying water and expanding high-speed communications. Output of water pipe decreased 5% in 2008, but non-corrugated gas pipe increased 10%. Demand for conduit posted a small gain in 2008, and this segment will experience a more robust increase in 2009.

About the Author

Bill Wood, an independent economist specializing in the plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. He can be contacted by e-mail at BillWood@PlasticsEconomics.com. His monthly Injection Molding and Extrusion Business Indexes are available at www.ptonline.com.

Related Content

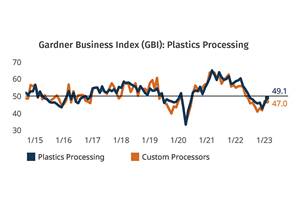

Processing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry.

Read MorePlastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More