Prices Rise As Leaves Fall

After a mid-summer respite from price increases in commodity resins—with some prices actually declining—processors face rising prices again heading into fall.

After a mid-summer respite from price increases in commodity resins—with some prices actually declining—processors face rising prices again heading into fall. Materials suppliers attribute the turnaround to similar behavior in monomer costs.

PE prices on the way up

Polyethylene prices remained flat through July, and suppliers held back on implementing their July 1 price hikes of 7¢/lb. However, resin makers appeared resolved to push through this hike in August as well as another 5¢ increase announced for Aug. 1.

The London Metal Exchange (LME) September short-term futures contract on butene LLDPE for blown film is 60.3¢/lb, up from August’s 55.5¢.

Contributing factors: Suppliers attribute their intent to firm up prices to the continued rise of feedstock and energy costs to levels comparable to or higher than historic peak prices. Ethylene monomer contracts for July settled 2¢/lb higher, but increases of 7¢ to 8¢/lb were sought for August contracts. “This has resulted in margins that are squeezed between ethylene and polyethylene,” said one supplier.”

Meanwhile, PE resin inventories remain tight. High summer temperatures and associated power outages have slowed resin production by 5% to 10%, according to some industry sources.

PP turning upward again

Polypropylene prices dropped by 1.5¢ to 2¢/lb during July. Nonetheless, suppliers announced a price increase of 4¢/lb for Aug. 1. Meanwhile, LME’s September short-term futures contract for g-p injection-grade homopolymer moved up to 60.5¢/lb from August’s 55.1¢/lb.

Contributing factors: Resin prices dropped when propylene monomer contract prices for July fell by 4¢/lb. However, in August, monomer prices were set to rebound by the same 4¢. PP suppliers are now aiming to firm up resin prices before margins are squeezed further. Adds one major supplier, “Resin demand is a bit better than we had anticipated for summer months.”

PVC: 2¢ hike expected

It has been an unusual year so far for PVC resin: There was no spring bump in demand, and prices actually fell 2¢ in March. Suppliers attempted to get the 2¢ back in May but had to put it off. Last month, PVC producers lined up firmly behind implementing that hike on Aug. 1. What’s more, Formosa, OxyChem and Georgia Gulf announced another 2¢ increase for Sept. 1.

Contributing factors: Price stability for PVC is rare, but it persisted for four months, even as demand improved slightly each month. Window profile demand last month was satisfactory, and pipe was strong, but siding was weak.

PS hikes: 9¢ now pending

After raising prices a total of 9¢ in May through July, polystyrene producers tried unsuccessfully for an additional 4¢ dated July 10. They delayed that hike first to Aug. 1 then to Aug. 15. As of mid August, Dow, Ineos, and Chevron all posted an additional 5¢ for Sept. 1. At press time, Nova had not been heard from.

Contributing factors: Recent price increases have all been driven by feedstock costs, not demand. PS markets for the first half of 2006 were down 1.9%, according to the American Plastics Council. Meanwhile, benzene contract prices rose from $3.30/gal in June to $3.87 in July and slipped back to $3.72 in August. Mid-August spot benzene was $3.80 to $3.90/gal.

Nylon and MDI prices up

Rhodia lifted tabs on its Technyl nylon 6 and 66 compounds by approximately 7¢/lb as of Sept. 1.

BASF Corp. issued a 10¢/lb increase on MDI products for rigid PUR foams, effective Aug. 1.

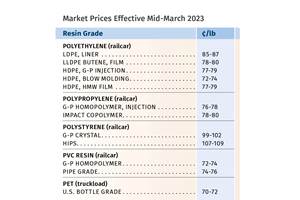

| Market Prices Effective Mid-August A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

Prices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreThe Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

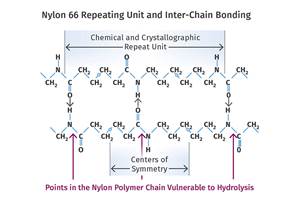

Read MoreWhat is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More