Prices of PP, PS Up, Flat for PE & PVC--For Now

The second quarter will bring a risk of higher prices for PE, PS, and PVC, driven primarily by higher feedstock costs and a strong rebound of exports.

The second quarter will bring a risk of higher prices for PE, PS, and PVC, driven primarily by higher feedstock costs and a strong rebound of exports. In contrast, PP prices were already softening last month following an unprecedented run-up spurred by monomer cost increases. A price correction for both is projected within the next couple of months. That sums up the outlook from resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas.

PP PRICES ON A YO-YO

Polypropylene prices surged a whopping 17¢/lb in January, following similar increases for propylene monomer. Some suppliers issued a new 3¢ hike for Feb. 1, based on signs that monomer would rise by that amount. However, February monomer prices stayed put at 77.5¢/lb.

Spot prices for both resin and monomer were sliding a bit by mid-February. Given a drop in demand and some improvements in supply, the monomer situation was showing a better balance over the previous month. Not surprisingly, demand for PP sank following the price increases. This was reflected by lower price offers in the secondary market. In response, PP suppliers began cutting production rates even more (rates had already dropped to 83.5% by early January from September’s 90%). Nymex PP futures indicate an expected sharp drop in prices.

Outlook & Suggested Action Strategies

30-60 Day: Monomer supply will continue to improve. A price correction could take two to three months for both monomer and resin. Buy as needed. This is not a good time to stock up, as further price erosion is expected. Prices could drop sharply in March—even by 10¢/lb or more.

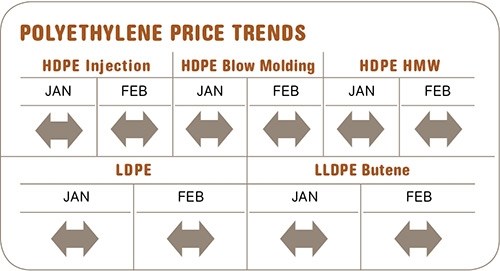

PE PRICES FLAT FOR NOW

Polyethylene prices remained flat through January, despite announced December/January price hikes that totaled 11¢/lb. Suppliers did issue a new 5¢ hike for Feb. 1, though some delayed 2¢ of it to March. There were no major market indicators supporting higher prices, but the situation is fluid: At press time, Dow, ExxonMobil, and LyondellBasell reported shutdowns and were putting customers on allocation.

Spot ethylene monomer prices were 44-47¢/lb in mid-February, up from 41-42¢ in mid-January, spurred by weather-related production disruptions. After the latest shutdowns, spot ethylene shot up to 53¢/lb. While ethylene supply was much improved in January, the situation appears to be changing. Several production units are also slated to go down for plannned maintenance in the next two months.

PE suppliers say the market is tight. But domestic and export demand has been flat, and increased material availability is reflected in a strong spot market with substantial discounts. Average days of inventory are at 29 days, where they have been for two years.

Outlook & Suggested Strategies

30-60 Day: Supply disruptions and an increase in exports are the two factors that could push PE prices up. Buy as needed.

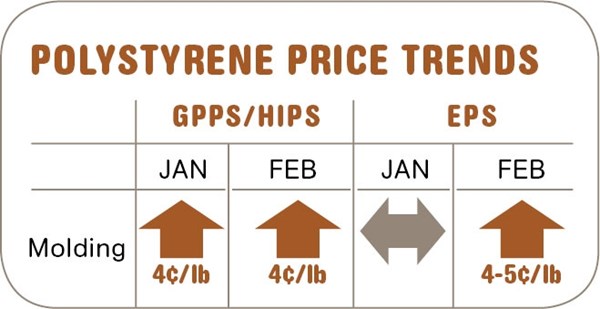

PS PRICES UP

Polystyrene prices moved up 4¢ in January and another 4¢ in February, mirroring movements in styrene monomer contract prices, which settled at 65¢/lb in January and were poised to rise 4-5¢/lb for February. Continued increases in benzene prices and tight monomer supplies have been the key drivers.

As had been expected, butadiene contract prices in January moved up 5¢ to 91¢/lb. February contract prices were poised to jump another 9¢, driven by strong global demand compounded by poor supplies of natural rubber in Asia. Prices have soared by 28% within a three-month period and are expected to remain at very high levels for most of the year.

U.S. PS prices are the highest in the world. Through January, GPPS had risen 9¢/lb over six months. HIPS commands an 8-9¢/lb premium over GPPS.

Outlook & Suggested Action Strategies

30-60 Days: We suggested stocking up to cover your inventory needs through April. Prices should peak in February/March, with HIPS prices expected to remain above the normal premium over GPPS, due to the cost of butadiene. Review your prices in relationship to the rest of the market, as price variances have increased as prices climbed.

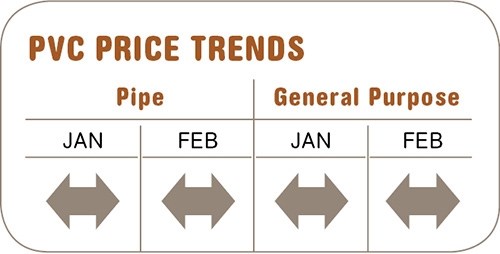

PVC PRICES STILL FLAT

PVC prices in February were flat for a third month, and the announced January 3¢/lb increase did not take effect. Suppliers were expected to attempt another increase last month, both as a hedge against unplanned cracker outages and the potential for revival of strong Chinese export demand by March.

Domestic demand dropped about 13% since last Fall, leaving resin plant operating rates in the 75% to 79% range by February. Exports to China came to a halt during the Lunar New Year holidays, but could now resume. Adding to an already well-supplied market is Formosa’s 240-million-lb capacity expansion slated for start-up this month.

Outlook & Suggested Action Strategies

30-60 Day: In January, we suggested purchasing as needed while looking for lower price opportunities through mid-February. Asian supply/demand balance after the Lunar New Year is the open question, with some traders betting on a strong recovery in demand for the rest of the year. While exports could drive the market higher starting this month, that is hardly certain. Anticipate ample supplies to influence the market at least through the first part of this quarter. Buy as needed.

Related Content

How to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MorePart 3: The World of Molding Thermosets

Thermosets were the prevalent material in the early history of plastics, but were soon overtaken by thermoplastics in injection molding applications.

Read MorePrices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

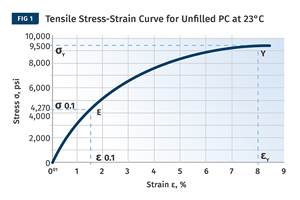

Read MoreThe Effects of Stress on Polymers

Previously we have discussed the effects of temperature and time on the long-term behavior of polymers. Now let's take a look at stress.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More