Resin Prices Are Soaring

Volatile energy and petrochemical feedstock prices, unsettled by events in Venezuela and the Middle East, are having a predictable effect on resin prices. Price hikes in almost all resins are coming thick and fast, making it hard to keep track of current market prices.

PE prices shoot up

Polyethylene prices were on the rise in March and April for processors with 30-day and 60-day contract protection, respectively, as suppliers sought to implement 6¢/lb increases scheduled for Feb. 1. A new 5¢/lb hike for March 15, supported by all major suppliers, was also under way. Moreover, an energy surcharge of 6¢/lb was issued in March by Nova Chemicals for all purchases (no exceptions), effective immediately. At press time, other suppliers were reportedly instituting similar surcharges.

Meanwhile, Dow Wire & Cable Compounds in Houston boosted all its polyolefin wire/cable materials by 5¢/lb on April 1. This comes on top of a 6¢/lb increase on Jan. 24. Spot prices are up 11¢/lb since the start of the year.

Contributing factors: The resin increases are driven by the unprecedented price escalation of feedstock and energy costs, a situation that is expected to continue. Moreover, resin supply has tightened considerably as production has been curtailed. LL/LDPE film grades are particularly tight, while HDPE injection and blow molding grades are a bit looser.

PP prices up

Polypropylene prices went up 3¢/lb in March, following implementation of an earlier 3¢ hike in February. A new round of 5¢ increases was announced for April 1. The emergence of still more increases for May is considered probable. Spot resin prices are up 9¢/lb since the start of the year.

Contributing factors: Resin suppliers are trying to catch up with propylene monomer costs. Polymer-grade propylene contract prices went up 2¢/lb in January, 2¢ in February, 4¢ in March, and April appeared ripe for another 3¢ increase. That would total 11¢/lb in four months, bringing propylene prices to over 30¢/lb. (Propylene’s last major price spike was in 1999, when in reached 27¢/lb).

Resin suppliers say they will barely break even when all pending increases are implemented, totaling 11¢/lb. Meanwhile, resin demand is strong and supply is tight because of a temporary shortness of monomer supply.

Engineering resins rise

Briefly summarizing recent changes in engineering and other thermoplastics:

- BASF hiked nylon injection molding grades by 14¢/lb on March 18. At press time last month there was no word of anyone else following suit.

- PBT resins were raised 7¢ by BASF on March 18 and 9¢/lb by Ticona on April 1. GE said it also raised PBT by an unspecified amount.

- BASF and Ticona both hiked acetals 10¢/lb on April 1.

- Ticona raised tabs on Impet PET, Riteflex polyester TPE, and Vadar polyester alloy by 7¢ April 1.

- Dow pushed ABS and SAN prices up 7¢ on April 1. GE said its ABS prices were up, too.

- Polycarbonate suppliers also admitted to raising prices but would not discuss actual amounts.

- Acrylic prices are on the rise with an 8¢/lb announcement by Cyro for April 1. Another increase is said to be likely within a month.

TDI, MDI, polyols up

April 1 price hikes on polyurethane chemicals—TDI, MDI, and polyols—have been issued by all major suppliers. Dow, Bayer, BASF, and Huntsman issued price increases of 10¢/lb for TDI, and 7¢ to 8¢/lb for pure and polymeric MDI. Rigid and flexible polyols went up 6-7¢, and BASF also raised its rigid and flexible foam systems 8¢ and spray-foam systems 10¢/lb. Dow added a 3¢/lb upcharge for tank-truck deliveries of all PUR products.

Moreover, in a surprising move, Dow issued further increases to take effect March 15. They include an additional 11¢/lb hike on TDI and 4¢/lb on MDI and polyether and copolymer polyols.

Thermosets go up again

After 4¢/lb hikes on unsaturated polyester and vinyl ester resins in February, suppliers announced similar or larger increases for early to mid-March. Reichhold, Interplastic, and Cook Composites raised polyesters 4¢/lb. Dow Plastics did the same for Derakane vinyl esters. AOC, however, announced a 5¢/lb hike on all resins, gel coats, and pigment pastes. Ashland did the same for its polyesters, vinyl esters, and gel coats. Most suppliers say another increase is likely for May.

Epoxy prices are up, too. Dow raised epoxy resins and hardeners on April 1. Resins went up 7¢ to 10¢/lb, while hardeners rose 6¢.

| Market Prices Effective Mid-Mar A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. |

Related Content

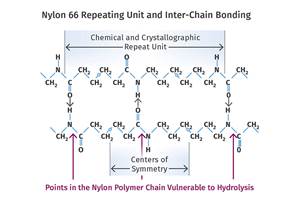

What is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MoreGeneral Polymers Thermoplastics to Further Expand Distribution Business

NPE2024: Following the company’s recent partnership buyout, new North American geographic territories are in its sight.

Read MoreScaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

Read MoreLanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More