PP Prices Spike, Others Rise, Too

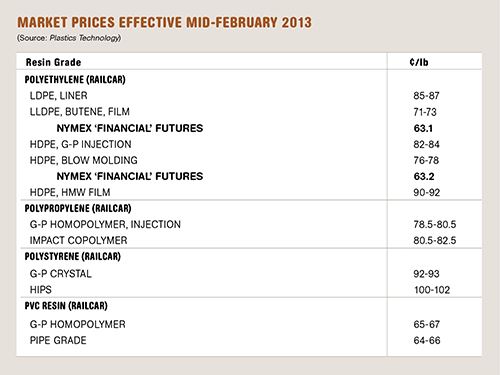

Prices of four commodity thermoplastics rose in late January and early February, and new increases were announced for this month in PP, PE, and PVC.

Prices of four commodity thermoplastics rose in late January and early February, and new increases were announced for this month in PP, PE, and PVC. The surge in PP prices is particularly stark as the total increase by the end of last month was expected to be 20¢ to 28¢/lb, driven entirely by tight monomer supply. Price hikes in PE and PVC were substantial as well, and the driving forces went beyond feedstock price pressures to include tight resin inventories at suppliers. Except for PS prices, which appear to be flattening out, further increases may be instore for the other resins. That’s the outlook from purchasing consultants at Resin Technology, Inc., Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

PE PRICES UP

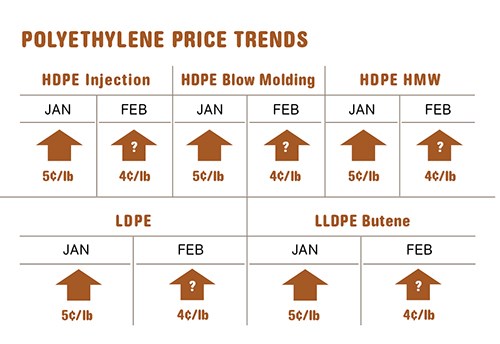

Polyethylene contract prices rose 5¢/lb in January, as suppliers implemented the year’s first increase. A 4¢ hike was also on the table for February, and a couple of suppliers issued another 4¢ hike for March 1.

Driving this activity were low supplier inventories resulting from strong domestic prebuying late last year ahead of expected price hikes. Strong exports in December and early January further supported the price move, said Mike Burns, v.p. of PE for RTi. He also cited some upward push from ethylene prices due to late-2012 cracker outages.

Despite some scheduled outages through February, spot ethylene prices were easing, and several spot monomer trades were down by 3¢ to as much as 5¢/lb for March transactions, according to Greenberg. Meanwhile, the PE spot market moved higher by early February, as most grades gained 1¢/lb and some evem more, Greenberg reported. HDPE injection grade remained scarce and there was also particular strength in prime LDPE film resin, where premiums expanded.

RTi’s Burns ventured that, without an unexpected event (such as disruptions in feedstock or PE resin production), the PE market will not see any more first-quarter price changes. “However, with lower inventories, any event could drive a price increase. Expect upward price pressure for 60 to 90 days until inventories recover.”

PP PRICES SPIKE AGAIN

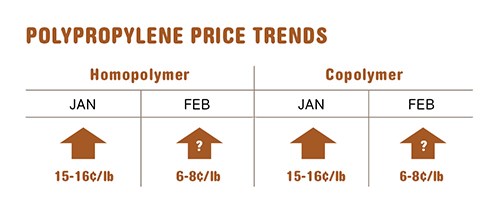

Polypropylene contract prices jumped by at least 15¢/lb in January, in concert with propylene monomer prices. Moreover, suppliers have been intent on expanding their profit margin by a penny, and most contract buyers are incurring that extra 1¢, with timing based on their contract arrangement, according to Scott Newell, director of client services for PP at RTi.

PP prices were expected to move up again in February, based on a proposed 9¢/lb monomer price increase, which Newell expected to settle closer to 5¢ to 8¢/lb. The price hikes have been based entirely on the monomer supply/demand balance. Unexpected and scheduled cracker shutdowns from the end of last year through the first quarter have upset the balance.

According to Greenberg, the spot PP market moved up a total of 14¢/lb in January and into early February. In the first week of February, spot PP prices had eclipsed their previous 52-week high of 82¢/lb by a couple of cents and were on their way higher after February monomer and PP contract settlements.

Meanwhile, suppliers’ PP inventories were the tightest in recent history (about 31.5 days) at the start of this year. But up to early last month, processors seemed to have no problem securing material. “This signals that demand is very poor,” said Newell. He added that industry expectations are for demand to remain weak into the second quarter, and the year overall will be relatively stable, with little growth.

PS PRICES RISE, THEN FLATTEN OUT

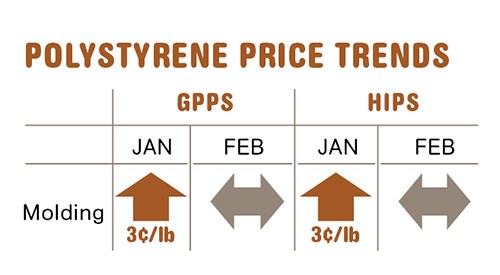

Polystyrene prices move up 3¢/lb in January, driven primarily by higher benzene prices, but were flat to slightly lower in February, as benzene prices dropped—offset a bit by higher ethylene contract prices. January ethylene contracts moved up 3.5¢ to 48¢/lb. Benzene prices are projected to drop further, as supply has improved and demand is soft, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC. Butadiene prices were flat through January and into February, so there was no extra price pressure on HIPS.

In the meantime, domestic demand is still lackluster in this fairly mature market. Some seasonal increase in demand is expected in the second quarter. PS operating rates are in the low 70% range. Says Kallman, “PS pricing is driven entirely by feedstock cost swings.”

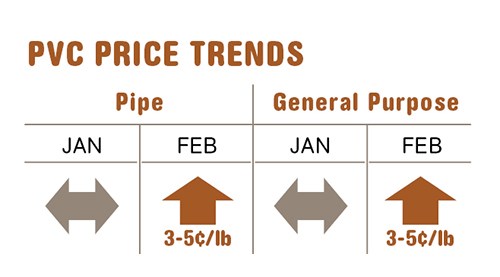

PVC PRICES UP

PVC prices were on the way up last month, with suppliers seeking increases of 3¢ to 5¢/lb for Feb. 1. A hike of 5¢/lb was also posted for March 1. The January 3¢ hike fell by the wayside, but implementation of the February increase looked certain, most likely at 3¢/lb, according to Kallman. He ventured that some of the March increase might also be implemented.

Kallman sees several factors driving PVC prices upward. These include increased ethylene contact prices due to unplanned and planned cracker outages; scheduled PVC plant maintenance outages through February and March; and strong exports in December that drew down suppliers’ inventories. Expectations for the second quarter are for a strong construction season (based on projected new housing starts), which will increase domestic demand, while the return of strong export demand is also likely after the Chinese New Year.

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More