Prices of PE, PP Heading Up; PS, PVC Moving Down

Polyolefin prices were up as the fourth quarter rolled in, while PS and PVC prices were moving in the opposite direction.

Tight supplies and determined suppliers pushed PE prices up in September to the highest levels they’ve seen in six years. Entering the fourth quarter, PP prices were poised to go up substantially as monomer tightness resulted in high contract-price nominations for October. Meanwhile, PS prices dropped and were expected to drop farther, while PVC prices were expected to be on a flat-to-downward track. These reflect the observations of resin-pricing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas and CEO Michael Greenberg of The Plastics Exchange, Chicago.

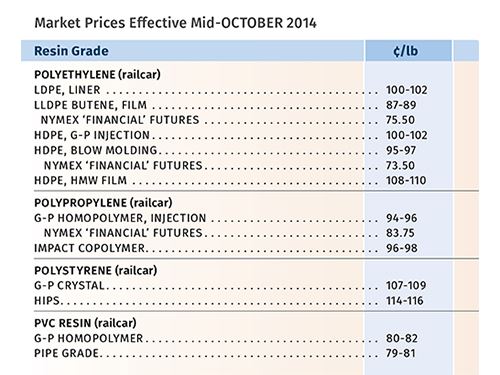

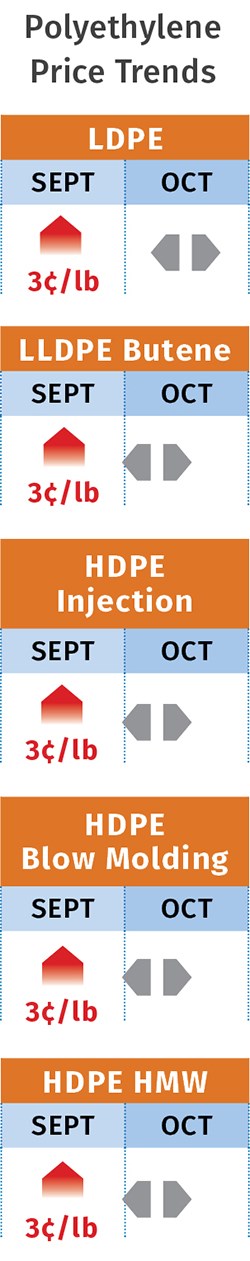

PE PRICES HIGHER BUT STABLE

Polyethylene prices moved up in September by the full 3¢/lb suppliers were seeking. In addition, two suppliers issued further price hikes of 3¢/lb—LyondellBasell for Oct. 15 and Dow for Nov. 1. Both Greenberg and Mike Burns (RTi’s v.p. for PE) believed these second increases would not be fully supported and that prices wouldn’t budge.

In fact, Burns believes that September saw the last increase of the year, though one is likely to crop up in December and/or January for implementation early next year. He adds that PE prices last month were at an all-time high, exceeding those of August 2008, when oil prices were over $130 bbl ($90 bbl currently).

Burns also notes that the gap between North American PE prices and lower Southeast Asian/Chinese prices is nearly 10¢/lb. Latin American markets, where U.S. exports have been going, are now near North American prices. Due to tight resin availability and higher prices, Latin America is starting to source material from Korea and Thailand. He sees this trend as one that may expedite domestic inventory recovery. Greenberg notes that spot export opportunities are nearly nil due to high domestic prices and he sees the potential for resin inventories to build quickly.

Addressing the domestic spot market, Greenberg notes that most LL/LDPE film grades, prime and widespec, are currently available in both bulk railcars and packaged truckloads. HDPE is also becoming more plentiful, particularly for blow molding and injection (low-MI grades). However, Greenburg said in early October that high-flow resins of HDPE and LL/LDPE are still tough to source. Burns noted that ethylene monomer finally adjusted in October, with spot prices falling by almost 10¢/lb. He expects spot ethylene prices to near 50¢/lb by year’s end, down from the current 68¢/lb.

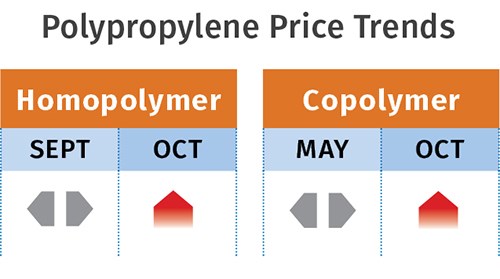

PP PRICES HEADING UP

Polypropylene prices were flat in September, but last month two factors were favoring higher prices: First, suppliers made attempts at a margin increase of about 3¢/lb, which was implemented spottily, according to Scott Newell, RTi’s director of client services for PP. Second, October propylene monomer contract nominations were for an increase of 4-8¢/lb. If they settled at that level, PP prices would follow higher by a nickel or more, according to both Newell and Greenberg.

Extremely short supply of refinery-grade propylene due to planned and unplanned refinery outages resulted in polymer-grade propylene getting tighter and spot prices surging by a few cents. Greenberg noted that spot PP saw strong trade flow, with prices jumping by 2¢/lb in October’s first week. He also noted that after a flurry of resin buying, where processors and

traders were able to get some well-priced offers, spot PP prices jumped up by as much as 10.5¢/lb. “With prime railcars now generally floated in the low-to-mid 90s [¢/lb] and prime packaged truckloads breaching a buck, thoughts of serious demand destruction swirled,” he reported.

Right after that, however, spot monomer reversed its ascent and resin offers eased, particularly for offgrade material. Said Greenberg, “We do expect to see a sizable PP price increase but

think a dime is too steep. It’s likely that monomer goes up a nickel or so and any extra margin expansion for PP will be based on market conditions and whether producers have the ability to exert pricing power.” Newell expected the emerging PP increase to be very difficult for buyers to swallow and anticipated a major drop in demand for October and possibly into November, as many processors had stocked up prior to the 5-7¢ August hikes.

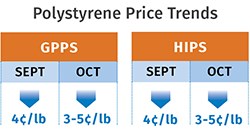

PS PRICES DOWN

Polystyrene prices dropped 4¢/lb in September and were poised to fall another 3-5¢ last month, according to Mark Kallman, RTi’s v.p, of client services for engineering resins, PS, and PVC.

Driving the downward trend for three consecutive months has been benzene contract prices, which dropped by another 48¢/lb last month to $4.22/gal. Another driver is suppliers’ inability to export styrene monomer due to high domestic prices and lower tabs abroad. However, planned maintenance shutdowns for both monomer and PS served to balance things out, notes

Kallman. He ventures that benzene prices may have bottomed out and anticipates PS prices to remain flat through this month and next.

PVC PRICES UP BUT NOT FOR LONG

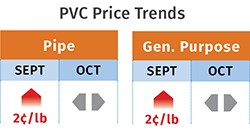

PVC prices rose 2¢/lb in September, as suppliers were able to push through their increase due to ethylene prices moving up, with contract monomer settling 5¢/lb higher in an August/September contract arrangement.

RTi’s Kallman forsaw flat-to-lower pricing for PVC in October, with the potential for further

relief this month and into December. He attributes this to a seasonal slowdown as well as weaker exports because domestic prices are higher than overseas. In fact, suppliers lowered their export prices recently so as not to lose any more business.

A very key factor, however, is that ethylene contract prices were expected to come down in October and perhaps further by year’s end as supply issues appear to have ironed themselves out. Domestic demand was relatively good (up 10% in August), as the construction season turned out to be better than expected. But the loss of exports this year may leave 2014 with a 2% drop in demand vs. 2013.

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More