PP Prices Up, Others Flat or Down

Polypropylene prices have moved up two months in a row and there is potential for further increases, all owing to propylene monomer tightness. PS prices moved lower in July, while attempts to hike prices of PE and PVC appeared to have failed.

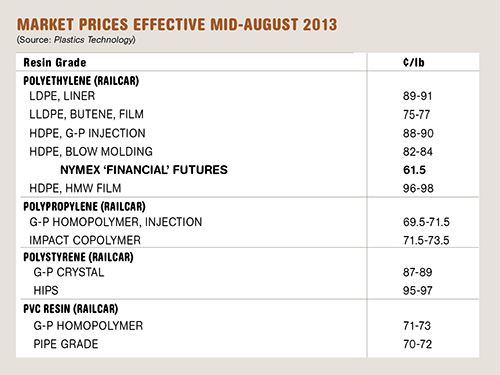

Polypropylene prices have moved up two months in a row and there is potential for further increases, all owing to propylene monomer tightness. PS prices moved lower in July, while attempts to hike prices of PE and PVC appeared to have failed. The outlook for the latter three commodity resins was for relatively flat pricing through October, barring unexpected production disruptions. Those were the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

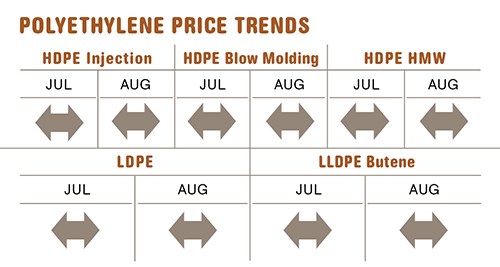

PE PRICES FLAT

Polyethylene prices held steady through July and into August, despite suppliers’ attempt to push through another 2¢/lb on HDPE and their 4¢/lb hike on LL/LDPE. Those two price increases are still on the table, along with a new 5¢ hike for Sept. 1, issued by all major players.

According The Plastics Exchange’s Greenberg, in early August, domestic railcars of HDPE and LDPE were still somewhat scarce, while LLDPE was a bit more abundant. However Greenberg and Mike Burns, RTi’s v.p. for PE, agree that availability has been slowly and steadily on the upswing.

In fact, by the second week in August, spot PE trading was more active, with prices edging up 0.5¢/lb across the board. Moreover, HDPE availability improved, “but the high asking price was a shocker,” comments Greenberg. He also noted that LDPE remained snug, and while LLDPE was not oversupplied, most grades could be obtained.

These sources also note that there has been a decoupling of spot ethylene and spot PE prices, owing to ample inventory levels for the monomer and tighter levels for the polymer. Spot ethylene prices dropped 10¢/lb while spot PE prices have risen by that amount this year through July.

“The main drivers are suppliers’ inventories, which have been improving, and an ease-up on purchasing,” says Burns. This is the case with both domestic and export demand. Burns characterizes domestic demand as good. Having bought material in “panic mode” in the first and second quarters, domestic processors are now buying as needed.

Burns projects relatively stable pricing until October, noting there are three factors that could have an impact by then: planned plant maintenance shutdowns, the Gulf Coast hurricane season, and the potential for exports to Asia to meet agricultural film demand.

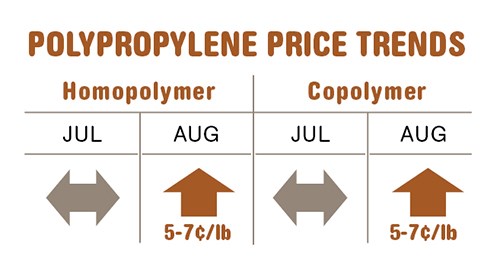

PP PRICES UP

Polypropylene prices held steady through July but were moving up by at least 5¢/lb in August, in step with a wide range of propylene monomer price nominations, which appeared to settle at 5¢/lb. But PP suppliers were once again looking for a 2¢/lb expansion of their profit margins.

Scott Newell, RTi’s director of client services for PP, does not anticipate hoped-for margin expansion succeeding in the broad er market, but he notes that anyone not protected by a contract or monomer price deal is likely to have to pay more.

Also, PP distributors who are paying the entire amount will look to pass it on to buyers. Greenberg noted in early August that spot prices for general prime PP were firming up as higher monomer price nominations emerged, although offgrade material prices slid to spur demand. He also noted that despite softer prices, export demand remained sluggish.

Newell says overall PP demand through March was down 9.5% for domestic and exports combined. That difference shrank to 2.5% from April and into August, owing to domestic demand as PP prices fell. Domestic demand to date is now off by only 0.6% from last year, whereas exports are down 40%.

Newell characterizes domestic supply/demand as rather balanced, although PP suppliers have portrayed the market as very tight. While there is some tightness in PP homopolymer, suppliers’ inventory is now at 32.3 days, which is considered good.

Says Newell, “No one is struggling to find material. Converters are now well stocked and are only likely to buy as needed over the next couple of months.” He forsees domestic demand being “average” over the next couple of months and prices flat to slightly higher. That will depend on demand for PP and on the monomer supply situation.

There was not the usual buildup in monomer supplies this summer, and there were a couple of unplanned production disruptions. Moreover, September holds some major planned cracker shutdowns. “There’s certainly some upwards pricing risk over the next couple of months,” Newell cautions.

PS PRICES DOWN

Polystyrene prices dropped by 2¢/lb in July, driven by lower feedstock costs, primarily benzene, and slowed seasonal demand. Prices for August and into this month were projected to be relatively stable, noted Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC.

Kallman characterized PS supply/demand as relatively balanced and expects a fairly flat market. Slightly higher benzene prices are likely to be offset by lower ethylene prices. July ethylene contracts remained unsettled but were expected to decline, judging by lower spot prices and improved availability.

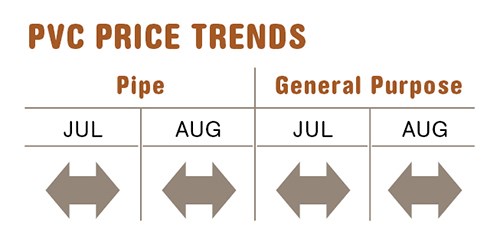

PVC PRICES FLAT

PVC prices remained relatively stable through July, despite suppliers’ attempt at a 2¢/lb price hike. Another 2¢ price increase, posted for August, was also unlikely to be implemented, due to an easeup in feedstock prices.

RTi’s Kallman saw the market as rather balanced. As a result, he expected prices to remain steady last month and into September. Factors that could launch an upward swing in prices include hurricane-season disruptions and a rally in exports.

But Kallman also notes that the construction season will also be coming to an end, heralding an expected slowdown for PVC demand and thus lower pricing.

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More